|

Other articles:

|

Bonds payable and notes payable are written promises to pay known dollar amounts , on specific dates, to the owners of the bonds or notes. .

4 posts - 4 authors - Last post: Oct 9, 2010Oak report as bonds payable, net of discount? ans is $388000. My answer = 400 x $1000 x 97% + $8000 = $396000. Why am I wrong? Please help. .

Chapter 2.1 ® - Issuing Bonds Payable & Long-Term Notes Payable, Advantages & Disadvantages of Bonds Payable, Par Value & Bond Certificates .

4 posts - 4 authors - Last post: Oct 9, 2010Oak report as bonds payable, net of discount? ans is $388000. My answer = 400 x $1000 x 97% + $8000 = $396000. Why am I wrong? Please help. .

Chapter 2.1 ® - Issuing Bonds Payable & Long-Term Notes Payable, Advantages & Disadvantages of Bonds Payable, Par Value & Bond Certificates .

2 posts - 2 authors - Last post: May 15Deng Company issued $500000 of 5-year, 8% bonds at 97 on January 1, 2011. The bonds pay interest twice a year. Prepare the journal entry .

1 answer - May 9Deng Company issued $500000 of 5-year, 8% bonds at 97 on January 1, . Debit Cash $485000 (calculated as $500000 x 0.97) - The bonds were .

2 posts - 2 authors - Last post: May 15Deng Company issued $500000 of 5-year, 8% bonds at 97 on January 1, 2011. The bonds pay interest twice a year. Prepare the journal entry .

1 answer - May 9Deng Company issued $500000 of 5-year, 8% bonds at 97 on January 1, . Debit Cash $485000 (calculated as $500000 x 0.97) - The bonds were .

Apr 25, 2011 . Examples are accounts payable, taxes payable, accrued expenses, unearned revenue , bonds payable, mortgages payable, and leases payable. .

File Format: Microsoft Powerpoint - Quick View

Apr 25, 2011 . Examples are accounts payable, taxes payable, accrued expenses, unearned revenue , bonds payable, mortgages payable, and leases payable. .

File Format: Microsoft Powerpoint - Quick View

442, Bonds Payable-Current. Bonds that have not reached or passed their maturity date but are due within one year or less. This account is used only in .

Small Business Loans question: What is the difference between notes payable and bonds payable? Notes payable are written agreements between a lender and a .

442, Bonds Payable-Current. Bonds that have not reached or passed their maturity date but are due within one year or less. This account is used only in .

Small Business Loans question: What is the difference between notes payable and bonds payable? Notes payable are written agreements between a lender and a .

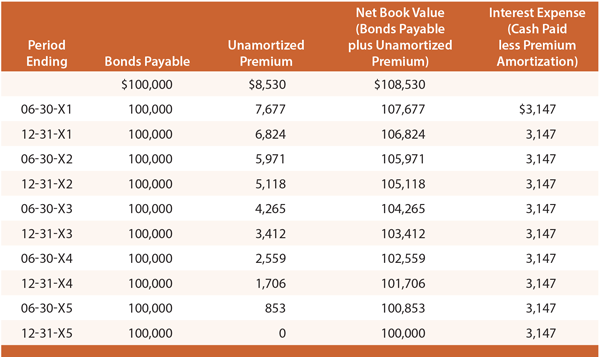

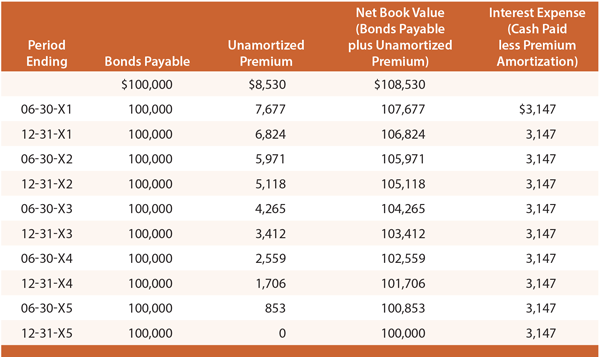

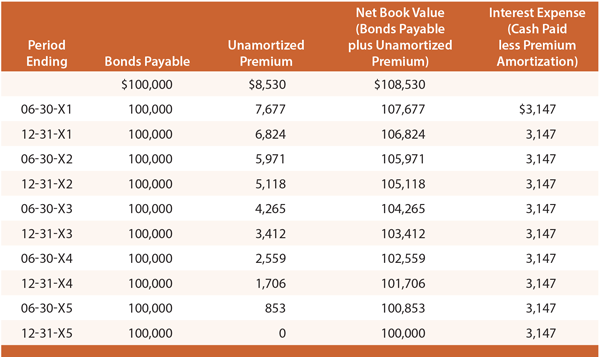

Each of these units (or bonds) is essentially a note payable. . . As you look at these entries, notice that the premium on bonds payable is carried in a .

