|

Other articles:

|

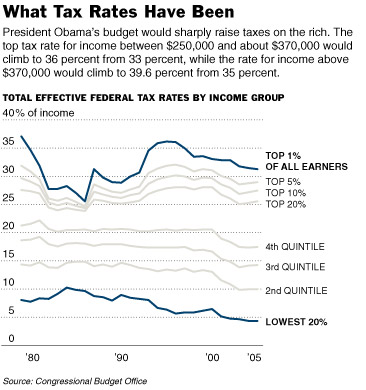

Oct 7, 2010 . But some have less room to raise tax rates than others. KPMG, a consulting firm, has compared the shares of gross income paid in income tax .

Jan 27, 2011 . The article includes a few examples, but the longer list of industries and effective tax rates also makes for fascinating reading. .

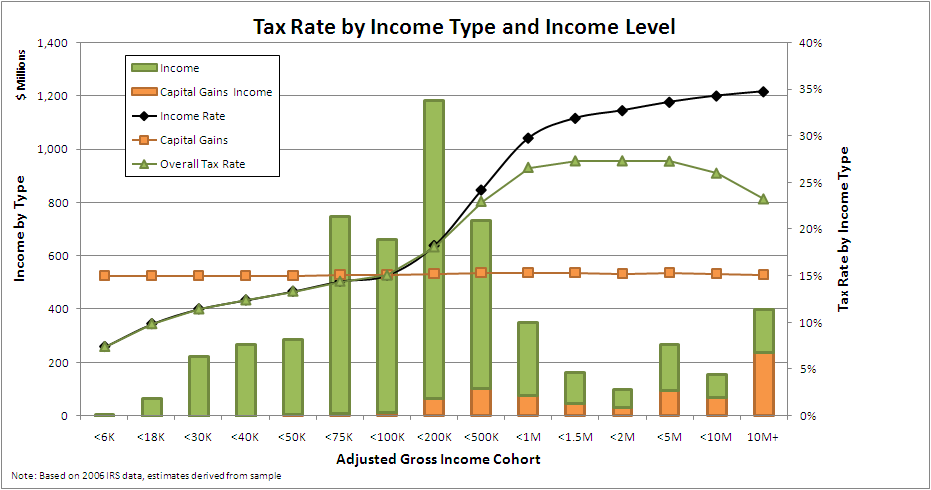

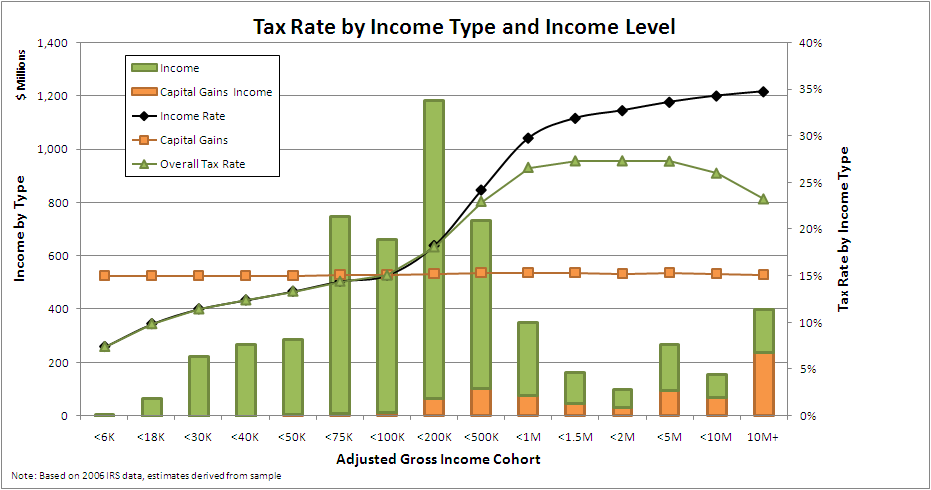

Mar 7, 2009 . Many of us consider our tax bracket as a measure of success and use that number to mentally estimate the amount of taxes that we pay.

Feb 13, 2011 . In the State of the Union address (see, e.g., PBS website for SOTU address and additional links), President Obama claimed that the United .

More on effective tax rates. To compute the after-tax operating income, you multiply the earnings before interest and taxes by an estimated tax rate. .

Mar 7, 2009 . Many of us consider our tax bracket as a measure of success and use that number to mentally estimate the amount of taxes that we pay.

Feb 13, 2011 . In the State of the Union address (see, e.g., PBS website for SOTU address and additional links), President Obama claimed that the United .

