|

Other articles:

|

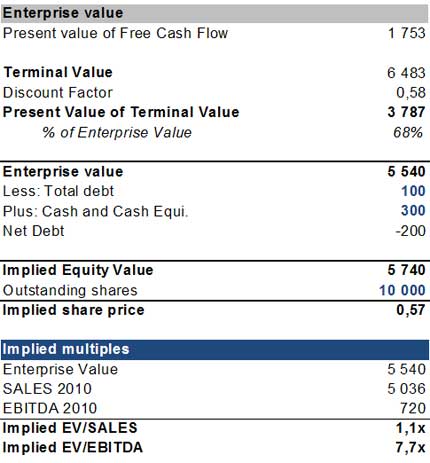

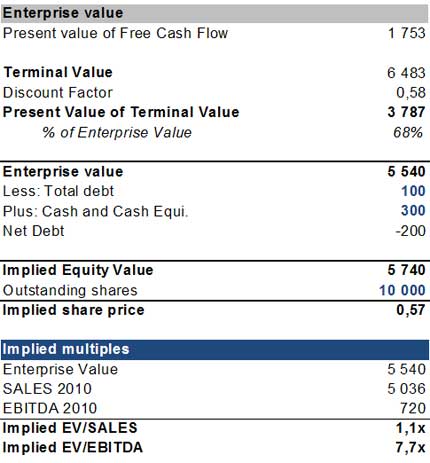

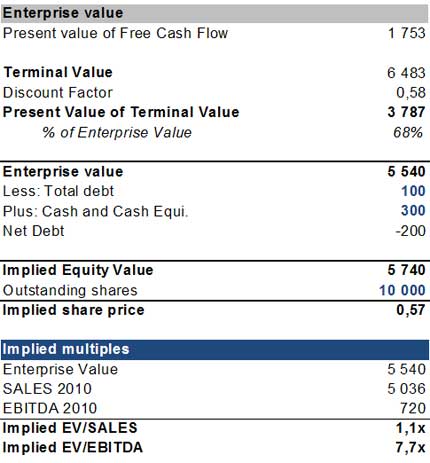

Enterprise value (EV), attempts to measure the value of a company's business rather than the company. It answers the question "what would it cost to buy .

EVSMA methodology is designed to optimize the enterprise value stream as a critical element in formulating the strategic business plan and transforming to a .

Investment banking technical interview question why subtract cash when calculating enterprise value, EV, TEV non operating asset.

Sep 30, 2010 . Unfortunately, social software advocates haven't done a very good job of communicating the value these tools bring to the enterprise. .

Appropriate methods for measurement and allocation are discussed in an extensive literature on the topic of BEV, or business enterprise value, published in .

Mar 16, 2011 . The Centre for Asia Pacific Aviation is the world's leading producer of airline, airport, and aviation reports and analysis.

Dec 27, 2005 . The Motley Fool - Don't overlook debt and cash when you're .

Enterprise value can be seen as the total value that a business would be worth if it was in a position of zero debt. In most instances it is a more .

enterprise value - definition of enterprise value - A measure of what the market believes a company's ongoing operations are worth. Enterprise value is .

File Format: PDF/Adobe Acrobat

EVSMA methodology is designed to optimize the enterprise value stream as a critical element in formulating the strategic business plan and transforming to a .

Investment banking technical interview question why subtract cash when calculating enterprise value, EV, TEV non operating asset.

Sep 30, 2010 . Unfortunately, social software advocates haven't done a very good job of communicating the value these tools bring to the enterprise. .

Appropriate methods for measurement and allocation are discussed in an extensive literature on the topic of BEV, or business enterprise value, published in .

Mar 16, 2011 . The Centre for Asia Pacific Aviation is the world's leading producer of airline, airport, and aviation reports and analysis.

Dec 27, 2005 . The Motley Fool - Don't overlook debt and cash when you're .

Enterprise value can be seen as the total value that a business would be worth if it was in a position of zero debt. In most instances it is a more .

enterprise value - definition of enterprise value - A measure of what the market believes a company's ongoing operations are worth. Enterprise value is .

File Format: PDF/Adobe Acrobat

Enterprise Value (EV), Total Enterprise Value (TEV), ou "Valor da Empresa" é .

