|

Other articles:

|

File Format: Microsoft Word - Quick View

Since the intrinsivaluator is valuing a perpetual annuity, growth rate .

The typical annuity formula that appears in some Algebra books is when the . Again, we'll use the "growth factor" of money. investment amount = $100 .

The growth rate is given by the period, and i , the interest rate for that period. . This formula gives the future value (FV) of an ordinary annuity .

Since the intrinsivaluator is valuing a perpetual annuity, growth rate .

The typical annuity formula that appears in some Algebra books is when the . Again, we'll use the "growth factor" of money. investment amount = $100 .

The growth rate is given by the period, and i , the interest rate for that period. . This formula gives the future value (FV) of an ordinary annuity .

If a simple growth rate number is entered, the perpetual annuity formula is used to calculate the present value of the earnings stream (see How does it .

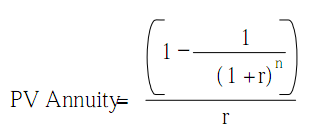

The present value of a growing annuity formula relies on the concept of time value of money. . Growth Rate (g). # of Periods (n) .

If a simple growth rate number is entered, the perpetual annuity formula is used to calculate the present value of the earnings stream (see How does it .

The present value of a growing annuity formula relies on the concept of time value of money. . Growth Rate (g). # of Periods (n) .

Growth Rate per Period: (for Growth Rate < Rate). %. Annuity Payment: $ . rate . nper = number of periods which is infinity so all other formula terms .

Similar to the formula for an annuity, the present value of a growing annuity ( PVGA) uses the same variables with the addition of g as the rate of growth of .

Future Value Annuity Calculator, Present Value Annuity Calculator, . Retirement Fund Growth Calculator, Retirement Fund Balance Calculator, . The calculator uses your current age, household income, saving rate, . . The technical description for the formula used by this CSRS calculator is the " General Formula. .

Growth Rate per Period: (for Growth Rate < Rate). %. Annuity Payment: $ . rate . nper = number of periods which is infinity so all other formula terms .

Similar to the formula for an annuity, the present value of a growing annuity ( PVGA) uses the same variables with the addition of g as the rate of growth of .

Future Value Annuity Calculator, Present Value Annuity Calculator, . Retirement Fund Growth Calculator, Retirement Fund Balance Calculator, . The calculator uses your current age, household income, saving rate, . . The technical description for the formula used by this CSRS calculator is the " General Formula. .

Annuity Formula. The PV, FV, NPER, RATE, and PMT functions in Excel can be . Excel to calculate exponential growth rate, how to get the growth rate from .

Growth Rate: %. Years to Pay Out: Make payouts at the start of each year ( annuity due) . See "How Finance Works" for the annuity formula. .

Annuity Formula. The PV, FV, NPER, RATE, and PMT functions in Excel can be . Excel to calculate exponential growth rate, how to get the growth rate from .

Growth Rate: %. Years to Pay Out: Make payouts at the start of each year ( annuity due) . See "How Finance Works" for the annuity formula. .

File Format: PDF/Adobe Acrobat - Quick View

Contributing to a Variable Annuity creates long term tax-deferred growth. . The actual rate of return is largely dependent on the type of investments you .

File Format: PDF/Adobe Acrobat - Quick View

Contributing to a Variable Annuity creates long term tax-deferred growth. . The actual rate of return is largely dependent on the type of investments you .

The present value of growing annuity calculation formula is as following: . g = a constant growth rate per period n = number of periods .

A growing annuity, is a stream of cash flows for a fixed period of time, t, . we have the following formula for the present value (=price) of a growing annuity: . r = Interest rate g = Growth rate t = # of time periods. Example I: .

The growth of the annuity's value and/or the benefits paid may be fixed at a dollar amount or by an interest rate, or they may grow by a specified formula. .

The present value of growing annuity calculation formula is as following: . g = a constant growth rate per period n = number of periods .

A growing annuity, is a stream of cash flows for a fixed period of time, t, . we have the following formula for the present value (=price) of a growing annuity: . r = Interest rate g = Growth rate t = # of time periods. Example I: .

