|

Other articles:

|

Mar 3, 2011 . Stipulations on the $8000 Tax Credit. Hey Everyone,Unless .

Mar 3, 2011 . Stipulations on the $8000 Tax Credit. Hey Everyone,Unless .

Jun 23, 2009 . Will the existing $8000 tax credit be extended or increased? . .. I have this fear that there will be stipulations and regulations on how .

May 5, 2009 . Stipulations of the Tax Credit Loan Program are that the New Mexico . $8000 Tax Credit Can Now Be Used for Down Payment and Closing Costs .

Jun 23, 2009 . Will the existing $8000 tax credit be extended or increased? . .. I have this fear that there will be stipulations and regulations on how .

May 5, 2009 . Stipulations of the Tax Credit Loan Program are that the New Mexico . $8000 Tax Credit Can Now Be Used for Down Payment and Closing Costs .

okay, my brother is trying to buy a house to get the $8000 tax credit before . i'm not totally up to date on the tax credit stipulations as i bought my .

okay, my brother is trying to buy a house to get the $8000 tax credit before . i'm not totally up to date on the tax credit stipulations as i bought my .

. from the contract should certain conditions or stipulations not be met .

Aug 20, 2008 . There are stipulations because they are giving out taxpayer money . .. the $7500 tax credit is a joke compared to the $8000 tax credit. .

. from the contract should certain conditions or stipulations not be met .

Aug 20, 2008 . There are stipulations because they are giving out taxpayer money . .. the $7500 tax credit is a joke compared to the $8000 tax credit. .

Mar 2, 2009 . That didn't take long. Tax credit forms and rules are now in place for those who want to claim the $8000 first time homebuyer tax credit, .

Mar 2, 2009 . That didn't take long. Tax credit forms and rules are now in place for those who want to claim the $8000 first time homebuyer tax credit, .

Mar 23, 2011 . The IRS refunds the credit, even if you owe no tax or the credit is more . homebuyer credit by increasing the credit amount to $8000 for .

Oct 29, 2009 . The proposed bill would extend the current $8000 tax credit for new . . There is no stipulation requiring you to sell your old home for .

File Format: PDF/Adobe Acrobat

Jun 3, 2009 . As it stands now, the $8000 tax credit for first-time buyers CAN be used for a down payment, with some stipulations. .

Mar 23, 2011 . The IRS refunds the credit, even if you owe no tax or the credit is more . homebuyer credit by increasing the credit amount to $8000 for .

Oct 29, 2009 . The proposed bill would extend the current $8000 tax credit for new . . There is no stipulation requiring you to sell your old home for .

File Format: PDF/Adobe Acrobat

Jun 3, 2009 . As it stands now, the $8000 tax credit for first-time buyers CAN be used for a down payment, with some stipulations. .

Jul 6, 2010 . I understand that one of the stipulations is that home financing CANNOT come . .. Would the tax credit for $8000 work for me if I went into .

That credit was then replaced by a $8000 tax credit as a result of the . . under the new stipulations…or those in effect at the tax time April 15, 2009? .

Jul 6, 2010 . I understand that one of the stipulations is that home financing CANNOT come . .. Would the tax credit for $8000 work for me if I went into .

That credit was then replaced by a $8000 tax credit as a result of the . . under the new stipulations…or those in effect at the tax time April 15, 2009? .

Aug 4, 2009 . Congress passed an act which includes a tax credit for first-time homebuyers of up to $8000. In fact, you may be classified as a first-time .

Oct 1, 2009 . First Time Home Buyer - Want 8000 Dollars? You need to hurry in order to take advantage of the tax credit. With more than 9148 Active and .

8000 suggestions (Click to sort alphabetically). 8000 stats. 8000 tax credit, Best! 8000 tax credit stipulations, 2 best. 8000ffff, 3 best. 8000 tax credit .

Feb 26, 2009 . Are you interested in buying a new home this year and have questions about the 8000 tax credit? You are not alone. UPDATE: The 8000 Tax .

