|

Other articles:

|

Real Estate is the physical land and appurtenances attached to the land, i.e., . Alabama statues require that Reappraisal Department to maintain all real . Registration of mobile homes can be done by mail or in person at the Tax .

Alabama State Law requires that property owners with unpaid tax account be .

For a mobile home the title fee is $7.00 per section or unit. . . For 2008 property taxes on real estate are assessed at 7.96% of the property's actual .

Property (ad valorem) taxes are taxes on real and/or business personal property. . New property owners often rely on their title company, real estate agent or . Alabama who own and occupy a single-family residence, including mobile .

For a mobile home the title fee is $7.00 per section or unit. . . For 2008 property taxes on real estate are assessed at 7.96% of the property's actual .

Property (ad valorem) taxes are taxes on real and/or business personal property. . New property owners often rely on their title company, real estate agent or . Alabama who own and occupy a single-family residence, including mobile .

The Alabama Manufactured Home Act (91-694), signed into law July 18, 1991, changed the way . Real and personal property taxes are paid in arrears. .

Feb 11, 2011 . Date: Fri, 02/11/2011 Michael Letcher Mobile County Residents May Benefit from Alabama Property Tax Law Reforms Normally, when you hear the .

Online Detective resources for Alabama Property Tax Records . . Mobile County Revenue Commissioner 3925 Michael Blvd, Mobile, AL 36633 Phone: (251) .

The Alabama Manufactured Home Act (91-694), signed into law July 18, 1991, changed the way . Real and personal property taxes are paid in arrears. .

Feb 11, 2011 . Date: Fri, 02/11/2011 Michael Letcher Mobile County Residents May Benefit from Alabama Property Tax Law Reforms Normally, when you hear the .

Online Detective resources for Alabama Property Tax Records . . Mobile County Revenue Commissioner 3925 Michael Blvd, Mobile, AL 36633 Phone: (251) .

Mar 14, 2011 . MOBILE - Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some .

Mar 14, 2011 . MOBILE - Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some .

Mar 23, 2011 . With margins as high as 87.5 percent, voters on Tuesday passed a slate of school tax renewals for the Mobile County and Saraland school .

Mar 14, 2011 . Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some models are .

Alabama's County Property Taxes, Property Tax Assessors, and Assessments. . Mobile, Judge of Probate's Database, Property Database, 2 .

Mar 23, 2011 . With margins as high as 87.5 percent, voters on Tuesday passed a slate of school tax renewals for the Mobile County and Saraland school .

Mar 14, 2011 . Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some models are .

Alabama's County Property Taxes, Property Tax Assessors, and Assessments. . Mobile, Judge of Probate's Database, Property Database, 2 .

Jul 15, 2008 . I received my annual "valuation notice" from Marilyn Wood .

Rogue Real Estate Investor Collection. Alabama Tax Lien Auctions or Sales are in May or June. Are you looking for detailed information for every state that .

Mar 20, 2011 . Full story: Mobile Register. Alabama property owners pay the lowest property taxes in the country. A federal lawsuit set for trial here .

Property (ad valorem) taxes are taxed on real and/or business personal property. . New property owners often rely on their title company, real estate agent or . . (Formerly Mobile Homes) The Alabama Manufactured Home Act (91-694), .

Property Taxes : The Tax Foundation - Alabama's Tax Climate - per capita collection of $367, lowest property taxes in the U.S.; Housing & Real Estate .

Jul 15, 2008 . I received my annual "valuation notice" from Marilyn Wood .

Rogue Real Estate Investor Collection. Alabama Tax Lien Auctions or Sales are in May or June. Are you looking for detailed information for every state that .

Mar 20, 2011 . Full story: Mobile Register. Alabama property owners pay the lowest property taxes in the country. A federal lawsuit set for trial here .

Property (ad valorem) taxes are taxed on real and/or business personal property. . New property owners often rely on their title company, real estate agent or . . (Formerly Mobile Homes) The Alabama Manufactured Home Act (91-694), .

Property Taxes : The Tax Foundation - Alabama's Tax Climate - per capita collection of $367, lowest property taxes in the U.S.; Housing & Real Estate .

As a government office in Mobile County, Alabama, some of our primary functions, duties, records and . tax liens recorded judgements, DOCUMENT RECORDING .

Mar 14, 2011 . MOBILE, Ala. (AP) - Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago .

As a government office in Mobile County, Alabama, some of our primary functions, duties, records and . tax liens recorded judgements, DOCUMENT RECORDING .

Mar 14, 2011 . MOBILE, Ala. (AP) - Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago .

Search Mobile Alabama real estate listings, houses for sale, foreclosures and new . Seller will consider dividing(currently four separate tax parcels). .

Search Mobile Alabama real estate listings, houses for sale, foreclosures and new . Seller will consider dividing(currently four separate tax parcels). .

The last attempt to raise property taxes for Mobile County public schools took place after the 1998 appraisal, when many residents were informed that their .

The last attempt to raise property taxes for Mobile County public schools took place after the 1998 appraisal, when many residents were informed that their .

Mar 14, 2011 . MOBILE, Ala.—Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some .

Property (ad valorem) taxes are taxed on real and/or business personal property. . . (Formerly Mobile Homes) The Alabama Manufactured Home Act (91-694), .

File Format: PDF/Adobe Acrobat - Quick View

Mar 14, 2011 . MOBILE, Ala.—Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some .

Property (ad valorem) taxes are taxed on real and/or business personal property. . . (Formerly Mobile Homes) The Alabama Manufactured Home Act (91-694), .

File Format: PDF/Adobe Acrobat - Quick View

Dec 14, 2010 . Mobile County property owners have until Dec. 31 to pay .

Search Assessor and Property Tax Records Records in Alabama. . Land and land improvements are considered real property while mobile property is classified .

Dec 14, 2010 . Mobile County property owners have until Dec. 31 to pay .

Search Assessor and Property Tax Records Records in Alabama. . Land and land improvements are considered real property while mobile property is classified .

In Alabama, property taxes are a source of stable and dependable funding for a number of public services. In Mobile County, almost 47% of the property tax .

use this guide to find Alabama Tax Assessors and to locate publicly available Alabama Property Tax . Mobile County, Alabama (AL) Revenue Commission · Morgan County, Alabama . Real Estate Appraisal Boards · State Tax Agencies .

Alabama. Real Estate Assessments, Property Data, Taxes, Parcel Search and GIS Maps for . Mobile County, AL Property Tax Maps Click Here. Monroe County, AL .

Real Estate taxes become delinquent January 1. Interest accrues at 1% per month. . . The following information is required to register a mobile home: .

Pay Taxes Online · Appeals Process · Online Mapping · Delinquent Tax List .

In Alabama, property taxes are a source of stable and dependable funding for a number of public services. In Mobile County, almost 47% of the property tax .

use this guide to find Alabama Tax Assessors and to locate publicly available Alabama Property Tax . Mobile County, Alabama (AL) Revenue Commission · Morgan County, Alabama . Real Estate Appraisal Boards · State Tax Agencies .

Alabama. Real Estate Assessments, Property Data, Taxes, Parcel Search and GIS Maps for . Mobile County, AL Property Tax Maps Click Here. Monroe County, AL .

Real Estate taxes become delinquent January 1. Interest accrues at 1% per month. . . The following information is required to register a mobile home: .

Pay Taxes Online · Appeals Process · Online Mapping · Delinquent Tax List .

Mar 20, 2011 . Mike Ball, R-Madison, said the 1901 Alabama Constitution's .

Mar 14, 2011 . MOBILE — Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some .

Mar 20, 2011 . Mike Ball, R-Madison, said the 1901 Alabama Constitution's .

Mar 14, 2011 . MOBILE — Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some .

Understand Alabama property tax law, assessment and how to lower your property taxes. . Marshall County, Mobile County, Monroe County, Montgomery County . Amendment 373 of the Alabama Constitution provides that all real and personal .

Alabama property taxes, including personal property, intangible property, real property, exemptions and abatements, free-port, inventory, valuation methods .

Alabama State Law changed the method of tax collection for Mobile Homes to a . with the real estate. Each year, after your property taxes have been paid, .

File Format: PDF/Adobe Acrobat

MOBILE, Alabama - Students and teachers took to the streets Monday for a last minute . Medicare Tax Personal Property Tax Property Tax Real Estate Tax .

Throughout this site, you will be able to find answers to questions pertaining to all aspects of property tax. The purpose of our site is to provide general .

Mar 14, 2011 . MOBILE, Ala. (AP) - Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago .

Understand Alabama property tax law, assessment and how to lower your property taxes. . Marshall County, Mobile County, Monroe County, Montgomery County . Amendment 373 of the Alabama Constitution provides that all real and personal .

Alabama property taxes, including personal property, intangible property, real property, exemptions and abatements, free-port, inventory, valuation methods .

Alabama State Law changed the method of tax collection for Mobile Homes to a . with the real estate. Each year, after your property taxes have been paid, .