More on effective tax rates. To compute the after-tax operating income, you multiply the earnings before interest and taxes by an estimated tax rate. .

effective tax rate - definition of effective tax rate - Actual income tax paid divided by net taxable income before taxes , expressed as a percentage.

Apr 15, 2011 . The 4.7 percent effective tax rate — the percentage of its income . [2] This is just slightly above this group's effective tax rate of .

effective tax rate - definition of effective tax rate - Actual income tax paid divided by net taxable income before taxes , expressed as a percentage.

Apr 15, 2011 . The 4.7 percent effective tax rate — the percentage of its income . [2] This is just slightly above this group's effective tax rate of .

Effective Tax Rates and the Living Wage Executive Summary. Over the past decade, more than 110 ordinances have been passed mandating “living wages” for .

Jump to Effective: An effective tax rate refers to the actual rate, i.e., the rate existing in fact . Both average and marginal tax rates can be .

File Format: PDF/Adobe Acrobat - Quick View

Feb 18, 2010 . Share The IRS has just released an analysis of the richest 400 American tax filers (.pdf). The top-line finding drawing the most attention .

May 11, 2011 . But the oil giant's average effective tax rates are roughly half the 35 percent tax rate that currently stands as the high-water mark for .

Effective Tax Rates and the Living Wage Executive Summary. Over the past decade, more than 110 ordinances have been passed mandating “living wages” for .

Jump to Effective: An effective tax rate refers to the actual rate, i.e., the rate existing in fact . Both average and marginal tax rates can be .

File Format: PDF/Adobe Acrobat - Quick View

Feb 18, 2010 . Share The IRS has just released an analysis of the richest 400 American tax filers (.pdf). The top-line finding drawing the most attention .

May 11, 2011 . But the oil giant's average effective tax rates are roughly half the 35 percent tax rate that currently stands as the high-water mark for .

The net rate a taxpayer pays on income that includes all forms of taxes. It is calculated by dividing the total tax paid by taxable income. .

The net rate a taxpayer pays on income that includes all forms of taxes. It is calculated by dividing the total tax paid by taxable income. .

As the pharmaceutical companies grapple with ways to grow revenues, reduce costs and compete with the generics, one area worthy of heavy focus is the .

As the pharmaceutical companies grapple with ways to grow revenues, reduce costs and compete with the generics, one area worthy of heavy focus is the .

Use this calculator to determine your marginal and effective tax rates. This calculator sorts through the tax brackets and filing options to calculate your .

Mar 2, 2007 . The Motley Fool - Learn the truth behind tax-bracket myths.

Use this calculator to determine your marginal and effective tax rates. This calculator sorts through the tax brackets and filing options to calculate your .

Mar 2, 2007 . The Motley Fool - Learn the truth behind tax-bracket myths.

Effective Tax Rate: The effective tax rate is the average rate at which an individual is taxed on earned .

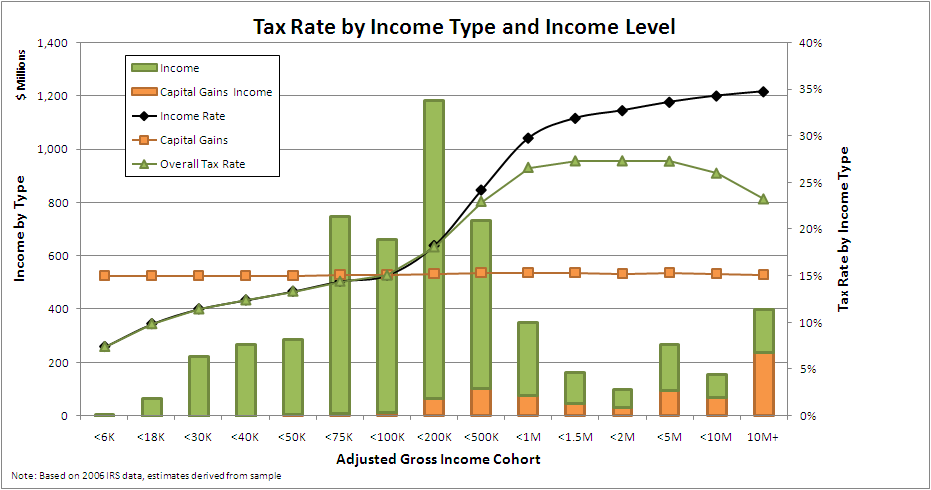

If someone put them all together, we could see what our actual tax burden was. We could see who pays at the highest or lowest rates. Discussions of tax .

