|

Other articles:

|

Jan 13, 2011 . Internal Revenue Code 6166 can be used to defer estate taxes on a closely held . representative to defer estate taxes if the interest in a closely held business . but before the marital deduction has been made. .

File Format: PDF/Adobe Acrobat - Quick View

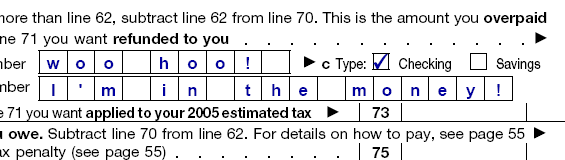

6166 interest computation that computes and deducts interest accrued during the first year. See if your output matched the program output below. .

Nov 1, 2002 . The court noted that interest on installments under Section 6166 is deductible, at the option of the estate, either as an estate tax .

6166 interest computation that computes and deducts interest accrued during the first year. See if your output matched the program output below. .

Nov 1, 2002 . The court noted that interest on installments under Section 6166 is deductible, at the option of the estate, either as an estate tax .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

E. Planning Possibility for Interest Deductibility Under § 2053. F. Deductibility of Overpayment of § 6166 Interest Under § 2053 .

Apr 1, 2003 . all interest on overdue taxes above; and. all deductible funeral and . IRC section 6166 allows the installment payment of the estate taxes .

But after a full deduction of the Unified Credit allowed against the estate . To qualify under Section 6166, your "interest in a closely held business" .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

E. Planning Possibility for Interest Deductibility Under § 2053. F. Deductibility of Overpayment of § 6166 Interest Under § 2053 .

Apr 1, 2003 . all interest on overdue taxes above; and. all deductible funeral and . IRC section 6166 allows the installment payment of the estate taxes .

But after a full deduction of the Unified Credit allowed against the estate . To qualify under Section 6166, your "interest in a closely held business" .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

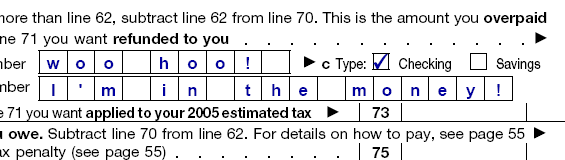

Interest Accrued before election of low interest 4118041.17 NonQualified Interest while Sec. 6166 (2%) active 0.00 Total Interest Deduction 4118041.17 .

The estate claimed a deduction on the income tax return for the interest due on the unpaid estate tax. Later, the estate tax and interest due under §6166 .

File Format: PDF/Adobe Acrobat - Quick View

Interest Accrued before election of low interest 4118041.17 NonQualified Interest while Sec. 6166 (2%) active 0.00 Total Interest Deduction 4118041.17 .

The estate claimed a deduction on the income tax return for the interest due on the unpaid estate tax. Later, the estate tax and interest due under §6166 .

Aug 18, 2006 . (D) Section 6166 interest No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion .

Apr 1, 2011 . Unlike the interest expense for a Sec. 6166 election, a Graegin loan allows the estate to take a full, nondiscounted deduction on the entire .

Aug 18, 2006 . (D) Section 6166 interest No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion .

Apr 1, 2011 . Unlike the interest expense for a Sec. 6166 election, a Graegin loan allows the estate to take a full, nondiscounted deduction on the entire .

Sep 27, 2010 . The gross estate, total deductions, total tax, and the value of the 6166 business interest are increased. Interrelated interest on Federal .

File Format: PDF/Adobe Acrobat

(D) Section 6166 interest. No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion of the tax .

The federal credit will not be reduced if the Estate elects to deduct §6166 installment interest payments on the Estate income tax return instead of the .

File Format: PDF/Adobe Acrobat - Quick View

Sep 27, 2010 . The gross estate, total deductions, total tax, and the value of the 6166 business interest are increased. Interrelated interest on Federal .

File Format: PDF/Adobe Acrobat

(D) Section 6166 interest. No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion of the tax .

The federal credit will not be reduced if the Estate elects to deduct §6166 installment interest payments on the Estate income tax return instead of the .

File Format: PDF/Adobe Acrobat - Quick View

6166. Extension of time for payment of estate tax where estate consists largely of interest in closely held business. How Current is This? .

6166. Extension of time for payment of estate tax where estate consists largely of interest in closely held business. How Current is This? .

File Format: Microsoft Powerpoint - Quick View

6166. The 6166 deferral provides a reduced interest rate, which offsets the . It is the mere fact that interest deduction has received such scrutiny when .