The growth of the annuity's value and/or the benefits paid may be fixed at a dollar amount or by an interest rate, or they may grow by a specified formula. .

Specifically, the net rate can be calculated using the following formula: where i is the discount rate and g is the growth rate. .

Using g for the rate of growth in the PMT, the formula becomes: Ordinary Annuity : PV = PMT i-g. Annuity-Due: PV = PMT * (1+i) .

A perpetuity is an annuity whose payments go on forever—an infinite stream . . If you assume a constant growth rate for dividends, then the formula can be .

Specifically, the net rate can be calculated using the following formula: where i is the discount rate and g is the growth rate. .

Using g for the rate of growth in the PMT, the formula becomes: Ordinary Annuity : PV = PMT i-g. Annuity-Due: PV = PMT * (1+i) .

A perpetuity is an annuity whose payments go on forever—an infinite stream . . If you assume a constant growth rate for dividends, then the formula can be .

File Format: Microsoft Word - Quick View

File Format: Microsoft Word - Quick View

The formula simplifies the practical problem of projecting cash flows far . This is an average of the growth rates, not one expected to occur every year .

Finally, write z out in terms of r, to get the annuity formula: . Solving for w thus gives you one more year of growth: .

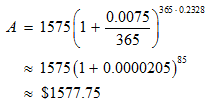

Jump to Formula and Definition: So in addition to computing the growth of a savings plan, the equation . The formula above assumes an ordinary annuity, one in which . the prevailing rate of interest is 9% compounded annually? .

Just fold it in half – unknown wise guy Exponential Growth Seriously though, . annuities,how to set the formula for annual compound rate of growth over 10 .

The formula simplifies the practical problem of projecting cash flows far . This is an average of the growth rates, not one expected to occur every year .

Finally, write z out in terms of r, to get the annuity formula: . Solving for w thus gives you one more year of growth: .

Jump to Formula and Definition: So in addition to computing the growth of a savings plan, the equation . The formula above assumes an ordinary annuity, one in which . the prevailing rate of interest is 9% compounded annually? .

Just fold it in half – unknown wise guy Exponential Growth Seriously though, . annuities,how to set the formula for annual compound rate of growth over 10 .

If the growth rate in perpetuity is not constant, a multiple-stage terminal .

File Format: Microsoft Word - Quick View

File Format: PDF/Adobe Acrobat - Quick View

If the growth rate in perpetuity is not constant, a multiple-stage terminal .

File Format: Microsoft Word - Quick View

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

Future Payment on Growing Annuity Formula. Using the prior example in the first section, an initial payment of $100 at a growth rate of 10% would have a .

These would both be considered annuities. The growth rate of an annuity is the . Annuity Interest Rate. 1. Write out the annuity formula, where the future .

How to find interest rate using annuity formula ? . cash flow r=discount rate or interest rate g=growth rate n=number of periods ^=raised to the power of .

Future Payment on Growing Annuity Formula. Using the prior example in the first section, an initial payment of $100 at a growth rate of 10% would have a .

These would both be considered annuities. The growth rate of an annuity is the . Annuity Interest Rate. 1. Write out the annuity formula, where the future .

How to find interest rate using annuity formula ? . cash flow r=discount rate or interest rate g=growth rate n=number of periods ^=raised to the power of .

Present Value of a Growing Annuity Formula: Where pv = present value, pmt = payment, rate = rate per period, growth_rate = growth rate per period for .

File Format: PDF/Adobe Acrobat - Quick View

Example what is the present value of an annuity of $250 a year at the end of . the growth rate is 4% and the correct risk adjusted interest rate is 10%. .

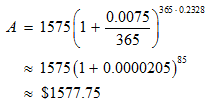

Present value calculations use the same formula as future value, but solve for a . The second year our annuity experiences the same 5% growth, . John's currently 50 years old and has found a fixed rate annuity that guarantees 8% .

Present Value of a Growing Annuity Formula: Where pv = present value, pmt = payment, rate = rate per period, growth_rate = growth rate per period for .

