|

Other articles:

|

Coverage Ratio Calculator, Palm Springs, Cathedral City, Palm Desert, La Quinta, Desert Hot Springs, Indio, Thermal, Thousand Palms, Rancho Mirage, .

Modelling the Debt Service Reserve Cover Ratio DSCR explained.

The interest coverage ratio is a measure of the number of times a company could make the interest payments on its debt with its earnings before interest and .

Cash Coverage Ratio | Calculation | Formula | Example.

Definition of fixed-charge coverage ratio from from Wall Street Words: An A to Z Guide to Investment Terms for Today's Investor.

Cash Coverage Ratio | Calculation | Formula | Example.

Definition of fixed-charge coverage ratio from from Wall Street Words: An A to Z Guide to Investment Terms for Today's Investor.

The debt service coverage ratio (DSCR), also known as "debt coverage ratio," is the ratio of cash available for debt servicing to interest, principal and .

The debt service coverage ratio (DSCR), also known as "debt coverage ratio," is the ratio of cash available for debt servicing to interest, principal and .

The Coverage Ratio Calculator will easily calculate the coverage ratio for a company. The formula for coverage ratio is net operating income divided by .

The debt service coverage ratio (DSCR) is used by bank loan officers to determine income property loans. Most lenders require a minimum DSCR of 1.2.

File Format: PDF/Adobe Acrobat - Quick View

The formula for the interest coverage ratio is used to measure a company's earnings relative to the amount of interest that it pays. .

Jan 30, 2007 . Coverage ratios indicate whether a company has sufficient resources to meet its contractual obligations. As such, they are a form of .

The Coverage Ratio Calculator will easily calculate the coverage ratio for a company. The formula for coverage ratio is net operating income divided by .

The debt service coverage ratio (DSCR) is used by bank loan officers to determine income property loans. Most lenders require a minimum DSCR of 1.2.

File Format: PDF/Adobe Acrobat - Quick View

The formula for the interest coverage ratio is used to measure a company's earnings relative to the amount of interest that it pays. .

Jan 30, 2007 . Coverage ratios indicate whether a company has sufficient resources to meet its contractual obligations. As such, they are a form of .

Jan 13, 2011 . The Debt Coverage Ratio indicator determines whether the real estate investment property generates enough money to cover the annual debt. .

Jan 13, 2011 . The Debt Coverage Ratio indicator determines whether the real estate investment property generates enough money to cover the annual debt. .

Use Commercial Loan Calculator to calculate debt service coverage on new commercial/business . and to calculate 10 key financial ratios for your business. .

Debt-Service Coverage Ratio (DSCR) - Definition of Debt-Service Coverage .

Interest coverage ratio is also known as debt service ratio. This is the Formula , Calculation, definition, Example of this ratio. This ratio relates the .

The Cash Current Debt coverage ratio measures a companys ability to repay their current debt. Unlike the current and acid test ratio which looks at the year .

Mar 11, 2008 . I got the numerator, but I'm so freaking lost on what the . Cash Debt Coverage = (cash flow from operations - dividends) / total debt. .

Business Accounting and Bookkeeping question: What advantage does fixed charge coverage ratio offer using times interest earned?

coverage ratio - definition of coverage ratio from BusinessDictionary.com: Banking: Measure of a bank's ability to absorb potential losses from its .

Use Commercial Loan Calculator to calculate debt service coverage on new commercial/business . and to calculate 10 key financial ratios for your business. .

Debt-Service Coverage Ratio (DSCR) - Definition of Debt-Service Coverage .

Interest coverage ratio is also known as debt service ratio. This is the Formula , Calculation, definition, Example of this ratio. This ratio relates the .

The Cash Current Debt coverage ratio measures a companys ability to repay their current debt. Unlike the current and acid test ratio which looks at the year .

Mar 11, 2008 . I got the numerator, but I'm so freaking lost on what the . Cash Debt Coverage = (cash flow from operations - dividends) / total debt. .

Business Accounting and Bookkeeping question: What advantage does fixed charge coverage ratio offer using times interest earned?

coverage ratio - definition of coverage ratio from BusinessDictionary.com: Banking: Measure of a bank's ability to absorb potential losses from its .

The fixed charge coverage ratio is an important debt ratio in financial .

View industry data on Interest Coverage Ratio and an explanation of Interest Coverage Ratio.

Real Estate: Debt Coverage Ratio DCR - Definition.

Debt coverage ratio shows a company's ability to pay its debts. The debt coverage ratio compares the cash flow the company has to the total amount of debt .

