|

Other articles:

|

Even if you contribute the maximum amount each year, your employer's matching contributions are in addition to these 401k limits. (FYI: Depending on the .

each year, your employer's matching contributions are in addition to these 401k limits. (FYI: Depending on the design of its 401k plan, a employer can match .

Any employer matching contributions being made to traditionally-enrolled participants' accounts . 401k account, a limit adjusted each year by lawmakers . .

Mar 14, 2010 . If I put in ,500 for 2007 and then my employer put in 00 have I gone over the IRS limit?

Mar 14, 2010 . If I put in ,500 for 2007 and then my employer put in 00 have I gone over the IRS limit?

Jan 22, 2009 . Why the interest in 401k limits? Well, we found out that my wife now gets a . . The post tax and employer match is not part of that. .

Jan 22, 2009 . Why the interest in 401k limits? Well, we found out that my wife now gets a . . The post tax and employer match is not part of that. .

Many employers will match employee contributions placed in 401k plans. Employer contributions to 401k plans are not counted toward the contribution limits .

Even if you contribute the maximum amount each year, your employer's matching contributions are in addition to these 401k limits. .

Many employers will match employee contributions placed in 401k plans. Employer contributions to 401k plans are not counted toward the contribution limits .

Even if you contribute the maximum amount each year, your employer's matching contributions are in addition to these 401k limits. .

Aug 2, 2010 . The maximum contribution limits for 401k plans change from year to year. . Is employer matching included in the $16500 limit? .

Another nice feature of 401k plans is the employer match. . There are three 401k contribution limits that apply in the years 2010 and 2011. .

5 answersEven if you contribute the maximum amount each year, your employer's .

Feb 1, 2011 . Similarly, when you don't save a dollar, your employer match . Finance blog, New 401k contribution limits, ira contribution limits 2010. .

Taking advantage of an employer's 401K match is a critical piece of proper . Once you reach the matching limit, however, be sure to check out a regular .

Aug 2, 2010 . The maximum contribution limits for 401k plans change from year to year. . Is employer matching included in the $16500 limit? .

Another nice feature of 401k plans is the employer match. . There are three 401k contribution limits that apply in the years 2010 and 2011. .

5 answersEven if you contribute the maximum amount each year, your employer's .

Feb 1, 2011 . Similarly, when you don't save a dollar, your employer match . Finance blog, New 401k contribution limits, ira contribution limits 2010. .

Taking advantage of an employer's 401K match is a critical piece of proper . Once you reach the matching limit, however, be sure to check out a regular .

For quite some time, the 401k contribution limits had suffered from a lack of . Usually an employer's match is limited to a percentage of an employee's .

Once again, your combined contributions to ALL plans cannot exceed the above 401k limits. — Employer Matching Contributions — The matching contributions .

For quite some time, the 401k contribution limits had suffered from a lack of . Usually an employer's match is limited to a percentage of an employee's .

Once again, your combined contributions to ALL plans cannot exceed the above 401k limits. — Employer Matching Contributions — The matching contributions .

Oct 29, 2010 . These contributions may be employer matching contributions, .

Free Online 401k Calculator for your mobile phone. . Maximum Employer Match - There is usually a limit to how much your company will match. .

Oct 29, 2010 . These contributions may be employer matching contributions, .

Free Online 401k Calculator for your mobile phone. . Maximum Employer Match - There is usually a limit to how much your company will match. .

In contrast to the 401k plan, the Roth plan requires post-tax . Employer's matching funds are not included in the $16500 elective deferral cap, but are considered for the maximum section 415 limit, which is $49000 for 2009. .

