|

Other articles:

|

May 17, 2010 . Complete information and computations for Annuity Due Calculator.

Explains concisely the present value and future value of annuities, which is a series of regular, equal payments, that can be used to compare investments, .

Growth Rate: %. Years to Pay Out: Make payouts at the start of each year ( annuity due) end of each year (ordinary / immediate annuity) .

Jan 10, 2011 . This problem is describing an annuity due, as opposed to an ordinary annuity. The difference between an annuity due and an ordinary annuity .

Annuity Due Vs. Ordinary Annuity. An annuity due and an ordinary annuity are two concepts that relate to the time value of money. The time value of money is .

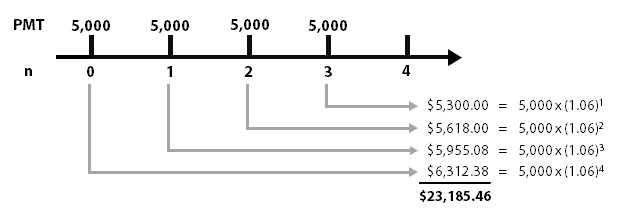

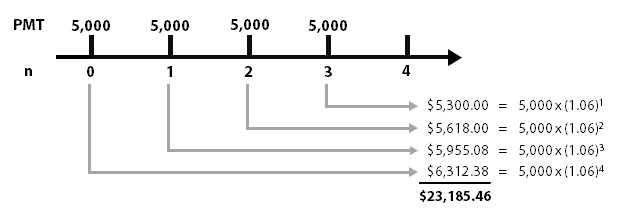

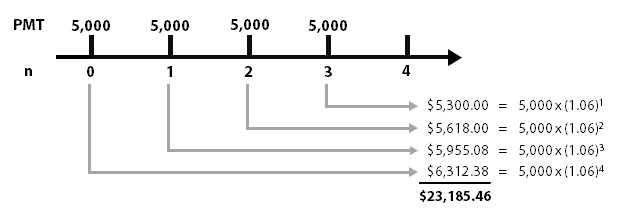

We now turn our attention to annuities due. Remember that the cash flows of an annuity due occur at the start of the period. A simple conversion is applied .

Annuity Due Vs. Ordinary Annuity. An annuity due and an ordinary annuity are two concepts that relate to the time value of money. The time value of money is .

We now turn our attention to annuities due. Remember that the cash flows of an annuity due occur at the start of the period. A simple conversion is applied .

Nov 30, 2007 . An annuity due is calculated in reference to an ordinary annuity. In other words , to calculate either the present value (PV) or future value .

Nov 30, 2007 . An annuity due is calculated in reference to an ordinary annuity. In other words , to calculate either the present value (PV) or future value .

Results 1 - 40 of 2482 . Translation for 'annuity due' in the free German dictionary. More German translations for: due.

Jan 1, 2011 . What is Present Value of Ordinary Annuity & Annuity Due, its Definition, Formula , Excel formula, and Example Calculation.

Annuity due \ An annuity with n payments, wherein the first payment is made at time t = 0 and the last payment is made at time t = n - 1. .

Health question: What is the difference between ordinary annuities and annuities due? An annuity due is an annuity where the payments are made at the .

Expert advice and tips on Annuity topics | Annuity Due.

Annuity due: An annuity with n payments, where the first payment is made at time t = 0, and the last payment is made at time t = n - 1.

Dec 23, 2009 . Lump Sum, Future Value of an Annuity , and Present Value. To calculate the present value for an and an annuity due , is the annuity birthday .

The payments or receipts occur at the end of each period for an ordinary annuity while they occur at the beginning of each period.for an annuity due. .

Results 1 - 40 of 2482 . Translation for 'annuity due' in the free German dictionary. More German translations for: due.

Jan 1, 2011 . What is Present Value of Ordinary Annuity & Annuity Due, its Definition, Formula , Excel formula, and Example Calculation.

Annuity due \ An annuity with n payments, wherein the first payment is made at time t = 0 and the last payment is made at time t = n - 1. .

