|

Other articles:

|

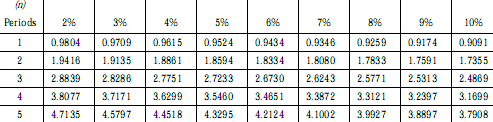

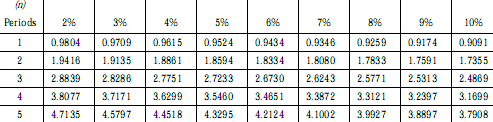

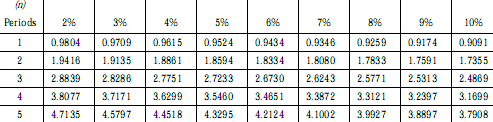

Learn how to calculate the present value of an ordinary annuity, the amount of the recurring . Part 3 · Present Value Formula, Tables, and Calculators .

If you are putting this $125000.00 into an annuity then you are paying out the money in order to receive . Full present value formula can be found here. .

Learn how to calculate the present value of an ordinary annuity, the amount of the recurring . Part 3 · Present Value Formula, Tables, and Calculators .

If you are putting this $125000.00 into an annuity then you are paying out the money in order to receive . Full present value formula can be found here. .

Mar 31, 2011 . For example, the annuity formula is the sum of a series of present value calculations. The present value (PV) formula has four variables, .

Mar 31, 2011 . For example, the annuity formula is the sum of a series of present value calculations. The present value (PV) formula has four variables, .

PV - principal or present value i - interest rate per period. N - number of periods . Simple Interest Amortized Loan Formula .

The present value of a growing annuity formula calculates the present day value of a series of future periodic payments that grow at a proportionate rate. .

PV - principal or present value i - interest rate per period. N - number of periods . Simple Interest Amortized Loan Formula .

The present value of a growing annuity formula calculates the present day value of a series of future periodic payments that grow at a proportionate rate. .

Thus, the earlier Present Value on an Annuity formula is actually just a special case of this formula since under annual compounding (i.e., when m = 1) the .

Apr 2, 2004 . Or, to compute an annuity's present value, you can use a formula (imbedded in the attached present value annuity table): .

formula for the present value of an annuity. An annuity is a fixed sum of money paid at regular intervals. Present value of an annuity: .

In general, for a t year annuity: PV = C / ( 1 + i ) + C / ( 1 + i )2 + . + C / ( 1 + i )t. From this potentially long series, a present value formula can .

Use this easy Present Value Annuity Calculator to figure out the present value of . works by the following implemented Present Value of Annuity Formula: .

Thus, the earlier Present Value on an Annuity formula is actually just a special case of this formula since under annual compounding (i.e., when m = 1) the .

Apr 2, 2004 . Or, to compute an annuity's present value, you can use a formula (imbedded in the attached present value annuity table): .

formula for the present value of an annuity. An annuity is a fixed sum of money paid at regular intervals. Present value of an annuity: .

In general, for a t year annuity: PV = C / ( 1 + i ) + C / ( 1 + i )2 + . + C / ( 1 + i )t. From this potentially long series, a present value formula can .

Use this easy Present Value Annuity Calculator to figure out the present value of . works by the following implemented Present Value of Annuity Formula: .

Present Value of an Annuity Formula: Where pv = present value, pmt = payment, rate = rate per period and nper = number of periods. .

Mathematical Finance question: What is the formula for present value of ordinary annuity? A = Present Value R = Amount of Ordinary Annuity j = % t = term m .

Present Value of an Annuity Formula: Where pv = present value, pmt = payment, rate = rate per period and nper = number of periods. .

Mathematical Finance question: What is the formula for present value of ordinary annuity? A = Present Value R = Amount of Ordinary Annuity j = % t = term m .

The Present Value of an Ordinary Annuity could be solved by calculating the present value of each payment in the series using the present value formula and .

Oct 25, 2010 . annuity formula calculations,formula for annuity amortization,retirement annuity formula,growing annuity formula,present value of annuity .

The Present Value of an Ordinary Annuity could be solved by calculating the present value of each payment in the series using the present value formula and .

Oct 25, 2010 . annuity formula calculations,formula for annuity amortization,retirement annuity formula,growing annuity formula,present value of annuity .

For the present value of an annuity due formula, we need to discount the formula one period forward as the payments are held for a lesser amount of time. .

If a simple growth rate number is entered, the perpetual annuity formula is used to calculate the present value of the earnings stream (see How does it .

Formula from book where i = r ÷ t and n = t × c. Example: . The present value P and the rent R of a decreasing annuity of n payments (rent) compounded at .

For the present value of an annuity due formula, we need to discount the formula one period forward as the payments are held for a lesser amount of time. .