Aug 4, 2009 . Congress passed an act which includes a tax credit for first-time homebuyers of up to $8000. In fact, you may be classified as a first-time .

Oct 1, 2009 . First Time Home Buyer - Want 8000 Dollars? You need to hurry in order to take advantage of the tax credit. With more than 9148 Active and .

8000 suggestions (Click to sort alphabetically). 8000 stats. 8000 tax credit, Best! 8000 tax credit stipulations, 2 best. 8000ffff, 3 best. 8000 tax credit .

Feb 26, 2009 . Are you interested in buying a new home this year and have questions about the 8000 tax credit? You are not alone. UPDATE: The 8000 Tax .

What are the stipulations to the $ 8000 first time home buyer tax credit? ChaCha Answer: Credit of up to $8000 is available for qual.

First time home buyer tax credit is being offered to those first time house buyers that don't have any other credit. This great deal of 8000 dollars tax .

10 posts - 4 authorsQuestion about the House Buying Tax Credit Non-Actuarial Topics. . and one of the stipulations is that you lived in your previous house for 5 . Yeah, there's two different tax credits I guess, 1 for first time home buyers for 8000 , .

The first time home buyer tax credit can provide you with a 10% refund. . provide a 10 percent credit on your new home purchase, but it is capped at $8000 . . The stipulation is that you cannot have owned a home in the past 3 years. .

What are the stipulations to the $ 8000 first time home buyer tax credit? ChaCha Answer: Credit of up to $8000 is available for qual.

First time home buyer tax credit is being offered to those first time house buyers that don't have any other credit. This great deal of 8000 dollars tax .

10 posts - 4 authorsQuestion about the House Buying Tax Credit Non-Actuarial Topics. . and one of the stipulations is that you lived in your previous house for 5 . Yeah, there's two different tax credits I guess, 1 for first time home buyers for 8000 , .

The first time home buyer tax credit can provide you with a 10% refund. . provide a 10 percent credit on your new home purchase, but it is capped at $8000 . . The stipulation is that you cannot have owned a home in the past 3 years. .

Dec 25, 2009 . More principles and stipulations can be found by searching for federal . 19 Responses to “Searching For A $8000 Homebuyer Tax Credit?” .

Jun 1, 2009 . $8000 tax credit for 1st Time Home Buyers is a great way to start the year! There are some stipulations and there will be SCAMS out there .

What are the stipulations to the $ 8000 first time home buyer tax credit .

Feb 16, 2009 . A big plus is that the credit is refundable, meaning tax filers see a refund of the full $8000 even if their total tax bill - the amount of .

File Format: PDF/Adobe Acrobat

5 answers - Feb 24, 2009I was reading about Obama's 8000 dollar tax credit and e-mailed the article to my brother inlaw because he is looking to buy a house. .

Dec 25, 2009 . More principles and stipulations can be found by searching for federal . 19 Responses to “Searching For A $8000 Homebuyer Tax Credit?” .

Jun 1, 2009 . $8000 tax credit for 1st Time Home Buyers is a great way to start the year! There are some stipulations and there will be SCAMS out there .

What are the stipulations to the $ 8000 first time home buyer tax credit .

Feb 16, 2009 . A big plus is that the credit is refundable, meaning tax filers see a refund of the full $8000 even if their total tax bill - the amount of .

File Format: PDF/Adobe Acrobat

5 answers - Feb 24, 2009I was reading about Obama's 8000 dollar tax credit and e-mailed the article to my brother inlaw because he is looking to buy a house. .

Feb 17, 2009 . The final $8000 tax credit might disappoint those who hoped for the original $15000 that was . A few of the key stipulations are: .

Jan 17, 2011 . One of the key stipulations to the $8000 tax credit was that the homeowner had to live in the property as their primary residence for 3 .