Coverage Ratio - Definition of Coverage Ratio on Investopedia - An accounting ratio that helps measure a company's ability to meet its obligations .

The fixed charge coverage ratio is an important debt ratio in financial .

View industry data on Interest Coverage Ratio and an explanation of Interest Coverage Ratio.

Real Estate: Debt Coverage Ratio DCR - Definition.

Debt coverage ratio shows a company's ability to pay its debts. The debt coverage ratio compares the cash flow the company has to the total amount of debt .

Coverage Ratio - Definition of Coverage Ratio on Investopedia - An accounting ratio that helps measure a company's ability to meet its obligations .

Aug 10, 2010 . Coverage ratio is a number that refers to a company's ability to meet its obligations. Specifically, the ratio involves dividing the .

Mar 10, 2008 . As a commercial finance consultant I speak with new apartment building investors on a daily basis whom respond to one of my fliers or visit .

Nov 1, 2009 . Accounting ratios used by accountants for calculating debt coverage.

Aug 10, 2010 . Coverage ratio is a number that refers to a company's ability to meet its obligations. Specifically, the ratio involves dividing the .

Mar 10, 2008 . As a commercial finance consultant I speak with new apartment building investors on a daily basis whom respond to one of my fliers or visit .

Nov 1, 2009 . Accounting ratios used by accountants for calculating debt coverage.

Interest Coverage Ratio - Definition of Interest Coverage Ratio on .

Oct 30, 2009 . See also: Loan Agreement · Times Interest Earned Ratio · Fixed Charge Coverage Ratio · Time Interest Earned Ratio Analysis · Free Cash Flow .

Interest Coverage Ratio - Definition of Interest Coverage Ratio on .

Oct 30, 2009 . See also: Loan Agreement · Times Interest Earned Ratio · Fixed Charge Coverage Ratio · Time Interest Earned Ratio Analysis · Free Cash Flow .