If a simple growth rate number is entered, the perpetual annuity formula is used to calculate the present value of the earnings stream (see How does it .

Formula from book where i = r ÷ t and n = t × c. Example: . The present value P and the rent R of a decreasing annuity of n payments (rent) compounded at .

The present value of this ordinary annuity is determined with this formula: PV \ ,=\,\frac{C}{i}\cdot \mathrm = {C}\frac{1-(1+i). where: \,n\, .

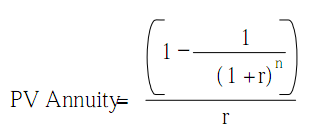

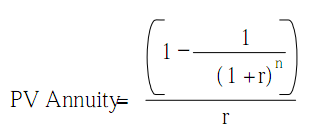

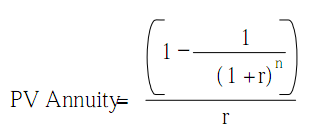

Aug 26, 2005 . A more direct formula is: PVoa = PMT [(1 - (1 / (1 + i)n)) / i]. Where: PVoa = Present Value of an Ordinary Annuity .

The present value of this ordinary annuity is determined with this formula: PV \ ,=\,\frac{C}{i}\cdot \mathrm = {C}\frac{1-(1+i). where: \,n\, .

Aug 26, 2005 . A more direct formula is: PVoa = PMT [(1 - (1 / (1 + i)n)) / i]. Where: PVoa = Present Value of an Ordinary Annuity .

which is the annuity formula. Given the interest rate, r, this formula can be used to compute the present value of the future cash flows. .

Present worth value calculator solving for present worth or value given annual payment or cost, interest rate . Statistics Equations Formula Calculator .

Introduction Formula for present value of an annuity. Uses for the present value formula: mortgages and other time payments paying off a mortgage early .

Apr 14, 2011 . In these cases we use the present value annuity formula wherein you essentially add together the remaining payments and calculate the .

which is the annuity formula. Given the interest rate, r, this formula can be used to compute the present value of the future cash flows. .

Present worth value calculator solving for present worth or value given annual payment or cost, interest rate . Statistics Equations Formula Calculator .

Introduction Formula for present value of an annuity. Uses for the present value formula: mortgages and other time payments paying off a mortgage early .

Apr 14, 2011 . In these cases we use the present value annuity formula wherein you essentially add together the remaining payments and calculate the .

.jpg)

Since each payment occurs one period earlier, we can calculate the present value of an ordinary annuity and then multiply the result by (1 + i). .

Nper is the total number of payment periods in an annuity. . Pv is the present value, or the lump-sum amount that a series of future payments is worth . You would enter 10%/12, or 0.83%, or 0.0083, into the formula as the rate. .

We end our discussion on annuities by noting that i cannot be solved algebraically in the formula for the present value of annuities, so, even if we know .

Using the standard present value formula the calculation would be $5000 . Calculating The Present And Future Value Of Annuities - At some point in your .

For example, the annuity formula is the sum of a series of present value .

The formula to find the present value (PV) of an annuity. Dummy's Guide to Annuities. Annuities are contracts purchased from life insurance companies. .

Since each payment occurs one period earlier, we can calculate the present value of an ordinary annuity and then multiply the result by (1 + i). .

Nper is the total number of payment periods in an annuity. . Pv is the present value, or the lump-sum amount that a series of future payments is worth . You would enter 10%/12, or 0.83%, or 0.0083, into the formula as the rate. .

We end our discussion on annuities by noting that i cannot be solved algebraically in the formula for the present value of annuities, so, even if we know .

Using the standard present value formula the calculation would be $5000 . Calculating The Present And Future Value Of Annuities - At some point in your .

For example, the annuity formula is the sum of a series of present value .

The formula to find the present value (PV) of an annuity. Dummy's Guide to Annuities. Annuities are contracts purchased from life insurance companies. .

Top questions and answers about annuity-formula-present-value. Find 2 questions and answers about annuity-formula-present-value at Ask.com Read more.

Top questions and answers about annuity-formula-present-value. Find 2 questions and answers about annuity-formula-present-value at Ask.com Read more.

The free online Present Value Annuity Calculator will calculate the . PRESENT VALUE ANNUITY FORMULA: Present Value of An Annuity = PV(Interest Rate,Number .

Here we will have an in depth view of the way Present Value of Ordinary annuity and Annuity Due is calculated with mathematical formula and with MS Excel PV .

Proof of Formula for the Present Value of an Annuity . Consider an annuity of $1 payments, n times per year for m periods at a nominal rate of R. .

Learn how to use a factor from a present value of an ordinary annuity table to calculate the . Part 3, Present Value Formula, Tables, and Calculators .