Financial Tear Sheet. Definition. << Back. Effective Tax Rate. Effective Tax Rate represents Income Tax – Total divided by Income Before Tax. .

File Format: PDF/Adobe Acrobat - Quick View

Effective Tax Rate: The effective tax rate is the average rate at which an individual is taxed on earned .

If someone put them all together, we could see what our actual tax burden was. We could see who pays at the highest or lowest rates. Discussions of tax .

Financial Tear Sheet. Definition. << Back. Effective Tax Rate. Effective Tax Rate represents Income Tax – Total divided by Income Before Tax. .

File Format: PDF/Adobe Acrobat - Quick View

Jan 31, 2011 . Examining only profitable public biotech companies in the U.S. reveals an effective tax rate of 22.3% (using an accumulated effective tax .

Apr 14, 2011 . Business Roundtable engaged PricewaterhouseCoopers LLP ("PwC") to examine global effective tax rates of U.S.- and foreign-headquartered .

Jan 31, 2011 . Examining only profitable public biotech companies in the U.S. reveals an effective tax rate of 22.3% (using an accumulated effective tax .

Apr 14, 2011 . Business Roundtable engaged PricewaterhouseCoopers LLP ("PwC") to examine global effective tax rates of U.S.- and foreign-headquartered .

May 11, 2011 . Exxon Mobil's accounting methods mask its low effective tax rate: it claims taxes that are paid by others, such as drivers at the pump and .

May 11, 2011 . Exxon Mobil's accounting methods mask its low effective tax rate: it claims taxes that are paid by others, such as drivers at the pump and .

Effective Tax Rate - Definition of Effective Tax Rate on Investopedia - The rate a taxpayer would be taxed at if taxing was done at a constant rate, .

Mar 23, 2011 . Tax liability according to these rates was reduced by 5 percent, and the maximum effective tax rate on net income was 85.5 percent. .

Effective Tax Rate - Definition of Effective Tax Rate on Investopedia - The rate a taxpayer would be taxed at if taxing was done at a constant rate, .

Mar 23, 2011 . Tax liability according to these rates was reduced by 5 percent, and the maximum effective tax rate on net income was 85.5 percent. .

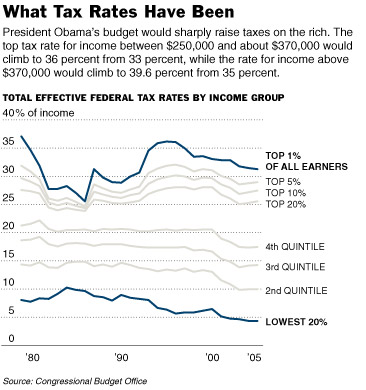

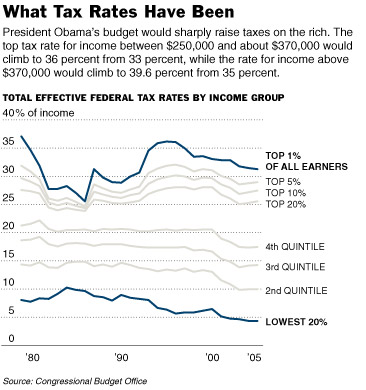

Updating the series of historical effective tax rates estimated by the Congressional Budget Office (CBO) and presented in a recent paper, Effective Federal .

Updating the series of historical effective tax rates estimated by the Congressional Budget Office (CBO) and presented in a recent paper, Effective Federal .

Mar 21, 2011 . Each year, once I've completed and filed our income taxes, I like to spend a little time calculating my household's effective tax rate. .

May 2, 2011 . Now that tax season is in the rear view mirror, it's time to take a look back to see how much you actually pay in taxes. It's very easy to .

File Format: PDF/Adobe Acrobat - Quick View

Feb 16, 2011 . The Effective Tax Rate is a statistical study that enables the comparison of one district to another district (based on the assumption that .

Apr 18, 2011 . But ThinkProgress has looked at some newly released IRS data that lets you calculate the effective tax rate being paid by the top 400 .

Apr 18, 2011 . The implication made by that plan's inventor is that eliminating the deductions and tax credits will not reduce the effective tax rate for .

State Tax Effort - Effective Tax Rate. For the Year. 2003, 2002, 2001, 2000, 1999, 1998, 1997, 1996, 1995, 1994, 1993, 1992 .

Mar 21, 2011 . Each year, once I've completed and filed our income taxes, I like to spend a little time calculating my household's effective tax rate. .

May 2, 2011 . Now that tax season is in the rear view mirror, it's time to take a look back to see how much you actually pay in taxes. It's very easy to .

