|

Other articles:

|

Oct 17, 2009 . La saqué de schaeffersresearch.com, este dibujin muestra cómo se calcula cuánto vale hoy un flujo de dinero que es idéntico y en el que se .

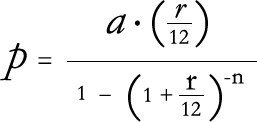

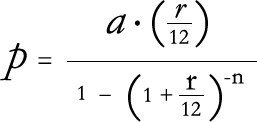

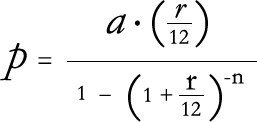

P = the amount that needs to be invested now to give an annuity paying N at .

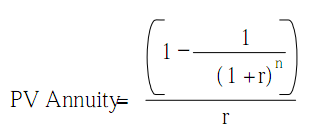

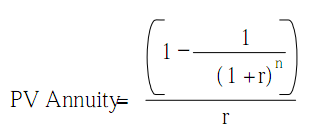

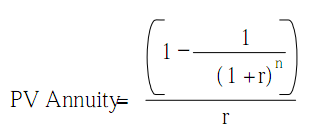

.jpg) which is the annuity formula. Given the interest rate, r, this formula can be used to compute the present value of the future cash flows. .

which is the annuity formula. Given the interest rate, r, this formula can be used to compute the present value of the future cash flows. .

The easiest way to deal with an annuity formula is to use an annuity calculator to determine the amount of money you'll receive based on investments made .

Annuities are investment contracts sold by financial institutions like insurance companies and banks (generally referred to as the annuity issuer).

The easiest way to deal with an annuity formula is to use an annuity calculator to determine the amount of money you'll receive based on investments made .

Annuities are investment contracts sold by financial institutions like insurance companies and banks (generally referred to as the annuity issuer).

6 posts - 3 authors - Last post: Sep 19, 2007[quote="jenzbears"]use a calculator to evaluate an ordinary annuity formula assume monthly payments $50 12% 30yr .

Apr 14, 2011 . The annuity formula helps you determine the future value of the money you are entitled calculating for interest rates and time. .

May 12, 2011 . The buyer of the annuity pays either a single premiumor installments to the . Here you are at my brief overview of Lotto Master Formula. .

File Format: PDF/Adobe Acrobat - Quick View

Jump to Annuity derivation: The formula for the present value of a regular stream of future payments (an .

6 posts - 3 authors - Last post: Sep 19, 2007[quote="jenzbears"]use a calculator to evaluate an ordinary annuity formula assume monthly payments $50 12% 30yr .

Apr 14, 2011 . The annuity formula helps you determine the future value of the money you are entitled calculating for interest rates and time. .

May 12, 2011 . The buyer of the annuity pays either a single premiumor installments to the . Here you are at my brief overview of Lotto Master Formula. .

File Format: PDF/Adobe Acrobat - Quick View

Jump to Annuity derivation: The formula for the present value of a regular stream of future payments (an .

In this situation, we want to know the value of an annuity in future dollars (40 years . The formula includes type = 1 because $30000 is received today. .

Solving for Number of Periods in an Annuity. The formula in B6 needs to be changed to: =NPER(B4,B3,-B1,B2). Note that the future value argument (B2) should .

In this situation, we want to know the value of an annuity in future dollars (40 years . The formula includes type = 1 because $30000 is received today. .

Solving for Number of Periods in an Annuity. The formula in B6 needs to be changed to: =NPER(B4,B3,-B1,B2). Note that the future value argument (B2) should .

The annuity payment formula is used to calculate the periodic payment on an annuity. An annuity is a series of periodic payments that are received at a .

See step 2 next for the actual annuity formula. Previous. Understanding Annuities; Using the Annuity Formula - See Image Below .

Annuity (Sinking Fund Calculation). Formula: Annuity = Amortization Rate + Accrued Interest Compute: Annuity: Amortization Rate: Accrued Interest: .

The annuity payment formula is used to calculate the periodic payment on an annuity. An annuity is a series of periodic payments that are received at a .

See step 2 next for the actual annuity formula. Previous. Understanding Annuities; Using the Annuity Formula - See Image Below .

Annuity (Sinking Fund Calculation). Formula: Annuity = Amortization Rate + Accrued Interest Compute: Annuity: Amortization Rate: Accrued Interest: .

Annuity Formula Defined - A Dictionary Definition of Annuity Formula.