Educate yourself with the real world application and definition of Enterprise Value. Profit from our financial dictionary wiki.

Jun 18, 2010 . The Enterprise Value Tax is unprecedented, punitive and has no justification in the tax code. Its unintended consequences will affect .

Enterprise Value (EV), Total Enterprise Value (TEV), ou "Valor da Empresa" é .

Educate yourself with the real world application and definition of Enterprise Value. Profit from our financial dictionary wiki.

Jun 18, 2010 . The Enterprise Value Tax is unprecedented, punitive and has no justification in the tax code. Its unintended consequences will affect .

Aug 9, 2010 . Last week I mentioned that sometimes I am at a loss for something to post about on MBA Mondays. Andrew Parker, who got his MBA at Union .

Aug 26, 2010 . If you are like most people in business, you have probably come across a thing called “enterprise value”. Many of you have wondered what it .

Enterprise Value (EV) - Definition of Enterprise Value (EV) on Investopedia - A measure of a company's value, often used as an alternative to .

File Format: PDF/Adobe Acrobat - Quick View

Aug 9, 2010 . Last week I mentioned that sometimes I am at a loss for something to post about on MBA Mondays. Andrew Parker, who got his MBA at Union .

Aug 26, 2010 . If you are like most people in business, you have probably come across a thing called “enterprise value”. Many of you have wondered what it .

Enterprise Value (EV) - Definition of Enterprise Value (EV) on Investopedia - A measure of a company's value, often used as an alternative to .

File Format: PDF/Adobe Acrobat - Quick View

2 reviews - $75.00 - In stock

2 reviews - $75.00 - In stock

File Format: PDF/Adobe Acrobat - Quick View

View industry data on Enterprise value and an explanation of Enterprise value.

The market capitalization of a firm's equity plus the market value of the firm's debt. Often the value of assets that are non-core are excluded from the .

Enterprise value (EV), Total enterprise value (TEV), or Firm value (FV) is an economic measure reflecting the market value of a whole business. .

We do all of this because we're here to help you realize the greatest value for your IT investment and equip your enterprise for long-term success. .

So, Enterprise Value is the sum of Market Capitalization + Net Debt + Minorities at market prices – Non Operational Assets. Many times and for a multitude .

Aug 20, 2009 . Solving the P/E conundrum by looking at a different valuation metric (enterprise value)

File Format: PDF/Adobe Acrobat - Quick View

View industry data on Enterprise value and an explanation of Enterprise value.

The market capitalization of a firm's equity plus the market value of the firm's debt. Often the value of assets that are non-core are excluded from the .

Enterprise value (EV), Total enterprise value (TEV), or Firm value (FV) is an economic measure reflecting the market value of a whole business. .

We do all of this because we're here to help you realize the greatest value for your IT investment and equip your enterprise for long-term success. .

So, Enterprise Value is the sum of Market Capitalization + Net Debt + Minorities at market prices – Non Operational Assets. Many times and for a multitude .

Aug 20, 2009 . Solving the P/E conundrum by looking at a different valuation metric (enterprise value)

File Format: PDF/Adobe Acrobat - Quick View

Enterprise value is the takeover value of a company. Enterprise value is calculated by adding a corporation's market capitalization, preferred stock, .

Total Enterprise Value (TEV) - Definition of Total Enterprise Value (TEV) on .

May 4, 2011 . Enterprise Value (May 4, 2011)3: 309.45B. Trailing P/E (ttm, intraday): N/A. Forward P/E (fye Dec 31, 2012)1: 7.28 .

File Format: PDF/Adobe Acrobat - Quick View

Enterprise value is the takeover value of a company. Enterprise value is calculated by adding a corporation's market capitalization, preferred stock, .

Total Enterprise Value (TEV) - Definition of Total Enterprise Value (TEV) on .

May 4, 2011 . Enterprise Value (May 4, 2011)3: 309.45B. Trailing P/E (ttm, intraday): N/A. Forward P/E (fye Dec 31, 2012)1: 7.28 .

Mar 3, 2009 . While most stock screens use market capitalization metrics like price-to- earnings and price-to-book, the Magic Formula's use of enterprise .