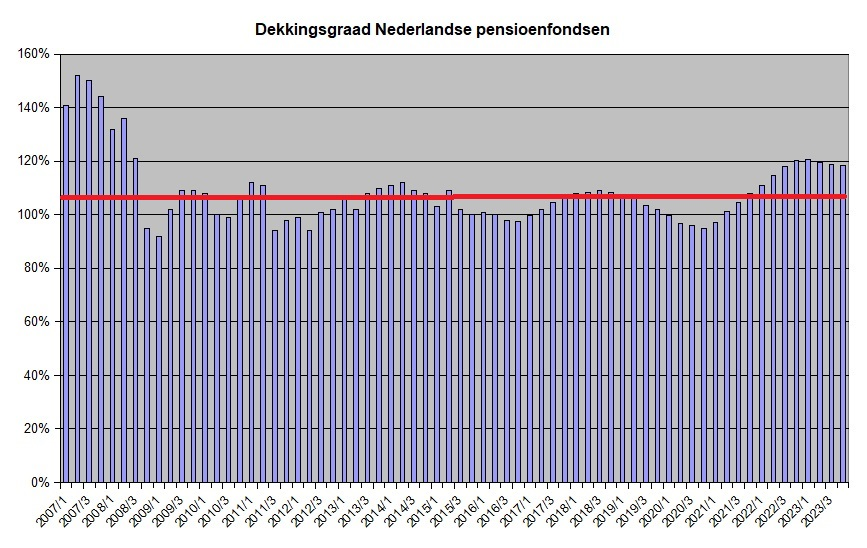

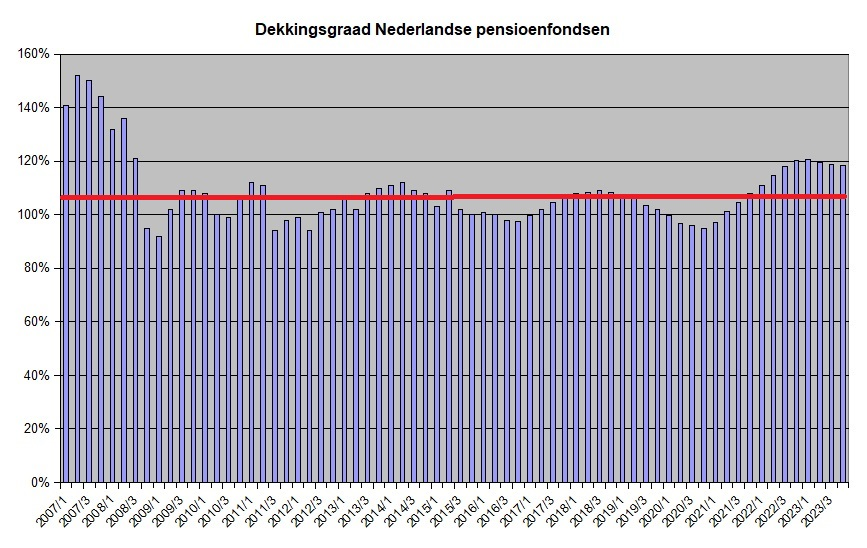

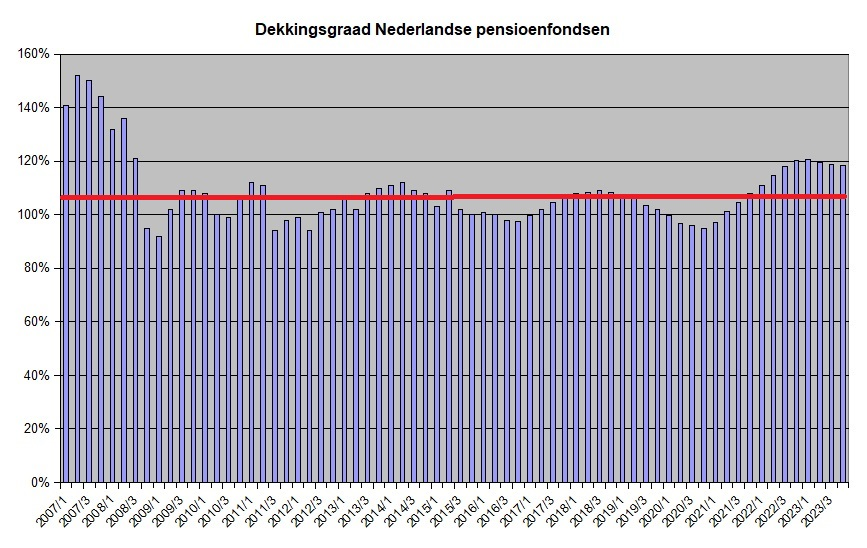

Sep 11, 2010 . The average coverage ratio of many pension funds has fallen to a level well below 100% (underfunded). Some major Dutch pension funds with .

The interest coverage ratio is a measurement of the number of times a company can make its interest payments with its earnings before interest and taxes.

Article on Debt Coverage Ratio also known as Debt Service Coverage Ratio. - Real estate investment software by Advantage Software LLC.

Interest Coverage Ratio. Compare prices, check ratings & read product reviews before . Interest Coverage Ratio. Opps.. this website is under maintenance, .

DSCR = NOI/Total Debt Service -- The DSCR is a ratio used to analyze the amount of debt that can be supported by the cash flow generated from the property.

Sep 11, 2010 . The average coverage ratio of many pension funds has fallen to a level well below 100% (underfunded). Some major Dutch pension funds with .

The interest coverage ratio is a measurement of the number of times a company can make its interest payments with its earnings before interest and taxes.

Article on Debt Coverage Ratio also known as Debt Service Coverage Ratio. - Real estate investment software by Advantage Software LLC.

Interest Coverage Ratio. Compare prices, check ratings & read product reviews before . Interest Coverage Ratio. Opps.. this website is under maintenance, .

DSCR = NOI/Total Debt Service -- The DSCR is a ratio used to analyze the amount of debt that can be supported by the cash flow generated from the property.

Sep 18, 2009 . A flat coverage ratio on 2008 would have wiped out 1H2009 PBT for the sector. In aggregate, the banks under our coverage reported €19 bn of .

Nov 26, 2004 . A coverage ratio compares the estimate from the sample of the number of people who have a particular characteristic to the same estimate .

