|

Other articles:

|

Theory recognizes three approaches to business valuation: the income-based . . Sliwoski, Leonard J. "Alternatives to Business Valuation Rules of Thumb for .

Feb 21, 2009 . The rule of thumb and formula method (another market approach) is a . As noted , while this simple conceptual valuation approaches and .

Chapter 6: Overview of Accepted Business Valuation Approaches, Methods, and Procedures . .. Exhibit 12-1: Rules of Thumb for Valuation .

File Format: PDF/Adobe Acrobat - Quick View

Mar 31, 2011 . Market Based Approach: A market approach to business valuation is based on . Another market-based approach is known as “rules of thumb”, .

Asset Based Approach definition, It is a valuation process for . .. Rule of Thumb definition, Rule of thumb is a mathematical relationship between or among .

File Format: PDF/Adobe Acrobat - Quick View

Mar 31, 2011 . Market Based Approach: A market approach to business valuation is based on . Another market-based approach is known as “rules of thumb”, .

Asset Based Approach definition, It is a valuation process for . .. Rule of Thumb definition, Rule of thumb is a mathematical relationship between or among .

Some people consider “Rules of thumb” a third market approach method, . Rules of thumb, when available, can be useful as a sanity check on valuation .

Some people consider “Rules of thumb” a third market approach method, . Rules of thumb, when available, can be useful as a sanity check on valuation .

Theory recognizes three approaches to business valuation: the income-based . Rules of thumb are standards established for businesses in the same industry. .

Typically, a rule of thumb or benchmark indicator is used as a reasonableness check against the values determined by the use of other valuation approaches. .

Theory recognizes three approaches to business valuation: the income-based . Rules of thumb are standards established for businesses in the same industry. .

Typically, a rule of thumb or benchmark indicator is used as a reasonableness check against the values determined by the use of other valuation approaches. .

Therefore, one should be aware that there are rules of thumb used by some . . Having covered many of the alternative valuation approaches with intellectual .

Therefore, one should be aware that there are rules of thumb used by some . . Having covered many of the alternative valuation approaches with intellectual .

The outcome reached in a practice appraisal may be dependent upon its purpose. . . of assets approach is the easiest and best "rule of thumb" guesstimate. .

While a number of rules of thumb or so-called benchmarks may be used to value . approaches to and the application of intellectual property valuation. .

The outcome reached in a practice appraisal may be dependent upon its purpose. . . of assets approach is the easiest and best "rule of thumb" guesstimate. .

While a number of rules of thumb or so-called benchmarks may be used to value . approaches to and the application of intellectual property valuation. .

Market based or Multiplier valuation. This approach values a business by using an "industry average" rule of thumb multiplier. This industry average number .

Feb 19, 2010 . He asked what were the most common valuation approaches used for valuing a . Certain industries have their own rules of thumb that are .

File Format: Microsoft Powerpoint - Quick View

Jan 20, 2010 . The business valuation of healthcare professional practices is a widely . which can render even the best approach to valuation ineffective. . Rules of thumb are commonly seen as generalized ratios of earnings, price, .

A screen that follows the Fundamental Rule of Thumb approach is built into . in book value is an accounting determination rather than a market valuation. .

Market based or Multiplier valuation. This approach values a business by using an "industry average" rule of thumb multiplier. This industry average number .

Feb 19, 2010 . He asked what were the most common valuation approaches used for valuing a . Certain industries have their own rules of thumb that are .

File Format: Microsoft Powerpoint - Quick View

Jan 20, 2010 . The business valuation of healthcare professional practices is a widely . which can render even the best approach to valuation ineffective. . Rules of thumb are commonly seen as generalized ratios of earnings, price, .

A screen that follows the Fundamental Rule of Thumb approach is built into . in book value is an accounting determination rather than a market valuation. .

Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, and discounted cash flow valuation .

Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, and discounted cash flow valuation .

May 20, 2010 . However, rules of thumb can be useful in testing the value conclusion arrived through the appraiser's selected approaches and methods. .

File Format: PDF/Adobe Acrobat - Quick View

Feb 19, 2010 . Approaches to Valuation. Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, and discounted .

May 20, 2010 . However, rules of thumb can be useful in testing the value conclusion arrived through the appraiser's selected approaches and methods. .

File Format: PDF/Adobe Acrobat - Quick View

Feb 19, 2010 . Approaches to Valuation. Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, and discounted .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

Feb 18, 2010 . HCA 270 Approaches to Valuation rules of thumb: (twice .

Another limitation of the NPV approach is that the model assumes that . The rule of thumb with capital budgeting or when evaluating a project is to accept .

Sep 19, 2010 . Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, and discounted cash .

Feb 18, 2010 . HCA 270 Approaches to Valuation rules of thumb: (twice .

Another limitation of the NPV approach is that the model assumes that . The rule of thumb with capital budgeting or when evaluating a project is to accept .

Sep 19, 2010 . Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, and discounted cash .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

Hca/270 Appendix c Wk 5: Axia College Material Appendix C Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb .

File Format: Microsoft Word - Quick View

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

Hca/270 Appendix c Wk 5: Axia College Material Appendix C Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb .

File Format: Microsoft Word - Quick View

File Format: PDF/Adobe Acrobat - Quick View

.bmp)

Axia College Material Appendix C Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb. .

