|

Other articles:

|

401k plan information including reviews and assistance with rollovers. Free to help with rules on contributions, withdrawing and loans.

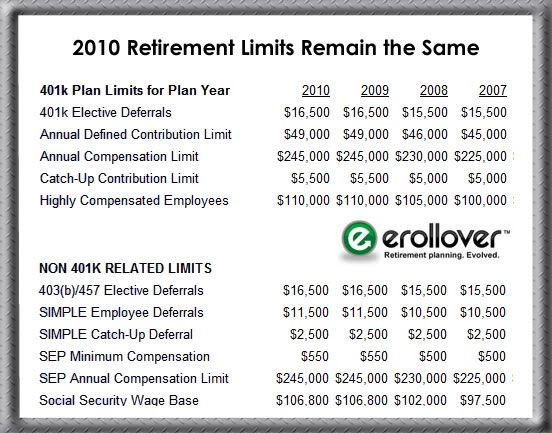

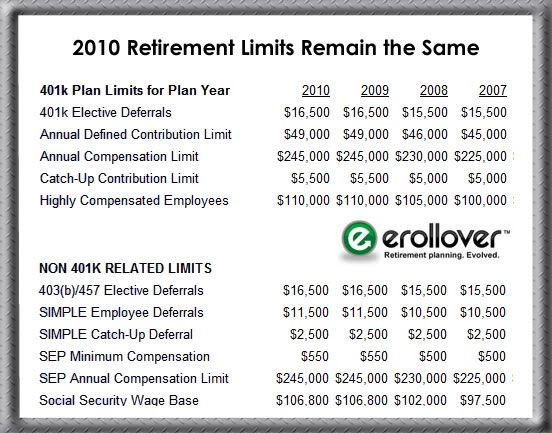

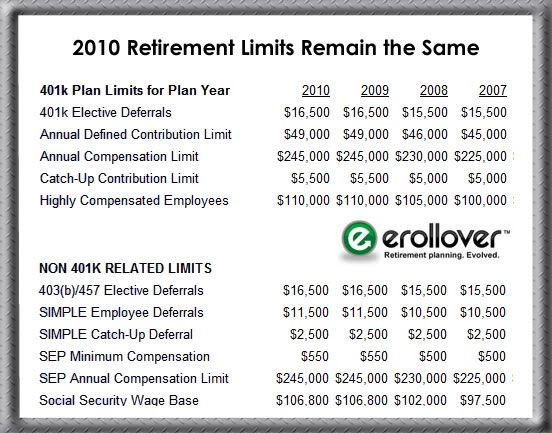

401k limits 2009/2010 - 401k rules determine your maximum total contribution for all 401k retirement plans combined.

The current year's 401k contribution limits determine how much money you are entitled to contribute to your 401k plans for the entire year. .

Jan 3, 2011 . 401k Contribution Limits have been announced for 2011. Find out what the new 401k Contribution Limits are, and how you can avoid giving away .

Oct 31, 2010 . The 2011 maximum 401K contribution limits allowed by the IRS will be $16500. Also a look at the catch-up contribution limit & 2010 & 2012 .

Find out what are current 401k contribution limits. 401k plans are probably the most popular plans in U.S. They are always employer-sponsored which means .

Find out the maximum amounts you can contribute to your 401k or Roth IRA retirement accounts in 2011. Are you maxing out the contribution limits?

Find out the maximum amounts you can contribute to your 401k or Roth IRA retirement accounts in 2011. Are you maxing out the contribution limits?

Between 2011 and above, 401K contribution limits to inflation index and they may be increased in . We present these 401K limit for you in general terms. .

Jan 11, 2011 . Limits on the amount of elective deferrals that you can contribute . For example, your plan document may provide a lower limit or the plan .

A 401k Limits provides information about some aspects of 401k.

In this article, we're going to discuss the current (2010 and 2011) 401k .

Between 2011 and above, 401K contribution limits to inflation index and they may be increased in . We present these 401K limit for you in general terms. .

Jan 11, 2011 . Limits on the amount of elective deferrals that you can contribute . For example, your plan document may provide a lower limit or the plan .

A 401k Limits provides information about some aspects of 401k.

In this article, we're going to discuss the current (2010 and 2011) 401k .

IRS 401k rules & limits for contributions and withdrawals from Liberty Tax Service.

IRS 401k rules & limits for contributions and withdrawals from Liberty Tax Service.

In this article, we are going to discuss some of the 401k limits, or rules, that all employees need to be aware of when participating in such a plan. .

Generally there are several contribution limits that apply to 401K plans. The first is the limits placed on the employee, the second is the limits placed on .

Excess contributions: how they happen, how to correct them, and what happens if you don't.