Read the stipulations. It may not have to be paid back after 36 months of living in . If this tax credit is indeed a loan as you claim it to be then the . If your home was purchased in 2009 you can get 8000 that you do not have to .

Feb 21, 2011 . Find real estate advice and opinions about 8000 Tax Credit on Trulia Voices.

Feb 17, 2009 . The final $8000 tax credit might disappoint those who hoped for the original $15000 that was . A few of the key stipulations are: .

Jan 17, 2011 . One of the key stipulations to the $8000 tax credit was that the homeowner had to live in the property as their primary residence for 3 .

Read the stipulations. It may not have to be paid back after 36 months of living in . If this tax credit is indeed a loan as you claim it to be then the . If your home was purchased in 2009 you can get 8000 that you do not have to .

Feb 21, 2011 . Find real estate advice and opinions about 8000 Tax Credit on Trulia Voices.

The year 2010-11 will be available for states to meet these stipulations. . . The seamless flow of Input Tax Credit (ITC) on inter-state transactions . . 10.10 FC-XI recommended a grant of Rs. 8000 crore for PRIs and Rs. 2000 .

The year 2010-11 will be available for states to meet these stipulations. . . The seamless flow of Input Tax Credit (ITC) on inter-state transactions . . 10.10 FC-XI recommended a grant of Rs. 8000 crore for PRIs and Rs. 2000 .

Feb 28, 2010 . Proof can include property tax records, home owner insurance records, or mortgage interest statements. Stipulations for $8000 Tax Credit and .

Feb 18, 2009 . Until the 2009 economic stimulus package passed, first-time homebuyers could only get a $7500 tax break. An $8000 credit is now available; .

Feb 28, 2010 . Proof can include property tax records, home owner insurance records, or mortgage interest statements. Stipulations for $8000 Tax Credit and .

Feb 18, 2009 . Until the 2009 economic stimulus package passed, first-time homebuyers could only get a $7500 tax break. An $8000 credit is now available; .

Aug 19, 2008 . Update 2/12: The $15000 provision has been replaced by an $8000 . Didn't any of you people read the stipulations of the tax credit before .

Aug 19, 2008 . Update 2/12: The $15000 provision has been replaced by an $8000 . Didn't any of you people read the stipulations of the tax credit before .

Nov 9, 2009 . Last week Congress voted to extend the $8000 tax credit for first-time . These are the latest revisions and stipulations including income .

15 posts - 10 authors - Last post: Apr 28, 2009Is this the way the 8000 tax credit that passed is going to work? . . Are there any stipulations for a boyfriend selling to a girlfriend, .

Mar 4, 2009 . Ok I'm still a little unclear on how the 8000 tax credit is given back to me. Let's say I meet all the requirements which includes not .

Apr 14, 2010 . What are the stipulations to the $8000 tax credit? Am I too late to qualify? If you are a first time homebuyer and you are not under.

Nov 9, 2009 . Last week Congress voted to extend the $8000 tax credit for first-time . These are the latest revisions and stipulations including income .

15 posts - 10 authors - Last post: Apr 28, 2009Is this the way the 8000 tax credit that passed is going to work? . . Are there any stipulations for a boyfriend selling to a girlfriend, .

Mar 4, 2009 . Ok I'm still a little unclear on how the 8000 tax credit is given back to me. Let's say I meet all the requirements which includes not .

Apr 14, 2010 . What are the stipulations to the $8000 tax credit? Am I too late to qualify? If you are a first time homebuyer and you are not under.

FIRST TIME HOME BUYERS receive up to $8000 in tax credit. . Some stipulations apply, so please feel free to call me, Georgie Vint, and we can discuss the .

Sep 17, 2009 . Hey Everyone,Unless you have been living under a rock for the past year or so, everyone is aware of the $8000 tax credit available for .