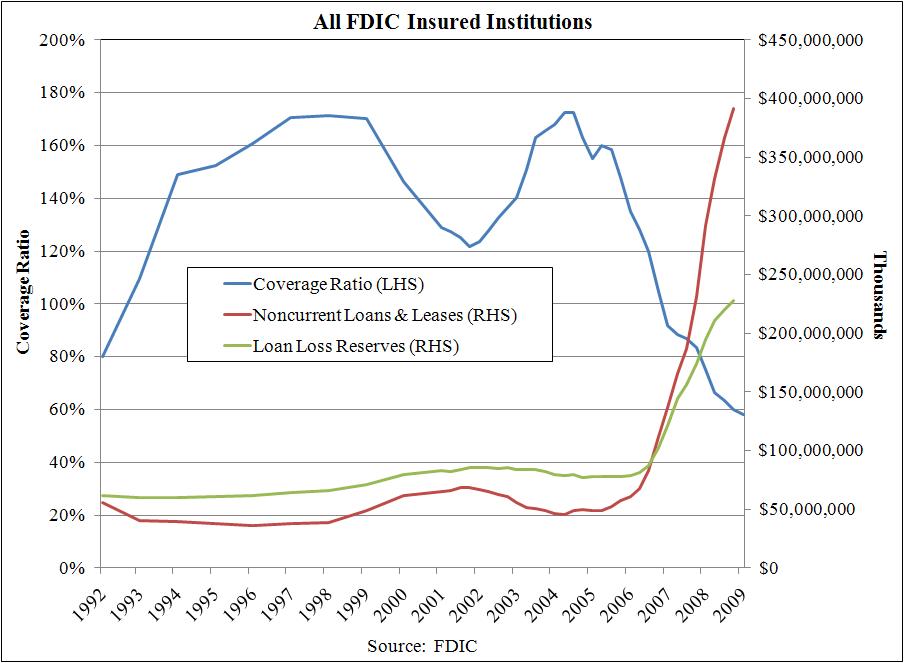

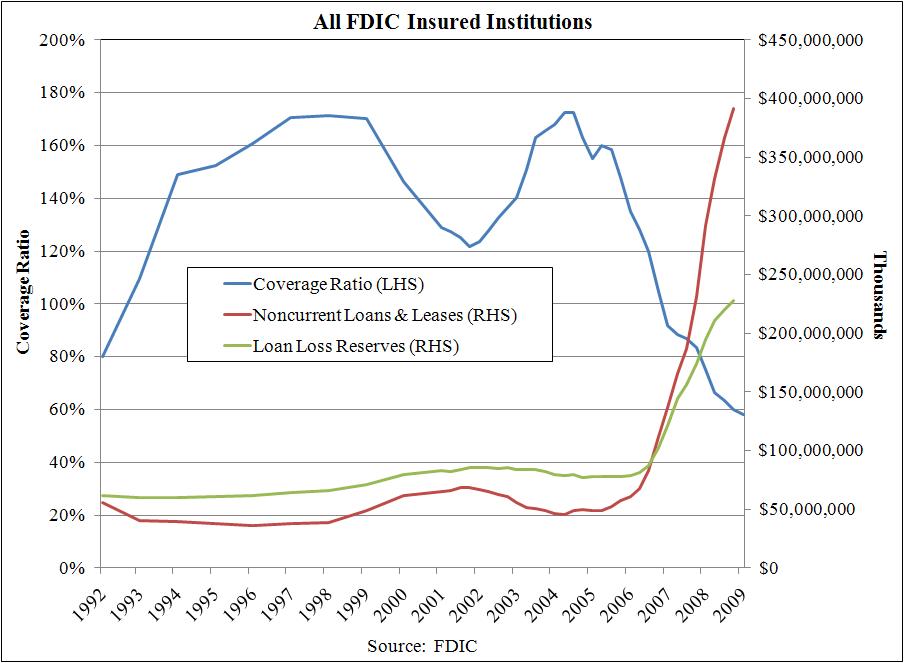

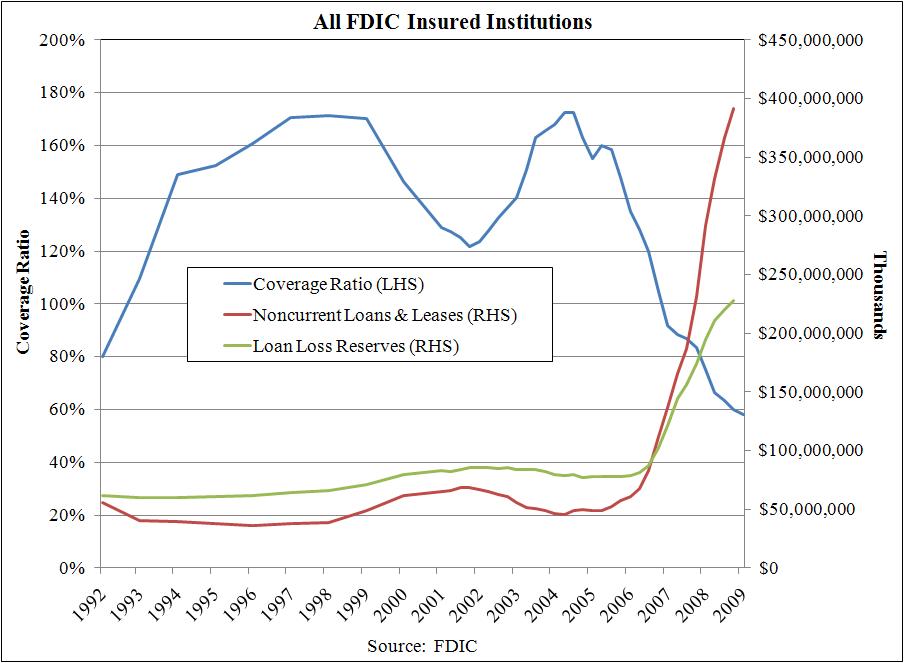

Banks use the loan-loss coverage ratio to define the quality of its assets and how well it protects itself from losses caused by problematic loans. .

Sep 18, 2009 . A flat coverage ratio on 2008 would have wiped out 1H2009 PBT for the sector. In aggregate, the banks under our coverage reported €19 bn of .

Nov 26, 2004 . A coverage ratio compares the estimate from the sample of the number of people who have a particular characteristic to the same estimate .

Banks use the loan-loss coverage ratio to define the quality of its assets and how well it protects itself from losses caused by problematic loans. .

A measure of a corporation's ability to meet a certain type of expense. In general, a high coverage ratio indicates a better ability to meet the expense in .

Jun 7, 2009 . high test coverage ratio, and ultimately 100% test coverage, is an illusion of quality. The underlying reason is that when a .

Debt service coverage ratio gives much more information than interest . Interest coverage ratio is more appropriate when the company is able to borrow more in .

coverage ratio - definition of coverage ratio - A measure of a coproration's ability to meet a particular expense .

A measure of a corporation's ability to meet a certain type of expense. In general, a high coverage ratio indicates a better ability to meet the expense in .

Jun 7, 2009 . high test coverage ratio, and ultimately 100% test coverage, is an illusion of quality. The underlying reason is that when a .

Debt service coverage ratio gives much more information than interest . Interest coverage ratio is more appropriate when the company is able to borrow more in .

coverage ratio - definition of coverage ratio - A measure of a coproration's ability to meet a particular expense .

Learn about debt coverage ratio (DCR), how to calculate it, and why its important to real estate investment.

Learn about debt coverage ratio (DCR), how to calculate it, and why its important to real estate investment.