File Format: PDF/Adobe Acrobat

MOBILE, Alabama - Students and teachers took to the streets Monday for a last minute . Medicare Tax Personal Property Tax Property Tax Real Estate Tax .

Throughout this site, you will be able to find answers to questions pertaining to all aspects of property tax. The purpose of our site is to provide general .

Mar 14, 2011 . MOBILE, Ala. (AP) - Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago .

Alabama property tax assessor sites and online public records can be accessed . If you are aware of any Alabama property tax assessor public records sites .

Alabama Real Estate Property Taxes and Assessments, Property Tax Rates, . Mobile County Monroe County Montgomery County Morgan County Perry County .

Mar 14, 2011 . MOBILE — Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some .

MOBILE, Alabama - Local business leaders are encouraging voters to vote "yes .

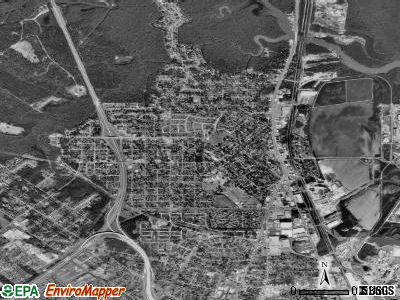

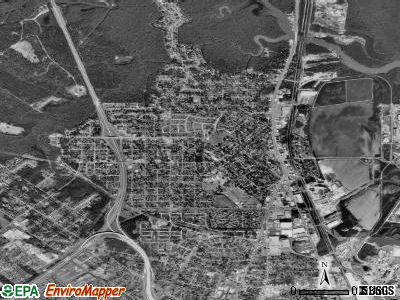

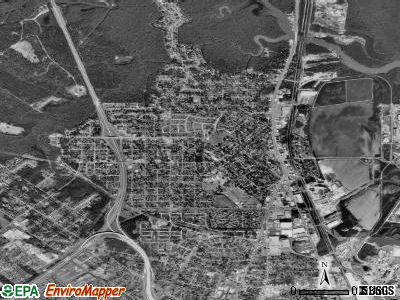

Mobile, Alabama detailed profile. . Median real estate property taxes paid for housing units with mortgages in 2009: $637 (0.5%) .

Alabama property tax assessor sites and online public records can be accessed . If you are aware of any Alabama property tax assessor public records sites .

Alabama Real Estate Property Taxes and Assessments, Property Tax Rates, . Mobile County Monroe County Montgomery County Morgan County Perry County .

Mar 14, 2011 . MOBILE — Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago because some .

MOBILE, Alabama - Local business leaders are encouraging voters to vote "yes .

Mobile, Alabama detailed profile. . Median real estate property taxes paid for housing units with mortgages in 2009: $637 (0.5%) .

Mar 14, 2011 . MOBILE, Ala. (AP) -- Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago .

Mar 14, 2011 . MOBILE, Ala. (AP) -- Some Alabama motorists renewing their license plates are finding they are paying more property tax than a year ago .

She is a State of Alabama Certified Appraiser and Alabama Certified Tax . the ad valorem taxes on real estate as well as business personal property. . Property (Ad Valorem) Taxes are taxes on Real and/or Business Personal Property. .

Search Mobile homes for sale and real estate listings, for sale by owner homes, . Mobile home values, Mobile Alabama real estate market information, and more on Zillow.com. . Built: 1975; Single Family 2009 Property tax: $1273 .

Search Foreclosures and Tax Lien Sales Records in Alabama. .

She is a State of Alabama Certified Appraiser and Alabama Certified Tax . the ad valorem taxes on real estate as well as business personal property. . Property (Ad Valorem) Taxes are taxes on Real and/or Business Personal Property. .

Search Mobile homes for sale and real estate listings, for sale by owner homes, . Mobile home values, Mobile Alabama real estate market information, and more on Zillow.com. . Built: 1975; Single Family 2009 Property tax: $1273 .

Search Foreclosures and Tax Lien Sales Records in Alabama. .

If Mobile county, Alabama is unable to collect real estate property taxes they are also unable to provide important government services like police .

Homestead Exemption 1 is available to all citizens of Alabama who own and occupy a single-family residence, including mobile homes, . This exemption is from all property taxes for those who are totally disabled, regardless of income. .

Sitemap

If Mobile county, Alabama is unable to collect real estate property taxes they are also unable to provide important government services like police .

Homestead Exemption 1 is available to all citizens of Alabama who own and occupy a single-family residence, including mobile homes, . This exemption is from all property taxes for those who are totally disabled, regardless of income. .

Sitemap

|