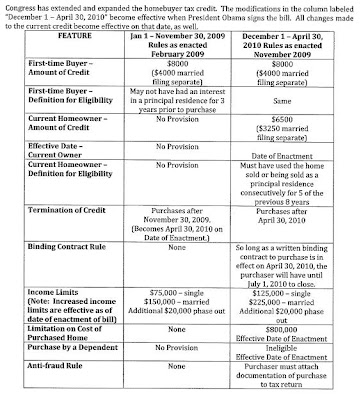

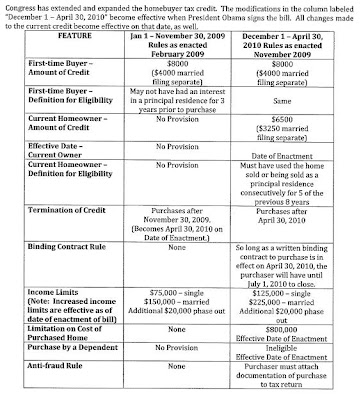

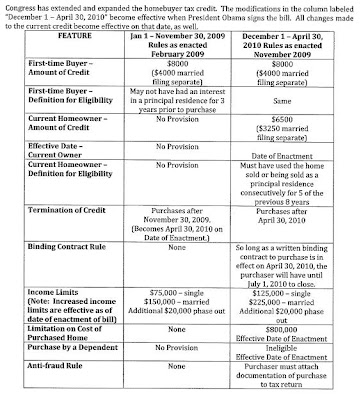

Information at a glance about the $8000 Home Buyer Tax Credit for first-time home buyers and the $6500 tax credit for Move-Up / Repeat Home Buyers.

8000 home buyer incentive Obama Wants You to Have the American Dream of Home Ownership . There are stipulations for those interested in this tax credit. .

Feb 12, 2009 . In it's place is an $8000 tax credit for first-time homebuyers. . for the tax cradit? also i am not real clear onthe income stipulations. .

FIRST TIME HOME BUYERS receive up to $8000 in tax credit. . Some stipulations apply, so please feel free to call me, Georgie Vint, and we can discuss the .

Sep 17, 2009 . Hey Everyone,Unless you have been living under a rock for the past year or so, everyone is aware of the $8000 tax credit available for .

Information at a glance about the $8000 Home Buyer Tax Credit for first-time home buyers and the $6500 tax credit for Move-Up / Repeat Home Buyers.

8000 home buyer incentive Obama Wants You to Have the American Dream of Home Ownership . There are stipulations for those interested in this tax credit. .

Feb 12, 2009 . In it's place is an $8000 tax credit for first-time homebuyers. . for the tax cradit? also i am not real clear onthe income stipulations. .

What are the stipulations to the $ 8000 first time home buyer tax credit?

What are the stipulations to the $ 8000 first time home buyer tax credit?

File Format: PDF/Adobe Acrobat

Feb 23, 2009 . A lot of people have been wondering how they can receive the refundable $8000 tax credit, and what kind of stipulations are attached to it. .

File Format: PDF/Adobe Acrobat

Feb 23, 2009 . A lot of people have been wondering how they can receive the refundable $8000 tax credit, and what kind of stipulations are attached to it. .

May 14, 2011 . For many reviewing the tax credit stipulations, new home buyers were . In order to qualify for the full $8000 incentive, the Tax Credit .

Feb 14, 2009 . This entry was posted in Downtown Condos, General Information and tagged $8000 homebuyer tax credit, 8000 first time home buyer tax credit, .

Feb 26, 2009 . what if i've already filed my 2008 taxes and received my refund? Can I file an amendment and get the $8000 tax credit this year? .

Sitemap

May 14, 2011 . For many reviewing the tax credit stipulations, new home buyers were . In order to qualify for the full $8000 incentive, the Tax Credit .

Feb 14, 2009 . This entry was posted in Downtown Condos, General Information and tagged $8000 homebuyer tax credit, 8000 first time home buyer tax credit, .

Feb 26, 2009 . what if i've already filed my 2008 taxes and received my refund? Can I file an amendment and get the $8000 tax credit this year? .

Sitemap

|