In 2010 and 2011 the total contribution limit for a Solo 401k is $49000 or $54500 if age 50 or older. The annual Solo 401k contribution consists of 2 parts .

In 2011 the contribution limits on employer-sponsored retirement plans such as the 401(k) remain unchanged at $16500. IRA contribution limits also remain .

In this article, we are going to discuss some of the 401k limits, or rules, that all employees need to be aware of when participating in such a plan. .

Generally there are several contribution limits that apply to 401K plans. The first is the limits placed on the employee, the second is the limits placed on .

Excess contributions: how they happen, how to correct them, and what happens if you don't.

In 2010 and 2011 the total contribution limit for a Solo 401k is $49000 or $54500 if age 50 or older. The annual Solo 401k contribution consists of 2 parts .

In 2011 the contribution limits on employer-sponsored retirement plans such as the 401(k) remain unchanged at $16500. IRA contribution limits also remain .

2010 Roth 401k and 2010 Roth IRA Limits. Find out the contribution limits for 2010 401k and IRA retirement plans.

Jan 30, 2011 . Your 401k maximum contribution limit is the combined total maximum contribution that you can make each year to ALL 401k plans in which you .

401K Contribution Limits and how to get the 401K maximum balace. . 401K Contribution Limits and Other Personal Finance Tips to Maximize Your 401K .

Contribution limits for IRA Roth Simple 401K 457 SEP 403B plans Dallas CPA Firm providing Income Tax Preparation.

401k Retirement Plans - Contribution Limits, Rules, Contributions & Distributions, Rollovers, IRS forms, Roth 401k, Roth IRA and more. .

Whether you're just getting started in your retirement planning or you've been a lifelong saver, important and expected news is coming for your 401k program .

Jan 22, 2009 . All these years, I've been under the impression that the 401k limit includes all contributions, regardless of the source, but I recently got .

Benefit from the 2010 401(k) contribution limits by taking maximum advantage of this powerful tax-deferred retirement plan.

2010 Roth 401k and 2010 Roth IRA Limits. Find out the contribution limits for 2010 401k and IRA retirement plans.

Jan 30, 2011 . Your 401k maximum contribution limit is the combined total maximum contribution that you can make each year to ALL 401k plans in which you .

401K Contribution Limits and how to get the 401K maximum balace. . 401K Contribution Limits and Other Personal Finance Tips to Maximize Your 401K .

Contribution limits for IRA Roth Simple 401K 457 SEP 403B plans Dallas CPA Firm providing Income Tax Preparation.

401k Retirement Plans - Contribution Limits, Rules, Contributions & Distributions, Rollovers, IRS forms, Roth 401k, Roth IRA and more. .

Whether you're just getting started in your retirement planning or you've been a lifelong saver, important and expected news is coming for your 401k program .

Jan 22, 2009 . All these years, I've been under the impression that the 401k limit includes all contributions, regardless of the source, but I recently got .

Benefit from the 2010 401(k) contribution limits by taking maximum advantage of this powerful tax-deferred retirement plan.

October 28th, 2010 IRS Announces Max 401k Contribution Limits for 2011. The IRS (Internal Revenue Service) announced on October 28th, 2010 the cost of .

October 28th, 2010 IRS Announces Max 401k Contribution Limits for 2011. The IRS (Internal Revenue Service) announced on October 28th, 2010 the cost of .

401K Contribution Limits and How Do They Work to Build Wealth? . Congress makes the rules for the 401k contribution limits, not the IRS like most More » .

Currently the IRS has imposed limits on the contributions a person can make to their 401k plan whether it be as an individual or through their company.

Nov 11, 2010 . What are the SIMPLE IRA Contribution Limits for 2010? If .

401k plan contribution limits for tax years 2005 - 2011.

401K Contribution Limits and How Do They Work to Build Wealth? . Congress makes the rules for the 401k contribution limits, not the IRS like most More » .

Currently the IRS has imposed limits on the contributions a person can make to their 401k plan whether it be as an individual or through their company.

Nov 11, 2010 . What are the SIMPLE IRA Contribution Limits for 2010? If .

401k plan contribution limits for tax years 2005 - 2011.

Discusses the IRS contribution and other 401k limits for tax year 2011.

Nov 10, 2003 . Allowable elective deferrals for 401k plans increased to $13000 per year in 2004 , up $1000 from 2003's $12000 limit. .

Oct 28, 2010 . Provides easy to use and understand table of IRS 401k plan .

Jump to Contribution limits: There is also a maximum 401k contribution limit that applies to all employee and employer 401k contributions in a calendar .

401k Contribution Limits 2008 - Many of the pension plan limitations will change for 2004 - for most of the limitations,

Discusses the IRS contribution and other 401k limits for tax year 2011.