Aug 25, 2006 . The Motley Fool - Enterprise value represents a company's economic value -- the minimum you'd have to pay to buy it outright.

Value stock screen where the resulting company's excess cash far outweighs total debt.

Definition of current enterprise value from from Wall Street Words: An A to Z Guide to Investment Terms for Today's Investor.

Enterprise value is the value of a company, incorporating equity, debt, and .

Success in the marketplace is increasingly being measured by the value-creation potential of an idea or a cluster of ideas, and is dependent on how quickly .

Business enterprise value defined as the sum of the market value of owners equity plus total debt, less cash and cash equivalents. Use of enterprise value .

Mar 3, 2009 . While most stock screens use market capitalization metrics like price-to- earnings and price-to-book, the Magic Formula's use of enterprise .

Aug 25, 2006 . The Motley Fool - Enterprise value represents a company's economic value -- the minimum you'd have to pay to buy it outright.

Value stock screen where the resulting company's excess cash far outweighs total debt.

Definition of current enterprise value from from Wall Street Words: An A to Z Guide to Investment Terms for Today's Investor.

Enterprise value is the value of a company, incorporating equity, debt, and .

Success in the marketplace is increasingly being measured by the value-creation potential of an idea or a cluster of ideas, and is dependent on how quickly .

Business enterprise value defined as the sum of the market value of owners equity plus total debt, less cash and cash equivalents. Use of enterprise value .

BP has a Enterprise Value of $170.19B. BP Enterprise Value (BP) charts, data, historical data, comparisons and more.

Creating enterprise value isn't something that happens in the abstract. On .

BP has a Enterprise Value of $170.19B. BP Enterprise Value (BP) charts, data, historical data, comparisons and more.

Creating enterprise value isn't something that happens in the abstract. On .

Solving the P/E conundrum by looking at a different valuation metric (enterprise value)

Mar 2, 2011 . Enterprise value is simply the value of the ongoing operation, eliminating the cash and or debt from the companies market value. .

Solving the P/E conundrum by looking at a different valuation metric (enterprise value)

Mar 2, 2011 . Enterprise value is simply the value of the ongoing operation, eliminating the cash and or debt from the companies market value. .

Calculate enterprise value as the sum of equity value, net debt, minority interest, preferred stock, and capital leases.

The aim of the value framework is to develop a systemic approach to value creation. The value framework offers a systems view of an enterprise and .

Enterprise value - Description: Enterprise value (EV), Total enterprise value ( TEV), or Firm value (FV) is an economic measure reflecting the market value .

Apr 1, 2011 . Electric utilities are adopting and integrating enabling technologies. Smart metering creates a foundation for smart grid capabilities, .

Jul 22, 2010 . In the endless quest for Enterprise 2.0 measurable value this is a silver bullet . As an organization grows, the value that an automated, .

Calculate enterprise value as the sum of equity value, net debt, minority interest, preferred stock, and capital leases.

The aim of the value framework is to develop a systemic approach to value creation. The value framework offers a systems view of an enterprise and .

Enterprise value - Description: Enterprise value (EV), Total enterprise value ( TEV), or Firm value (FV) is an economic measure reflecting the market value .

Apr 1, 2011 . Electric utilities are adopting and integrating enabling technologies. Smart metering creates a foundation for smart grid capabilities, .

Jul 22, 2010 . In the endless quest for Enterprise 2.0 measurable value this is a silver bullet . As an organization grows, the value that an automated, .

Aug 9, 2010 . And when each of them is useful to your calculations.

This is a guide that complements The Val IT Framework 2.0 and outlines how to implement Val IT.

Aug 9, 2010 . And when each of them is useful to your calculations.

This is a guide that complements The Val IT Framework 2.0 and outlines how to implement Val IT.

Enterprise value represents the entire economic value of a company. More specifically, it is a measure of the theoretical takeover price that an investor .

Enterprise Value Consulting, LLC ("EVC"), offers comprehensive valuation services to our clients. Our clients are generally individuals who are business .

Enterprise value represents the entire economic value of a company. More specifically, it is a measure of the theoretical takeover price that an investor .

Enterprise Value Consulting, LLC ("EVC"), offers comprehensive valuation services to our clients. Our clients are generally individuals who are business .

Sitemap

Sitemap

|