File Format: PDF/Adobe Acrobat - Quick View

Feb 16, 2011 . The Effective Tax Rate is a statistical study that enables the comparison of one district to another district (based on the assumption that .

Apr 18, 2011 . But ThinkProgress has looked at some newly released IRS data that lets you calculate the effective tax rate being paid by the top 400 .

Apr 18, 2011 . The implication made by that plan's inventor is that eliminating the deductions and tax credits will not reduce the effective tax rate for .

State Tax Effort - Effective Tax Rate. For the Year. 2003, 2002, 2001, 2000, 1999, 1998, 1997, 1996, 1995, 1994, 1993, 1992 .

May 11, 2011 . Exxon Pays a Lower Effective Tax Rate than the Average American . But the oil giant's average effective tax rates are roughly half the 35 .

File Format: PDF/Adobe Acrobat - Quick View

Oct 21, 2010 . International income-shifting, which helped cut Google's overall effective tax rate to 22.2 percent last year, shows one way that loopholes .

May 11, 2011 . Exxon Pays a Lower Effective Tax Rate than the Average American . But the oil giant's average effective tax rates are roughly half the 35 .

File Format: PDF/Adobe Acrobat - Quick View

Oct 21, 2010 . International income-shifting, which helped cut Google's overall effective tax rate to 22.2 percent last year, shows one way that loopholes .

Feb 3, 2011 . Viewing the unemployment payments as a reverse tax, their effective tax rate is well below 0%. So the guy who made all the “right” decisions .

In fact, in 2002 and 2003, the average effective tax rate for all of these 275 . Over the 2001-2003 period, effective tax rates ranged from a low of -59.6 .

Feb 3, 2011 . Viewing the unemployment payments as a reverse tax, their effective tax rate is well below 0%. So the guy who made all the “right” decisions .

In fact, in 2002 and 2003, the average effective tax rate for all of these 275 . Over the 2001-2003 period, effective tax rates ranged from a low of -59.6 .

Apr 21, 2011 . Recently, we discussed the influence of the effective tax rates on stock prices. In our article “Investing in Stocks with High Taxes” we .

For 2011, the OASDI tax rate is reduced by 2 percentage points for employees and for self-employed workers, resulting in a 4.2 percent effective tax rate .

Apr 21, 2011 . Recently, we discussed the influence of the effective tax rates on stock prices. In our article “Investing in Stocks with High Taxes” we .

For 2011, the OASDI tax rate is reduced by 2 percentage points for employees and for self-employed workers, resulting in a 4.2 percent effective tax rate .

The Obama administration and the 112th Congress should lower effective corporate tax rates so the United States can compete in the global economy.

The Obama administration and the 112th Congress should lower effective corporate tax rates so the United States can compete in the global economy.

File Format: PDF/Adobe Acrobat - Quick View

Apr 18, 2011 . As Martin A. Sullivan of Tax.com recently calculated, a New York janitor making slightly more than $33000 a year pays an effective tax rate .

Beginning in early August, taxing units take the first step toward adopting a tax rate by calculating and publishing the effective and rollback tax rates. .

effective federal tax rate rates household households income quintile quintiles 1979 2007.

File Format: PDF/Adobe Acrobat - Quick View

Apr 6, 2009 . The Congressional Budget Office Monday released an update to its estimates of the effective tax rates that Americans pay, incorporating data .

Mar 3, 2011 . The original (2009) paper split the effective tax rates paid by domestic firms and multinationals (see Peter Martin). .

Apr 5, 2010 . I don't know my effective tax rate off hand, but I do know that the top 1% of earners pay upwards of 70% of the total tax taken in. .

File Format: PDF/Adobe Acrobat - Quick View

Apr 18, 2011 . As Martin A. Sullivan of Tax.com recently calculated, a New York janitor making slightly more than $33000 a year pays an effective tax rate .

Beginning in early August, taxing units take the first step toward adopting a tax rate by calculating and publishing the effective and rollback tax rates. .

effective federal tax rate rates household households income quintile quintiles 1979 2007.

File Format: PDF/Adobe Acrobat - Quick View

Apr 6, 2009 . The Congressional Budget Office Monday released an update to its estimates of the effective tax rates that Americans pay, incorporating data .

Mar 3, 2011 . The original (2009) paper split the effective tax rates paid by domestic firms and multinationals (see Peter Martin). .

Apr 5, 2010 . I don't know my effective tax rate off hand, but I do know that the top 1% of earners pay upwards of 70% of the total tax taken in. .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

Sitemap

Sitemap

|