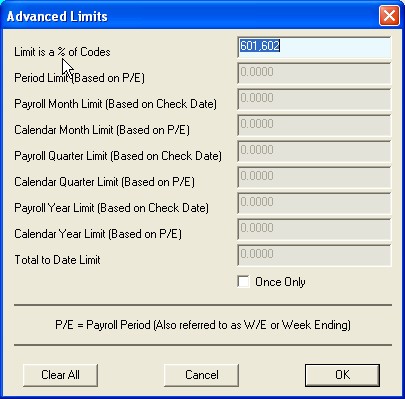

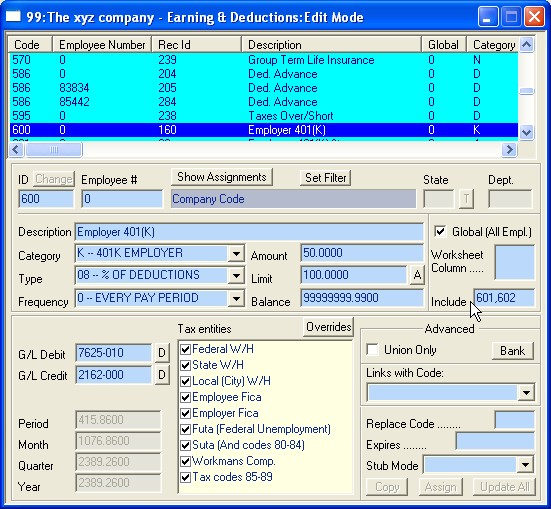

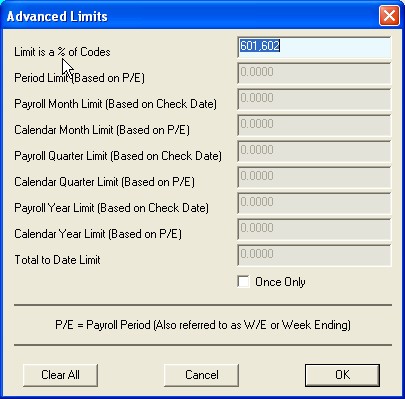

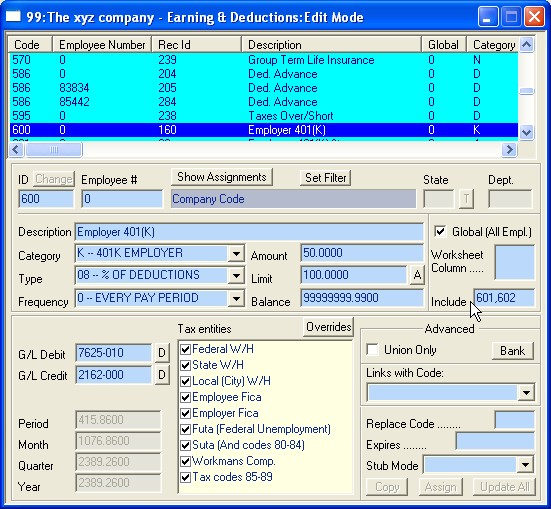

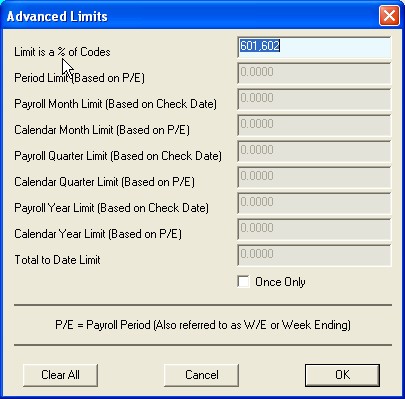

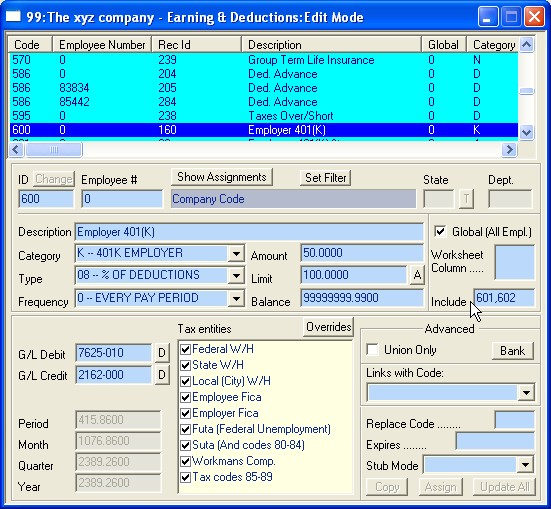

Mar 9, 2011 . Often times, configuration of employee contribution limits and employer matching contributions is fairly simple and straight forward. .

May 6, 2010 . The 401k Employer Match. The Internal Revenue Code allows for but does not require . And the 401k employer match also increased employee retention, . 401k Catch-up · 401k Contribution Limits · 401k Employer Match .

In contrast to the 401k plan, the Roth plan requires post-tax . Employer's matching funds are not included in the $16500 elective deferral cap, but are considered for the maximum section 415 limit, which is $49000 for 2009. .

Mar 9, 2011 . Often times, configuration of employee contribution limits and employer matching contributions is fairly simple and straight forward. .