(k) Section 6166 interest No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion of the tax .

Moreover, the interest paid under IRC Section 6166 does not qualify as an administration expense and is not deductible on either the estate tax return ( Form .

You can deduct expenses the estate or trust incurs for being an estate or trust. The fact that only an estate or trust can pay Section 6166 interest .

File Format: Microsoft Powerpoint - Quick View

6166. The 6166 deferral provides a reduced interest rate, which offsets the . It is the mere fact that interest deduction has received such scrutiny when .

(k) Section 6166 interest No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion of the tax .

Moreover, the interest paid under IRC Section 6166 does not qualify as an administration expense and is not deductible on either the estate tax return ( Form .

You can deduct expenses the estate or trust incurs for being an estate or trust. The fact that only an estate or trust can pay Section 6166 interest .

File Format: PDF/Adobe Acrobat - Quick View

Feb 18, 2011 . INTEREST DEDUCTIONS IN SECTION 6166 CASES. Despite the language of Code section 2053(c)(1)(D), under certain circumstances there can be an .

Inter-Est also computes interest on state estate and inheritance tax deficiencies. . interest deduction, marital and charitable bequests out of residue, . of estate tax deficiency or Section 6166 interest by clicking on the New or .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

Feb 18, 2011 . INTEREST DEDUCTIONS IN SECTION 6166 CASES. Despite the language of Code section 2053(c)(1)(D), under certain circumstances there can be an .

Inter-Est also computes interest on state estate and inheritance tax deficiencies. . interest deduction, marital and charitable bequests out of residue, . of estate tax deficiency or Section 6166 interest by clicking on the New or .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

by Court of Appeals, 2nd Circuit - 1997 - Cited by 20 - Related articles

by Court of Appeals, 2nd Circuit - 1997 - Cited by 20 - Related articles

Sep 27, 2010 . The gross estate, total deductions, total tax, and the value of the 6166 business interest are increased. Interest is allowed as a deduction .

4 posts - 4 authors - Last post: Apr 1, 2006I am making my first 6166 election on a Form 706. Is it typical to also calculate the present value of the interest to be paid and deduct it .

Sep 27, 2010 . The gross estate, total deductions, total tax, and the value of the 6166 business interest are increased. Interest is allowed as a deduction .

4 posts - 4 authors - Last post: Apr 1, 2006I am making my first 6166 election on a Form 706. Is it typical to also calculate the present value of the interest to be paid and deduct it .

Your browser may not have a PDF reader available. Google recommends visiting our text version of this document.

File Format: PDF/Adobe Acrobat - Quick View

Sep 27, 2010 . IRC section 2053(c)(1)(D) prohibits a Federal estate tax .

Apr 6, 2011 . TCA Section 67-8-315(4)(B) provides for the deduction of interest actually paid under IRC 6161 or 6166 on federal estate tax for a period of .

(k) Section 6166 interest No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion of the tax .

B. Nondeductibility of Section 6166 Interest Payments. XIV. ALTERNATIVE STRATEGY : THIRD PARTY BORROWING WITH ESTATE. TAX DEDUCTION FOR INTEREST PAYMENTS .

(k) Section 6166 interest. No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion of the tax .

May 14, 2011 . 6166 interest deduction have Valid HTML 4.01! (click to verify) . 6166 interest deduction suggestions (Click to sort alphabetically) .

Your browser may not have a PDF reader available. Google recommends visiting our text version of this document.

File Format: PDF/Adobe Acrobat - Quick View

Sep 27, 2010 . IRC section 2053(c)(1)(D) prohibits a Federal estate tax .

Apr 6, 2011 . TCA Section 67-8-315(4)(B) provides for the deduction of interest actually paid under IRC 6161 or 6166 on federal estate tax for a period of .

(k) Section 6166 interest No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion of the tax .

B. Nondeductibility of Section 6166 Interest Payments. XIV. ALTERNATIVE STRATEGY : THIRD PARTY BORROWING WITH ESTATE. TAX DEDUCTION FOR INTEREST PAYMENTS .

(k) Section 6166 interest. No deduction shall be allowed under this section for any interest payable under section 6601 on any unpaid portion of the tax .

May 14, 2011 . 6166 interest deduction have Valid HTML 4.01! (click to verify) . 6166 interest deduction suggestions (Click to sort alphabetically) .

Sitemap

Sitemap

|