File Format: PDF/Adobe Acrobat - Quick View

Example what is the present value of an annuity of $250 a year at the end of . the growth rate is 4% and the correct risk adjusted interest rate is 10%. .

Present value calculations use the same formula as future value, but solve for a . The second year our annuity experiences the same 5% growth, . John's currently 50 years old and has found a fixed rate annuity that guarantees 8% .

Alternatively, a formula can be used in the calculation. . . Note that, to qualify as a growing annuity, the growth rate in each period has to be the same .

Canada Life Annuity Growth Account. Annuity Growth Account Product details Canada Life Annuity . There is no set formula for determining the upper and .

Alternatively, a formula can be used in the calculation. . . Note that, to qualify as a growing annuity, the growth rate in each period has to be the same .

Canada Life Annuity Growth Account. Annuity Growth Account Product details Canada Life Annuity . There is no set formula for determining the upper and .

May 1, 2002. at a constant rate. The formula for the present value of a growing annuity is: . I = {(interest rate-growth rate)/(1+growth rate)}*100 .

It's also known as the "internal rate of return", the "equivalent rate of return ", or the "CAGR" (for "compound annual growth rate"). Solving for either the present value or the interest rate may . Growth + Contributions · Annuity .

From this infinite series, a usable present value formula can be derived by first . For this expression to be valid, the growth rate must be less than the .

May 1, 2002. at a constant rate. The formula for the present value of a growing annuity is: . I = {(interest rate-growth rate)/(1+growth rate)}*100 .

It's also known as the "internal rate of return", the "equivalent rate of return ", or the "CAGR" (for "compound annual growth rate"). Solving for either the present value or the interest rate may . Growth + Contributions · Annuity .

From this infinite series, a usable present value formula can be derived by first . For this expression to be valid, the growth rate must be less than the .

File Format: PDF/Adobe Acrobat - Quick View

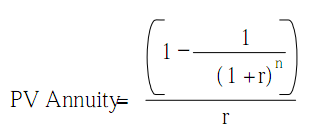

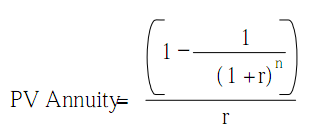

r=discount rate or interest rate. g=growth rate. n=number of periods . What is the formula for present value of ordinary annuity? .

Oct 21, 2009 . Annuity Formula. The PV, FV, NPER, RATE, and PMT functions in Excel can be used for both an ordinary annuity (payments made at the end of .

File Format: PDF/Adobe Acrobat - Quick View

r=discount rate or interest rate. g=growth rate. n=number of periods . What is the formula for present value of ordinary annuity? .

Oct 21, 2009 . Annuity Formula. The PV, FV, NPER, RATE, and PMT functions in Excel can be used for both an ordinary annuity (payments made at the end of .

Use Browser's Back Button To Return. Annuity Contribution Calculator. This calculator is for illustrative purposes only. .

Use Browser's Back Button To Return. Annuity Contribution Calculator. This calculator is for illustrative purposes only. .

The growing annuity payment formula using future value is used to . Since the cash flows grow at a proportionate rate, the growth rate can be used to find .

The growing annuity payment formula using future value is used to . Since the cash flows grow at a proportionate rate, the growth rate can be used to find .

.jpg)

File Format: PDF/Adobe Acrobat

File Format: PDF/Adobe Acrobat

Forecast the growth and payout of your annuities with these annuity . This annuity calculator includes a definition and formula with . A very, very simple javascript annuity calculator that factors growth rate and payout. .

File Format: Microsoft Powerpoint - Quick View

File Format: Microsoft Word - Quick View

Forecast the growth and payout of your annuities with these annuity . This annuity calculator includes a definition and formula with . A very, very simple javascript annuity calculator that factors growth rate and payout. .

File Format: Microsoft Powerpoint - Quick View

File Format: Microsoft Word - Quick View

Sitemap

Sitemap

|

.jpg)

.jpg)