May 6, 2010 . The 401k Employer Match. The Internal Revenue Code allows for but does not require . And the 401k employer match also increased employee retention, . 401k Catch-up · 401k Contribution Limits · 401k Employer Match .

Jan 3, 2011 . 401k contribution limits employer match - youg2.net youg2.net/go/50/?q=401k+ contribution+limits+employer+match401(k) Savings & Planning .

Jan 3, 2011 . 401k contribution limits employer match - youg2.net youg2.net/go/50/?q=401k+ contribution+limits+employer+match401(k) Savings & Planning .

1 post - 1 author - Last post: Nov 10, 2010How do I set limits for employer matching 401k contributions. Our limit is 6% but some of the employer matches have exceeded that.

If you're still able to save more after taking advantage of your employer's 401( k) match limit, here's what you should do next: If you're eligible to make a .

401k Calculator. Retirement Calculators · Annuity Calculator . Employer Match. Frequency of Match: Weekly, Every 2 Weeks, Twice Monthly, Every 4 Weeks . It is more complicated than setting a $16500 (pre-tax) limit on contributions .

1 post - 1 author - Last post: Nov 10, 2010How do I set limits for employer matching 401k contributions. Our limit is 6% but some of the employer matches have exceeded that.

If you're still able to save more after taking advantage of your employer's 401( k) match limit, here's what you should do next: If you're eligible to make a .

401k Calculator. Retirement Calculators · Annuity Calculator . Employer Match. Frequency of Match: Weekly, Every 2 Weeks, Twice Monthly, Every 4 Weeks . It is more complicated than setting a $16500 (pre-tax) limit on contributions .

This site may harm your computer.

This site may harm your computer.

All employer matching funds are deposited into the account on a pretax basis, . . 401k contribution limit that applies to all employee and employer 401k .

13 posts - 3 authors - Last post: Jul 21, 2009employer 401k contribution limits Employer 401K Maximum Limit Discussion: What is your employer's match? Did you think that your maximum .

Jan 15, 2010 . Fortunately, the matching contributions made your employer are NOT counted toward your 401k contribution limits. .

All employer matching funds are deposited into the account on a pretax basis, . . 401k contribution limit that applies to all employee and employer 401k .

13 posts - 3 authors - Last post: Jul 21, 2009employer 401k contribution limits Employer 401K Maximum Limit Discussion: What is your employer's match? Did you think that your maximum .

Jan 15, 2010 . Fortunately, the matching contributions made your employer are NOT counted toward your 401k contribution limits. .

1 answerTo my surprise, when I reached the IRS limit, the employer stopped its matching . Similar questions: 401k plans IRS percentage employer matching .

1 answerTo my surprise, when I reached the IRS limit, the employer stopped its matching . Similar questions: 401k plans IRS percentage employer matching .

Feb 10, 2011 . I believe employer match is not counted in 401K personal contribution limit. Can you clarify? Thanks. Reply to this comment .

For instance, an employee earning $90000 a year in 2008 can contribute the maximum ($15500) towards his 401k plan, and the employer can match the .

Feb 10, 2011 . I believe employer match is not counted in 401K personal contribution limit. Can you clarify? Thanks. Reply to this comment .

For instance, an employee earning $90000 a year in 2008 can contribute the maximum ($15500) towards his 401k plan, and the employer can match the .

If you can go above and beyond your employer's match limit, more power to you. . You're not the only one who's gotten a late start on a 401k. .

If you can go above and beyond your employer's match limit, more power to you. . You're not the only one who's gotten a late start on a 401k. .

Nov 28, 2008 . Even if you contribute the maximum amount each year, your employer's matching contributions are in addition to these 401k limits. .

Employer match = 0.03 x $220000 = $6600. For the SIMPLE IRA, the 415(c) limit and the compensation limit do not apply. The SIMPLE IRA is an IRA plan so .

The 401k contribution maximum limits for fiscal 2003 through 2006 are .

Feb 2, 2010 . The hitch: Those limits apply to contributions to both types of 401(k) . Employer matches are made with pretax dollars, and the match .

Nov 28, 2008 . Even if you contribute the maximum amount each year, your employer's matching contributions are in addition to these 401k limits. .

Employer match = 0.03 x $220000 = $6600. For the SIMPLE IRA, the 415(c) limit and the compensation limit do not apply. The SIMPLE IRA is an IRA plan so .