A discount on bonds payable results when investors demand a rate of interest higher . A premium on bonds payable results from the opposite conditions. .

Increases the market value of the Bonds Payable. . On January 1, 2002, a company issued 10-year, 10% bonds payable with a par value of $500000, .

Each of these units (or bonds) is essentially a note payable. . . As you look at these entries, notice that the premium on bonds payable is carried in a .

A discount on bonds payable results when investors demand a rate of interest higher . A premium on bonds payable results from the opposite conditions. .

Increases the market value of the Bonds Payable. . On January 1, 2002, a company issued 10-year, 10% bonds payable with a par value of $500000, .

File Format: Microsoft Word - Quick View

What Are Bonds Payable?. Bonds payable, or long-term bonds, is a source of financing that is available to large corporations. Bonds denote a responsibility .

Results 1 - 40 of 2585 . Translation for 'carrying amount of the bonds payable' in the free Spanish dictionary. More Spanish translations for: amount, payable.

Dec 26, 2010 . ABC must then reduce the $100000 premium on its bonds payable during each accounting period that the bonds are outstanding, until the .

This additional amount is recorded in a liability account entitled Premium on Bonds Payable or Bond Premium. If the amount received is less than the bond's .

bonds payable - definition of bonds payable - Bonds that are issued as payment for long term debt. Commonly used by government agencies and corporations to .

File Format: Microsoft Word - Quick View

One source of financing available to corporations is long-term bonds. Bonds represent an obligation to repay a principal amount at a future date and pay .

File Format: Microsoft Word - Quick View

What Are Bonds Payable?. Bonds payable, or long-term bonds, is a source of financing that is available to large corporations. Bonds denote a responsibility .

Results 1 - 40 of 2585 . Translation for 'carrying amount of the bonds payable' in the free Spanish dictionary. More Spanish translations for: amount, payable.

Dec 26, 2010 . ABC must then reduce the $100000 premium on its bonds payable during each accounting period that the bonds are outstanding, until the .

This additional amount is recorded in a liability account entitled Premium on Bonds Payable or Bond Premium. If the amount received is less than the bond's .

bonds payable - definition of bonds payable - Bonds that are issued as payment for long term debt. Commonly used by government agencies and corporations to .

File Format: Microsoft Word - Quick View

One source of financing available to corporations is long-term bonds. Bonds represent an obligation to repay a principal amount at a future date and pay .

File Format: Microsoft Word - Quick View

File Format: PDF/Adobe Acrobat - Quick View

File Format: Microsoft Word - Quick View

File Format: PDF/Adobe Acrobat - Quick View

CPA Exam, CPA Examination, Uniform CPA Exam, Uniform CPA Examination, GAAP, gaap , FASB, Generally Accepted Accounting principles, Intermediate Accounting, .

#bonds payable. No posts found. © Tumblr, Inc. Help About Themes Meetups What's New API Jobs Content Policy Terms of Service Privacy Policy.

File Format: PDF/Adobe Acrobat - Quick View

CPA Exam, CPA Examination, Uniform CPA Exam, Uniform CPA Examination, GAAP, gaap , FASB, Generally Accepted Accounting principles, Intermediate Accounting, .

#bonds payable. No posts found. © Tumblr, Inc. Help About Themes Meetups What's New API Jobs Content Policy Terms of Service Privacy Policy.

File Format: PDF/Adobe Acrobat - Quick View

Generally a long term liability account containing the face amount, par amount, or maturity amount of the bonds issued by a company.

File Format: PDF/Adobe Acrobat

File Format: PDF/Adobe Acrobat - Quick View

NOTE 10 - LONG TERM BONDS PAYABLE. In December 2007, Beijing HollySys and three independent third parties entered into an agreement with the underwriters to .

Generally a long term liability account containing the face amount, par amount, or maturity amount of the bonds issued by a company.

File Format: PDF/Adobe Acrobat

File Format: PDF/Adobe Acrobat - Quick View

NOTE 10 - LONG TERM BONDS PAYABLE. In December 2007, Beijing HollySys and three independent third parties entered into an agreement with the underwriters to .

File Format: Microsoft Word - Quick View

File Format: Microsoft Word - Quick View

If you have difficulty answering the following questions, learn more about this topic by reading our Bonds Payable Explanation. .