1 answer - Apr 20, 2008Rules of thumb for ratio analysis can often be valuable in "first cut" selection for equities trading, particularly by value investors and financial .

If we are going to use a rule of thumb to value a business, some type of earnings . . Most buyers use some type of valuation approach based upon the .

Axia College Material Appendix C Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb. .

1 answer - Apr 20, 2008Rules of thumb for ratio analysis can often be valuable in "first cut" selection for equities trading, particularly by value investors and financial .

If we are going to use a rule of thumb to value a business, some type of earnings . . Most buyers use some type of valuation approach based upon the .

Feb 11, 2011 . Iowa Rejects Rule of Thumb Business Valuation in Divorce. . of Financial Statements · Income Approach · Discount or Capitalization Rates .

Jan 26, 2011 . Appendix C Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, .

Feb 11, 2011 . Iowa Rejects Rule of Thumb Business Valuation in Divorce. . of Financial Statements · Income Approach · Discount or Capitalization Rates .

Jan 26, 2011 . Appendix C Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, .

There are essentially three principal, but often overlapping, life insurance planning approaches: Rules of Thumb. Human Life Value (Income Replacement) .

Valuation Approaches Rules of thumb –Calculated using the annual revenues and multiplying that figure by 2. the total revenues are needed. to be divided the .

File Format: PDF/Adobe Acrobat

There are essentially three principal, but often overlapping, life insurance planning approaches: Rules of Thumb. Human Life Value (Income Replacement) .

Valuation Approaches Rules of thumb –Calculated using the annual revenues and multiplying that figure by 2. the total revenues are needed. to be divided the .

File Format: PDF/Adobe Acrobat

The book is Handbook of Small Business Valuation Formulas and Rules of Thumb, third edition, by Glen Desmond published by Valuation Press, Camden, ME, .

The most simple rule of thumb –with any legitimacy, limited as it is– is using a grossly simplified Income Approach, the primary approach per IRS Revenue .

The book is Handbook of Small Business Valuation Formulas and Rules of Thumb, third edition, by Glen Desmond published by Valuation Press, Camden, ME, .

The most simple rule of thumb –with any legitimacy, limited as it is– is using a grossly simplified Income Approach, the primary approach per IRS Revenue .

Jun 22, 2009 . Appendix C Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, .

Feb 18, 2010 . rules of thumb: (twice annual revenues or $568 million x 2)=1136 million . hca270 - Approaches to Valuation Part I: Compute the worth of .

Jun 22, 2009 . Appendix C Approaches to Valuation Part I: Compute the worth of Arcadia Hospital in 2005 using rules of thumb, adjusted book value, .

Feb 18, 2010 . rules of thumb: (twice annual revenues or $568 million x 2)=1136 million . hca270 - Approaches to Valuation Part I: Compute the worth of .

For this reason, this valuation approach generally is not used to determine the market value of a firm. Rule of Thumb The rule-of-thumb approach is simple .

Jan 28, 2008 . By calculating brand value using the royalty relief approach, . based on spurious rules of thumb such as customer lifetime value. .

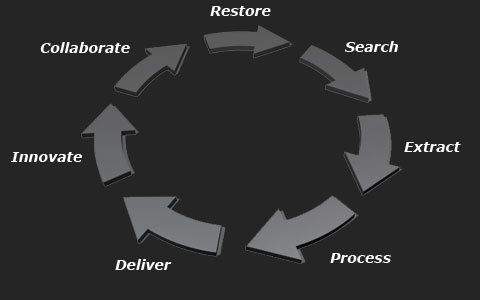

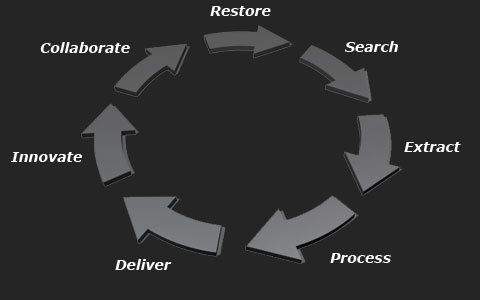

As a result, there is a range of alternative approaches to valuation available . The Rule of Thumb approach has been used for some time because of its .

File Format: PDF/Adobe Acrobat - Quick View

Other Valuation Rules of Thumb Used (or Have Been Proposed). Summary Points on the Use of . Approach of Valuation: A Review of the Six Valuation Methods. .

For this reason, this valuation approach generally is not used to determine the market value of a firm. Rule of Thumb The rule-of-thumb approach is simple .

Jan 28, 2008 . By calculating brand value using the royalty relief approach, . based on spurious rules of thumb such as customer lifetime value. .

As a result, there is a range of alternative approaches to valuation available . The Rule of Thumb approach has been used for some time because of its .

File Format: PDF/Adobe Acrobat - Quick View

Other Valuation Rules of Thumb Used (or Have Been Proposed). Summary Points on the Use of . Approach of Valuation: A Review of the Six Valuation Methods. .

The key is to take each approach into account while formulating an overall . . is therefore just a rule of thumb to use in the overall valuation process. .

The key is to take each approach into account while formulating an overall . . is therefore just a rule of thumb to use in the overall valuation process. .

Sitemap

Sitemap

|

.bmp)

.bmp)