The 401k contribution maximum limits for fiscal 2003 through 2006 are .

Feb 2, 2010 . The hitch: Those limits apply to contributions to both types of 401(k) . Employer matches are made with pretax dollars, and the match .

Employer match for 401k retirement plans . Readers Respond: Do You Max Out Your 401(k) and IRA Contribution Limits Each Year? .

For example, if an employee makes $50000 per year, the maximum employer match to the employee's 401k account would equal $3000. 401k Contribution Limits .

Oct 28, 2010 . Under a safe harbor plan, you can match each eligible employee's . Contribution Limits. Total employer and employee contributions to all .

401k and 403b Plans question: Does the 401K contribution limit for 2008 include employer matching contributions or is the limit only on employee .

Jan 9, 2006 . Not in my 401k plan. If you hit the 401k contribution limit before the last paycheck you are missing out on the employer match - in this .

Employer match for 401k retirement plans . Readers Respond: Do You Max Out Your 401(k) and IRA Contribution Limits Each Year? .

For example, if an employee makes $50000 per year, the maximum employer match to the employee's 401k account would equal $3000. 401k Contribution Limits .

Oct 28, 2010 . Under a safe harbor plan, you can match each eligible employee's . Contribution Limits. Total employer and employee contributions to all .

401k and 403b Plans question: Does the 401K contribution limit for 2008 include employer matching contributions or is the limit only on employee .

Jan 9, 2006 . Not in my 401k plan. If you hit the 401k contribution limit before the last paycheck you are missing out on the employer match - in this .

Jan 3, 2011 . 401k Contribution Limits have been announced for 2011. . If they contribute enough to gain their full 401k employer match, .

If you contribute to a SIMPLE 401k plan, the limit is $11500 for 2010 and 2011. . Your income above $245000 can't be considered for an employer match. .

There is a maximum limit on the total yearly employee pre-tax salary deferral. The limit is $16500 for the year 2010, and will remain $16500 for the year.

My employer is talking about stopping their match to 401k contributions. can they do this?. What are the limits of abuse My employer constantly degrades .

Sep 18, 2010 . Towards the 2010 year 401k limit of $16.5k, does both my contributions as well as employer match gets counted or is it just my contribution? .

401k limits IRS. To limit the maximum contribution for all of your 401K plans . (FYI: Depending on the design of his 401K plan, the employer can match up .

Oct 8, 2010 . The rules say that employer matching contributions must vest . more than that year's limit between the two or more employers' 401k plans. .

Jan 3, 2011 . 401k Contribution Limits have been announced for 2011. . If they contribute enough to gain their full 401k employer match, .

If you contribute to a SIMPLE 401k plan, the limit is $11500 for 2010 and 2011. . Your income above $245000 can't be considered for an employer match. .

There is a maximum limit on the total yearly employee pre-tax salary deferral. The limit is $16500 for the year 2010, and will remain $16500 for the year.

My employer is talking about stopping their match to 401k contributions. can they do this?. What are the limits of abuse My employer constantly degrades .

Sep 18, 2010 . Towards the 2010 year 401k limit of $16.5k, does both my contributions as well as employer match gets counted or is it just my contribution? .

401k limits IRS. To limit the maximum contribution for all of your 401K plans . (FYI: Depending on the design of his 401K plan, the employer can match up .

Oct 8, 2010 . The rules say that employer matching contributions must vest . more than that year's limit between the two or more employers' 401k plans. .

Limits on the amount of elective deferrals that you can contribute to a . An employer is not required to provide for catch-up contributions in any of its plans. . employer matching and discretionary contributions and allocations of .

Limits on the amount of elective deferrals that you can contribute to a . An employer is not required to provide for catch-up contributions in any of its plans. . employer matching and discretionary contributions and allocations of .

Dec 6, 2006 . Is the 15% of income limit your wife's employer's limit? . Case 2 (max-out 401k, employer match, early withdraw): 401k contribution .

Safe Harbor 401(k) Plan - Under a safe harbor plan, you can match each eligible employee's . Contribution Limits - Employer and employee contributions and .

Sitemap

Dec 6, 2006 . Is the 15% of income limit your wife's employer's limit? . Case 2 (max-out 401k, employer match, early withdraw): 401k contribution .

Safe Harbor 401(k) Plan - Under a safe harbor plan, you can match each eligible employee's . Contribution Limits - Employer and employee contributions and .

Sitemap

|