Nov 10, 2003 . Allowable elective deferrals for 401k plans increased to $13000 per year in 2004 , up $1000 from 2003's $12000 limit. .

Oct 28, 2010 . Provides easy to use and understand table of IRS 401k plan .

Jump to Contribution limits: There is also a maximum 401k contribution limit that applies to all employee and employer 401k contributions in a calendar .

401k Contribution Limits 2008 - Many of the pension plan limitations will change for 2004 - for most of the limitations,

Mar 12, 2008 . Just what are the limits you're subject to when contributing, withdrawing or rolling over a 401k plan anyway? 401k Contribution Limits: .

Dec 27, 2010 . There are reasons for relief in some quarters since the IRS release its official 2011 regulations for 401k, 403b, and other retirement plan .

A compilation of retirement and qualified plan contribution limits. You'll find 2010 / 2011 IRA, Roth IRA, Simple IRA, 401k limits, 403b, 457, and SEP IRA .

Because these funds are meant to be retirement savings, there are very strict 401k withdrawal limits set by employers and the government that explicitly .

Mar 12, 2008 . Just what are the limits you're subject to when contributing, withdrawing or rolling over a 401k plan anyway? 401k Contribution Limits: .

Dec 27, 2010 . There are reasons for relief in some quarters since the IRS release its official 2011 regulations for 401k, 403b, and other retirement plan .

A compilation of retirement and qualified plan contribution limits. You'll find 2010 / 2011 IRA, Roth IRA, Simple IRA, 401k limits, 403b, 457, and SEP IRA .

Because these funds are meant to be retirement savings, there are very strict 401k withdrawal limits set by employers and the government that explicitly .

Similar to the calculation for the 401k, take the IRS limit, in this case $5000, and divide it by the number of paychecks you have left. .

Nov 24, 2010 . Every year around this time the IRS releases updated retirement contribution and tax bracket information for the coming year.

Similar to the calculation for the 401k, take the IRS limit, in this case $5000, and divide it by the number of paychecks you have left. .

Nov 24, 2010 . Every year around this time the IRS releases updated retirement contribution and tax bracket information for the coming year.

Nov 20, 2007 . 401K Maximum contribution limits for F/Y 2004-06 The contribution limits towards 401K account are associated with your salary, .

Feb 10, 2011 . In 2011, the maximum you may contribute to your 401(k) has not changed. This applies to 403(b) accounts, as well. For 2009, 2010, and 2011, .

Information on 401k, 401k Plans, 401k Rollover, and Individual Retirement Accounts. Request your Free 401k Quote and 401k Insider's Guide.

Nov 20, 2007 . 401K Maximum contribution limits for F/Y 2004-06 The contribution limits towards 401K account are associated with your salary, .

Feb 10, 2011 . In 2011, the maximum you may contribute to your 401(k) has not changed. This applies to 403(b) accounts, as well. For 2009, 2010, and 2011, .

Information on 401k, 401k Plans, 401k Rollover, and Individual Retirement Accounts. Request your Free 401k Quote and 401k Insider's Guide.

Aug 3, 2009 . The maximum contribution limits for 401k plans change from year to year. Here's what it is for 2010.

Nov 13, 2010 . 401k Limits takes the guesswork out of retirement planning, with helpful information about maximum contributions to retirement plans and .

Aug 3, 2009 . The maximum contribution limits for 401k plans change from year to year. Here's what it is for 2010.

Nov 13, 2010 . 401k Limits takes the guesswork out of retirement planning, with helpful information about maximum contributions to retirement plans and .

Apr 10, 2010 . In the US 401(k) is a retirement savings plan that allows workers to invest the savings thus deferring income tax on the saved money until .

Jan 13, 2009 . 2009 401(k) contribution limits have increased to $16500 for anyone under age 50 . Find out more information about the recent changes in .

Apr 10, 2010 . In the US 401(k) is a retirement savings plan that allows workers to invest the savings thus deferring income tax on the saved money until .

Jan 13, 2009 . 2009 401(k) contribution limits have increased to $16500 for anyone under age 50 . Find out more information about the recent changes in .

Jan 15, 2010 . When it comes to 401k contribution limits, or the combined total contribution you can make per year to all of your 401(k) plans including .

1/ 2011 limits reflect issuance of IRS News Release IR-2010-108 (Oct. 28, . 2/ 2010 limits reflect issuance of IRS Notice 2009-94, 2009-50 I.R.B. 848 .

Jan 15, 2010 . When it comes to 401k contribution limits, or the combined total contribution you can make per year to all of your 401(k) plans including .

1/ 2011 limits reflect issuance of IRS News Release IR-2010-108 (Oct. 28, . 2/ 2010 limits reflect issuance of IRS Notice 2009-94, 2009-50 I.R.B. 848 .

Sitemap

Sitemap

|