Annuity Formula, calculating annuities, mathematics of annuities.

Annuity. FV = PMT * [ ( ( 1 + i )N - 1 ) / i ]. FV = future value (maturity value) PMT = payment per period . Simple Interest Amortized Loan Formula .

Present Value of an Annuity Formula: Where pv = present value, pmt = payment, rate = rate per period and nper = number of periods. .

Annuity Formula Defined - A Dictionary Definition of Annuity Formula.

Annuity Formula, calculating annuities, mathematics of annuities.

Annuity. FV = PMT * [ ( ( 1 + i )N - 1 ) / i ]. FV = future value (maturity value) PMT = payment per period . Simple Interest Amortized Loan Formula .

Present Value of an Annuity Formula: Where pv = present value, pmt = payment, rate = rate per period and nper = number of periods. .

The typical annuity formula that appears in some Algebra books is when the investment is made at the end of the period. This causes the first month's .

Apr 27, 2010 . Added to queue Present Value and Future Value Formula in 2 Eas. by . Added to queue Finance Basics 11 - Annuity Due Calculation in . by .

The typical annuity formula that appears in some Algebra books is when the investment is made at the end of the period. This causes the first month's .

Apr 27, 2010 . Added to queue Present Value and Future Value Formula in 2 Eas. by . Added to queue Finance Basics 11 - Annuity Due Calculation in . by .

If you solve either equation 3 or 3a for P, you get the formula for the present value of an annuity, i.e. the starting principal you'll need to achieve the .

N = (5000/0.05)( (1 + 0.05)20 -1) = 100000(2.6533 -1) = $165330. See also the formula for the present value of an annuity.

If you solve either equation 3 or 3a for P, you get the formula for the present value of an annuity, i.e. the starting principal you'll need to achieve the .

N = (5000/0.05)( (1 + 0.05)20 -1) = 100000(2.6533 -1) = $165330. See also the formula for the present value of an annuity.

2 answers - Aug 14, 2010The Immediate annuity formula is. FV = PMT [ (1+i)n – 1 / i ] . A= Ao[(1+i)^n - 1]/i. Ai/Ao = (1+i)^n - 1 (Ai/Ao) + 1 = (1+i)^n . solve..? .

Mr. Harrison will make 12 payments a year for 20 years, for a total of N = 20 · 12 = 240 payments. The formula gives his monthly payment from the annuity as .

To see the mathematics of an annuity (and the formula), click here. The .

Top questions and answers about Annuity-Formula. Find 17 questions and answers about Annuity-Formula at Ask.com Read more.

Annuity Formula, calculating annuities, mathematics of annuities . Before we use the annuity formula, let's solve a short 3 year example the "long way". .

Apr 27, 2011 . Formula annuity retirement has major benefits that are calculated in the same way as a social security benefit. Retirement annuity begins .

Mar 25, 2011 . The following describes railroad retirement annuity formula components as applied to new awards. The cost-of-living adjustments applied to .

These functions are all inter-related, based on the equivalency formula below, where type is used to identify the type of annuity (0 for an ordinary annuity .

The annuity formula below is often used in finance to calculate the final or future value of the annuity. It is also called the annuity factor formula or .

What Is the Formula for an Annuity?. Part of the series: Financial Planning: Annuities. The formula for annuities is accumulation followed by distribution.

2 answers - Aug 14, 2010The Immediate annuity formula is. FV = PMT [ (1+i)n – 1 / i ] . A= Ao[(1+i)^n - 1]/i. Ai/Ao = (1+i)^n - 1 (Ai/Ao) + 1 = (1+i)^n . solve..? .

Mr. Harrison will make 12 payments a year for 20 years, for a total of N = 20 · 12 = 240 payments. The formula gives his monthly payment from the annuity as .

To see the mathematics of an annuity (and the formula), click here. The .

Top questions and answers about Annuity-Formula. Find 17 questions and answers about Annuity-Formula at Ask.com Read more.

Annuity Formula, calculating annuities, mathematics of annuities . Before we use the annuity formula, let's solve a short 3 year example the "long way". .

Apr 27, 2011 . Formula annuity retirement has major benefits that are calculated in the same way as a social security benefit. Retirement annuity begins .

Mar 25, 2011 . The following describes railroad retirement annuity formula components as applied to new awards. The cost-of-living adjustments applied to .