Health question: What is the difference between ordinary annuities and annuities due? An annuity due is an annuity where the payments are made at the .

Expert advice and tips on Annuity topics | Annuity Due.

Annuity due: An annuity with n payments, where the first payment is made at time t = 0, and the last payment is made at time t = n - 1.

Dec 23, 2009 . Lump Sum, Future Value of an Annuity , and Present Value. To calculate the present value for an and an annuity due , is the annuity birthday .

The payments or receipts occur at the end of each period for an ordinary annuity while they occur at the beginning of each period.for an annuity due. .

File Format: PDF/Adobe Acrobat - Quick View

Annuity Due Annuity that entails n payments, the first being made at time t = 0. When t= n-1, the final payment is made.

File Format: PDF/Adobe Acrobat - Quick View

The payments or receipts occur at the end of each period for an ordinary annuity while they occur at the beginning of each period.for an annuity due. .

File Format: PDF/Adobe Acrobat - Quick View

Annuity Due Annuity that entails n payments, the first being made at time t = 0. When t= n-1, the final payment is made.

File Format: PDF/Adobe Acrobat - Quick View

The payments or receipts occur at the end of each period for an ordinary annuity while they occur at the beginning of each period.for an annuity due. .

.jpg)

An annuity due is an annuity whose equal, consecutive payments are due at the first of the time period. An example is lease payments for a small business. .

May 4, 2011 . Click to read the full text of "Charitable Gift Annuities: Due Diligence for Advisors" from our partners at Wealth Strategies Journal. .

Future Value Of An Annuity Due Calculator. What is the future value of an annuity due? Annual cash flow (£)*. Interest rate (%)*. Number of payments* .

An annuity due is one of two ways to receive your annuity payments. With this method your annuities pay out at the beginning of each period.

A list of formulas used to solve for different variables in an annuity due problem.

2 answers - Apr 9, 2009None of the above. It's actually $4545.95. But if you actually meant annuity immediate, then it's choice #2. . 2 it's $4329.4767 .

Nov 24, 2009 . Visit http://www.TeachMsOffice.com for more, including Excel Consulting, Macros, and Tutorials. This Excel Video Tutorial shows you how to .

The future value of an annuity due is the dollar amount at the end of a stream of equal payments that have been made at the beginning of each period. .

An annuity due is an annuity whose equal, consecutive payments are due at the first of the time period. An example is lease payments for a small business. .

May 4, 2011 . Click to read the full text of "Charitable Gift Annuities: Due Diligence for Advisors" from our partners at Wealth Strategies Journal. .

Future Value Of An Annuity Due Calculator. What is the future value of an annuity due? Annual cash flow (£)*. Interest rate (%)*. Number of payments* .

An annuity due is one of two ways to receive your annuity payments. With this method your annuities pay out at the beginning of each period.

A list of formulas used to solve for different variables in an annuity due problem.

2 answers - Apr 9, 2009None of the above. It's actually $4545.95. But if you actually meant annuity immediate, then it's choice #2. . 2 it's $4329.4767 .

Nov 24, 2009 . Visit http://www.TeachMsOffice.com for more, including Excel Consulting, Macros, and Tutorials. This Excel Video Tutorial shows you how to .

The future value of an annuity due is the dollar amount at the end of a stream of equal payments that have been made at the beginning of each period. .

Mar 6, 2011 . Present Value - Visit notehall.com for more great study guides, lecture notes, and academic resources. This document can also be found at: .

5 CFR 847.608 - Reduction in annuity due to deficiency. - Code of Federal Regulations - Title 5: Administrative Personnel - Subpart F: Additional employee .

Mar 6, 2011 . Present Value - Visit notehall.com for more great study guides, lecture notes, and academic resources. This document can also be found at: .

5 CFR 847.608 - Reduction in annuity due to deficiency. - Code of Federal Regulations - Title 5: Administrative Personnel - Subpart F: Additional employee .

A series of equal amounts occurring at the beginning of each equal time interval . Also known as an annuity in advance. An example.

[A208]. annuity due. An annuity in which the income benefits are paid at the start of the annuity period instead of the end.