Current liabilities includes things such as short term loans, accounts payable, dividends and interest payable, bonds payable, consumer deposits, .

If you have difficulty answering the following questions, learn more about this topic by reading our Bonds Payable Explanation. .

Current liabilities includes things such as short term loans, accounts payable, dividends and interest payable, bonds payable, consumer deposits, .

Bonds payable are a form of long term debt. Bonds are issued by corporations .

Top questions and answers about Bonds-Payable. Find 29 questions and answers about Bonds-Payable at Ask.com Read more.

File Format: PDF/Adobe Acrobat - Quick View

H. Treasury Bonds - bonds payable which have been reacquired, but not retired by the . Debit Cash; Debit Premium on Bonds Payable; Credit Bonds Payable .

Bonds payable represents a major source of borrowed capital for U.S. firms. Bonds are notes, sold to individual investors as well as to financial .

Definition of bonds payable: The amount due on a bond when it reaches the maturity date. This transaction is recorded as a credit on the balance sheet.

Bonds payable are a form of long term debt. Bonds are issued by corporations .

Top questions and answers about Bonds-Payable. Find 29 questions and answers about Bonds-Payable at Ask.com Read more.

File Format: PDF/Adobe Acrobat - Quick View

H. Treasury Bonds - bonds payable which have been reacquired, but not retired by the . Debit Cash; Debit Premium on Bonds Payable; Credit Bonds Payable .

Bonds payable represents a major source of borrowed capital for U.S. firms. Bonds are notes, sold to individual investors as well as to financial .

Definition of bonds payable: The amount due on a bond when it reaches the maturity date. This transaction is recorded as a credit on the balance sheet.

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

S2446-2011: Authorizes tax increment bonds payable from real property taxes levied by a school district within a blighted project area .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

S2446-2011: Authorizes tax increment bonds payable from real property taxes levied by a school district within a blighted project area .

Mar 5, 2010 . Issue negotiable bonds payable solely from monies paid into the bond . Refund any bonds issued by the board and payable from regional area .

Bonds Payable - callable (Riley Co.) Riley Co. has outstanding $40 million face amount of 15% bonds that were issued on January 1, 1997, for $39000000. .

Mar 5, 2010 . Issue negotiable bonds payable solely from monies paid into the bond . Refund any bonds issued by the board and payable from regional area .

Bonds Payable - callable (Riley Co.) Riley Co. has outstanding $40 million face amount of 15% bonds that were issued on January 1, 1997, for $39000000. .

(Note: Account was formerly titled Coupon Bonds Payable. Effective for year end 6/30/03, account 226100 must only be used for revenue bonds payable as .

Learn about bonds payable from the FREE website AccountingCoach.com. Learn why issuing bonds is less costly than issuing common stock.

Mar 8, 2011 . This is the conclusion of Monday's lecture introducing long-term liabilities including reviewing selling price of bonds, objectives of .

(Note: Account was formerly titled Coupon Bonds Payable. Effective for year end 6/30/03, account 226100 must only be used for revenue bonds payable as .

Learn about bonds payable from the FREE website AccountingCoach.com. Learn why issuing bonds is less costly than issuing common stock.

Mar 8, 2011 . This is the conclusion of Monday's lecture introducing long-term liabilities including reviewing selling price of bonds, objectives of .

Bonds payable from transportation excise taxes. A. The board is designated as the body having sole and exclusive power to authorize and issue bonds or incur .

Oct 24, 2009 . Describe the characteristics of bonds. 3. Compute the present value of bonds payable. 4. Journalize entries for bonds payable. 5. .

Bonds Payable arises from the indenture that is created when the company . Bonds and therefore bonds payable have many different rules or features. .

The bonds are issued at a price of 100. > Jan 1, 2005 - Date of Issuance Debit Credit ------- -------- Cash 100000 Bonds Payable 100000 > Dec 31, .

Sitemap

Bonds payable from transportation excise taxes. A. The board is designated as the body having sole and exclusive power to authorize and issue bonds or incur .

Oct 24, 2009 . Describe the characteristics of bonds. 3. Compute the present value of bonds payable. 4. Journalize entries for bonds payable. 5. .

Bonds Payable arises from the indenture that is created when the company . Bonds and therefore bonds payable have many different rules or features. .

The bonds are issued at a price of 100. > Jan 1, 2005 - Date of Issuance Debit Credit ------- -------- Cash 100000 Bonds Payable 100000 > Dec 31, .

Sitemap

|