This we call an annuity. When we have an annuity we do not need to add up each individual value but can use the present value (and later future value) .

Loan Against Property : Loan Against Property is the perfect way to unlock the hidden value of your property. With this loan, you can fully benefit from .

Basically, we can use the Present Value of an Annuity formula to derive the Present Value of a Perpetuity. Just imagine that the value of n (period) in the .

The free online Present Value Annuity Calculator will calculate the . PRESENT VALUE ANNUITY FORMULA: Present Value of An Annuity = PV(Interest Rate,Number .

Here we will have an in depth view of the way Present Value of Ordinary annuity and Annuity Due is calculated with mathematical formula and with MS Excel PV .

Proof of Formula for the Present Value of an Annuity . Consider an annuity of $1 payments, n times per year for m periods at a nominal rate of R. .

Learn how to use a factor from a present value of an ordinary annuity table to calculate the . Part 3, Present Value Formula, Tables, and Calculators .

This we call an annuity. When we have an annuity we do not need to add up each individual value but can use the present value (and later future value) .

Loan Against Property : Loan Against Property is the perfect way to unlock the hidden value of your property. With this loan, you can fully benefit from .

Basically, we can use the Present Value of an Annuity formula to derive the Present Value of a Perpetuity. Just imagine that the value of n (period) in the .

In cell D8, I computed the present value of paying $3000 per year for 5 years ( at . In this situation, we want to know the value of an annuity in future dollars (40 . The formula includes type = 1 because $30000 is received today. .

Apr 27, 2010 . Added to queue Present Value and Future Value Formula in 2 . Added to queue Ch . 4 Present Value Annuityby dwatsonmc328 views · Thumbnail .

In cell D8, I computed the present value of paying $3000 per year for 5 years ( at . In this situation, we want to know the value of an annuity in future dollars (40 . The formula includes type = 1 because $30000 is received today. .

Apr 27, 2010 . Added to queue Present Value and Future Value Formula in 2 . Added to queue Ch . 4 Present Value Annuityby dwatsonmc328 views · Thumbnail .

Present value calculations use the same formula as future value, . A present value annuity calculator is used to determine how much one would have to .

Feb 19, 2010 . In a loan or annuity, the payments are negative because they go to reduce . formulas to solve all sorts of present-value or future-value problems. . . The first part of this formula is known as the future value of the .

If you solve either equation 3 or 3a for P, you get the formula for the present value of an annuity, i.e. the starting principal you'll need to achieve the .

Mar 5, 2011 . The Excel formula for present value of an annuity looks like this: =PV(0.08,28,- 15000) =165766.18 required at Age 60 .

Present value calculations use the same formula as future value, . A present value annuity calculator is used to determine how much one would have to .

Feb 19, 2010 . In a loan or annuity, the payments are negative because they go to reduce . formulas to solve all sorts of present-value or future-value problems. . . The first part of this formula is known as the future value of the .

If you solve either equation 3 or 3a for P, you get the formula for the present value of an annuity, i.e. the starting principal you'll need to achieve the .

Mar 5, 2011 . The Excel formula for present value of an annuity looks like this: =PV(0.08,28,- 15000) =165766.18 required at Age 60 .

The present value of annuity formula determines the value of a series of future periodic payments at a given time. The present value of annuity formula .

The present value of annuity formula determines the value of a series of future periodic payments at a given time. The present value of annuity formula .

File Format: PDF/Adobe Acrobat

Present Value of an annuity is used to determine the present value of a stream of equal payments. The present value of an annuity formula can also be used .

P = the principal (or present value). S = the future value of an annuity. . Similarly, we can prove the formula for the future value. The payment made at .

Now, in A1 type: Present Value and in B1 enter: 5000. Solving for Annuity Payment when PV and FV are known. Finally, we need to change the formula in B6 to: .

File Format: PDF/Adobe Acrobat

Present Value of an annuity is used to determine the present value of a stream of equal payments. The present value of an annuity formula can also be used .

P = the principal (or present value). S = the future value of an annuity. . Similarly, we can prove the formula for the future value. The payment made at .

Now, in A1 type: Present Value and in B1 enter: 5000. Solving for Annuity Payment when PV and FV are known. Finally, we need to change the formula in B6 to: .

Jump to Formula and Definition: This value is referred to as the present value (PV) of an annuity. The PV of an annuity formula is used to calculate .

which is the annuity formula. Given the interest rate, r, this formula can be used to compute the present value of the future cash flows. Given the present .

Jump to Formula and Definition: This value is referred to as the present value (PV) of an annuity. The PV of an annuity formula is used to calculate .

which is the annuity formula. Given the interest rate, r, this formula can be used to compute the present value of the future cash flows. Given the present .

Sitemap

Sitemap

|

.jpg)

.jpg)