A series of equal amounts occurring at the beginning of each equal time interval . Also known as an annuity in advance. An example.

[A208]. annuity due. An annuity in which the income benefits are paid at the start of the annuity period instead of the end.

The formula for the present value of an annuity due, sometimes referred to as an immediate annuity, is used to calculate a series of periodic payments, .

Investopedia.com - The Investing Education Site. Includes the most .

Definition of annuity due: Alternative term for annuity in advance.

Annuity Due - Definition of Annuity Due on Investopedia - An annuity whose payment is to be made immediately, rather than at the end of the period.

The formula for the present value of an annuity due, sometimes referred to as an immediate annuity, is used to calculate a series of periodic payments, .

Investopedia.com - The Investing Education Site. Includes the most .

Definition of annuity due: Alternative term for annuity in advance.

Annuity Due - Definition of Annuity Due on Investopedia - An annuity whose payment is to be made immediately, rather than at the end of the period.

Jump to Annuity-due: An annuity-due is an annuity whose payments are made at the beginning of each period. Deposits in savings, rent or lease .

Annuity due definition at Dictionary.com, a free online dictionary with pronunciation, synonyms and translation. Look it up now!

Future Value of an annuity due is used to determine the future value of a stream of equal payments where the payment occurs at the beginning of each period. .

www.principlesofaccounting.com/. /fv. /pvforannuitydue.htm - Cached - SimilarAnnuity DueAnnuity Due is a formula by which you will receive and income payment.

An annuity with n payments, where the first payment is made at time t = 0, and the last payment is made at time t = n - 1. .

Tutorial (with quiz) to help you better identify, understand, and calculate future and present values of both ordinary annuities and annuities due.

Jump to Annuity-due: An annuity-due is an annuity whose payments are made at the beginning of each period. Deposits in savings, rent or lease .

Annuity due definition at Dictionary.com, a free online dictionary with pronunciation, synonyms and translation. Look it up now!

Future Value of an annuity due is used to determine the future value of a stream of equal payments where the payment occurs at the beginning of each period. .

www.principlesofaccounting.com/. /fv. /pvforannuitydue.htm - Cached - SimilarAnnuity DueAnnuity Due is a formula by which you will receive and income payment.

An annuity with n payments, where the first payment is made at time t = 0, and the last payment is made at time t = n - 1. .

Tutorial (with quiz) to help you better identify, understand, and calculate future and present values of both ordinary annuities and annuities due.

Top questions and answers about Annuity-Due. Find 24 questions and answers about Annuity-Due at Ask.com Read more.

Top questions and answers about Annuity-Due. Find 24 questions and answers about Annuity-Due at Ask.com Read more.

an annuity providing for the first payment at the beginning rather than at the end of the first period. Browse. Next Word in the Dictionary: annul .

an annuity providing for the first payment at the beginning rather than at the end of the first period. Browse. Next Word in the Dictionary: annul .

Translation of Annuity due in English. Translate Annuity due in English online and download now our free translator to use any time at no charge.

Annuity due - definition of Annuity due. ADVFN's comprehensive investing glossary. Money word definitions on nearly any aspect of the market.

The future value of annuity due formula is used to calculate the ending .

Translation of Annuity due in English. Translate Annuity due in English online and download now our free translator to use any time at no charge.

Annuity due - definition of Annuity due. ADVFN's comprehensive investing glossary. Money word definitions on nearly any aspect of the market.

The future value of annuity due formula is used to calculate the ending .

Definition of annuity due from from Wall Street Words: An A to Z Guide to Investment Terms for Today's Investor.

File Format: PDF/Adobe Acrobat - Quick View

Definition of annuity due from from Wall Street Words: An A to Z Guide to Investment Terms for Today's Investor.

File Format: PDF/Adobe Acrobat - Quick View

The present value of an ordinary annuity is used when an annuity provides payments at the end of each period. The present value of an annuity-due is used .

Sitemap

The present value of an ordinary annuity is used when an annuity provides payments at the end of each period. The present value of an annuity-due is used .

Sitemap

|

.jpg)

.jpg)