Cash debt coverage ratio. Formula to calculate cash debt coverage ratio.

Debt Coverage Ratio (DCR) or Debt Service Coverage Ratio (DSCR) is a widely used ratio in the case of buy-to-let property and in general .

Cash debt coverage ratio. Formula to calculate cash debt coverage ratio.

Debt Coverage Ratio (DCR) or Debt Service Coverage Ratio (DSCR) is a widely used ratio in the case of buy-to-let property and in general .

Debt service coverage ratio for business and real estate.

How is the Debt Coverage Ratio (DCR) calculated for commercial real estate investments and developments? What are the factors that the Debt Coverage Ratio .

Real estate investment calculator solving for debt coverage ratio given annual net operating income and annual debt service.

We explain the definition of the Coverage Ratio and give examples of the different types of Coverage Ratios that indicate if a firm can meet its expenses .

Cash Flow coverage Ratio - Such cash flow coverage ratio highlights the financialstatement ratio analysis spreadsheets and formulas, definitions, charts and .

How to Calculate the Cash Coverage Ratio. The cash coverage ratio is a long-term solvency measure. The cash coverage ratio is a refinement of the TIE ratio.

Debt service coverage ratio for business and real estate.

How is the Debt Coverage Ratio (DCR) calculated for commercial real estate investments and developments? What are the factors that the Debt Coverage Ratio .

Real estate investment calculator solving for debt coverage ratio given annual net operating income and annual debt service.

We explain the definition of the Coverage Ratio and give examples of the different types of Coverage Ratios that indicate if a firm can meet its expenses .

Cash Flow coverage Ratio - Such cash flow coverage ratio highlights the financialstatement ratio analysis spreadsheets and formulas, definitions, charts and .

How to Calculate the Cash Coverage Ratio. The cash coverage ratio is a long-term solvency measure. The cash coverage ratio is a refinement of the TIE ratio.

Sitemap

Sitemap

|