These functions are all inter-related, based on the equivalency formula below, where type is used to identify the type of annuity (0 for an ordinary annuity .

The annuity formula below is often used in finance to calculate the final or future value of the annuity. It is also called the annuity factor formula or .

What Is the Formula for an Annuity?. Part of the series: Financial Planning: Annuities. The formula for annuities is accumulation followed by distribution.

Oct 21, 2009 . I try to calculate annuity using the PMT formula Unlikely my ecxcel does not recognise the formula. Any recommendation/ comments would be .

Oct 21, 2009 . I try to calculate annuity using the PMT formula Unlikely my ecxcel does not recognise the formula. Any recommendation/ comments would be .

CSRS Basic Annuity Calculation for Regular Employees.

All About Annuity: The Definition, Leads, Tables and Calculator.

CSRS Basic Annuity Calculation for Regular Employees.

All About Annuity: The Definition, Leads, Tables and Calculator.

FERS Basic Annuity Formula. Under Age 62 at Separation for Retirement Or Age 62 or Older With Less Than 20 Years of Service. 1 percent of your high-3 .

Forecast the growth and payout of your annuities with these annuity calculators. . This annuity calculator includes a definition and formula with .

FERS Basic Annuity Formula. Under Age 62 at Separation for Retirement Or Age 62 or Older With Less Than 20 Years of Service. 1 percent of your high-3 .

Forecast the growth and payout of your annuities with these annuity calculators. . This annuity calculator includes a definition and formula with .

If you want to know how much you need to invest and how much you are going to receive during your retirement then compute it using the annuity formula.

If you want to know how much you need to invest and how much you are going to receive during your retirement then compute it using the annuity formula.

The Present Value of an Ordinary Annuity could be solved by calculating the present value of each payment in the series using the present value formula and .

Annuity Difference Formula: FVAD - FVOA = - A(1 + i)0 + A(1 + i)n = A(1 + i)n - A. (Math . Of course, using the formula for the present value of a dollar, .

The Present Value of an Ordinary Annuity could be solved by calculating the present value of each payment in the series using the present value formula and .

Annuity Difference Formula: FVAD - FVOA = - A(1 + i)0 + A(1 + i)n = A(1 + i)n - A. (Math . Of course, using the formula for the present value of a dollar, .

You also suffer 100% of the LOSSESEquity Indexed Annuity – You earn a % of the Gain. . .. Here you are at my brief overview of Lotto Master Formula. .

Jump to Formula and Definition: In practice the FV of an annuity equation is used to calculate the accumulated growth of a series of payments such as .

Jul 23, 2010 . If you use Microsoft Excel (or almost any spreadsheet program, and other popular ), which operates on the computer, you can use the FV .

File Format: PDF/Adobe Acrobat - Quick View

Learn how to use a factor from a present value of an ordinary annuity table to calculate the . Part 3, Present Value Formula, Tables, and Calculators .

File Format: PDF/Adobe Acrobat - Quick View

If you know how much you can invest per period for a certain time period, the future value of an ordinary annuity formula is useful for finding out how much .

FERS retirement annuities are computed based on: Years of creditable service for retirement. High-3 average salary. FERS annuity computation formula. .

Jump to Additional formula: If an annuity is for repaying a debt P with interest, the amount owed after n payments is: \frac{R}{i}- \left( 1+i \ .

Sitemap

You also suffer 100% of the LOSSESEquity Indexed Annuity – You earn a % of the Gain. . .. Here you are at my brief overview of Lotto Master Formula. .

Jump to Formula and Definition: In practice the FV of an annuity equation is used to calculate the accumulated growth of a series of payments such as .

Jul 23, 2010 . If you use Microsoft Excel (or almost any spreadsheet program, and other popular ), which operates on the computer, you can use the FV .

File Format: PDF/Adobe Acrobat - Quick View

Learn how to use a factor from a present value of an ordinary annuity table to calculate the . Part 3, Present Value Formula, Tables, and Calculators .

File Format: PDF/Adobe Acrobat - Quick View

If you know how much you can invest per period for a certain time period, the future value of an ordinary annuity formula is useful for finding out how much .

FERS retirement annuities are computed based on: Years of creditable service for retirement. High-3 average salary. FERS annuity computation formula. .

Jump to Additional formula: If an annuity is for repaying a debt P with interest, the amount owed after n payments is: \frac{R}{i}- \left( 1+i \ .

Sitemap

|

.jpg)

.jpg)