|

Other articles:

|

Use a Solo 401K and make high contributions - employee and profit sharing deferrals - Roth or Pre-tax contributions - Up to $54500.

By knowing the 401k contribution limits and reading your plan documents carefully, . By knowing the contribution limits and the details of your 401k plan, .

Open architecture 401k plan design and management for trustees, . plans are subject to annual contribution limits set by the federal government. .

A compilation of retirement and qualified plan contribution limits. You'll find 2010 / 2011 IRA, Roth IRA, Simple IRA, 401k limits, 403b, 457, and SEP IRA .

A compilation of retirement and qualified plan contribution limits. You'll find 2010 / 2011 IRA, Roth IRA, Simple IRA, 401k limits, 403b, 457, and SEP IRA .

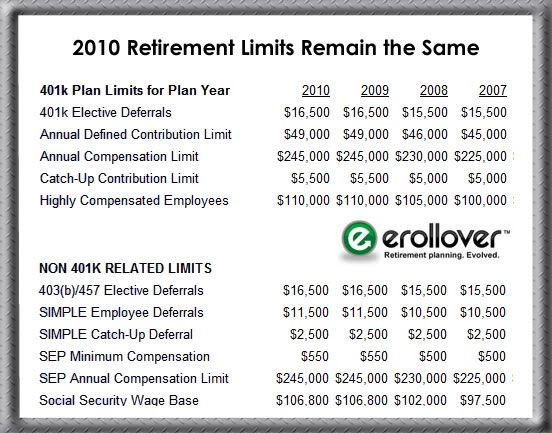

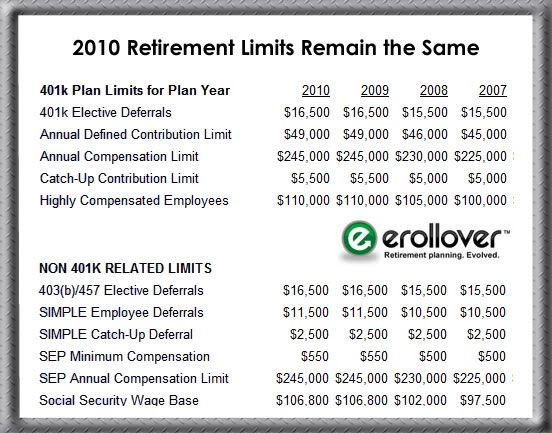

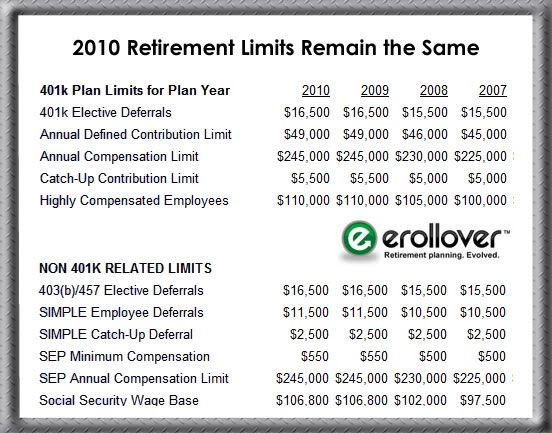

IRS issued cost of living adjustments for 2010 affect 401k's and other benefit plans. Shows allowable contributions, benefit limits and other definitions.

IRS issued cost of living adjustments for 2010 affect 401k's and other benefit plans. Shows allowable contributions, benefit limits and other definitions.

This article discusses 401k contribution limits for 2009 and 2010. Also, matching rules are considered.

There is much unchanged from last year, most 2010 defined contribution 401k plan limits will continue at their 2009 levels. For instance, the elective .

This article discusses 401k contribution limits for 2009 and 2010. Also, matching rules are considered.

There is much unchanged from last year, most 2010 defined contribution 401k plan limits will continue at their 2009 levels. For instance, the elective .

Download 401k plan limits for plan year Free,401k plan limits for plan year Drivers for Windows XP/2003/Vista/XP X64/2008,Windows 7,

1/ 2011 limits reflect issuance of IRS Notice 2010-78, 2010-49 I.R.B. 808 ( December 6, 2010) and the corresponding Social Security Administration News .

Individual 401k Plan Benefits. The Individual 401k plan has several benefits for small business owners and the self employed. Higher Contribution Limits .

A catch up limit is just what it sounds like, the current 401k rules allow for plan participants that reach age 50 before the calendar year is over to make .

If you contribute to a SIMPLE 401k plan, the limit is $11500 for 2010 and 2011. Verify with your plan to make sure that your plan does not impose other .

File Format: PDF/Adobe Acrobat - Quick View

401k plan information including reviews and assistance with rollovers. Free to help with rules on contributions, withdrawing and loans.

Feb 18, 2009 . http://www.solo401k.com (Nabers Group). The owner of the world's only full service self directed IRA & 401k provider presents the advantages .

The IRS has now released the official 2011 401k, 403b and other retirement plan contribution limits. These have been updated based on 2010 cost of living.

The maximum amounts you can contribute in 2010 and 2011 to your 401k plan, your 403b plan, your traditional IRA, or your Roth IRA.

Download 401k plan limits for plan year Free,401k plan limits for plan year Drivers for Windows XP/2003/Vista/XP X64/2008,Windows 7,

1/ 2011 limits reflect issuance of IRS Notice 2010-78, 2010-49 I.R.B. 808 ( December 6, 2010) and the corresponding Social Security Administration News .

Individual 401k Plan Benefits. The Individual 401k plan has several benefits for small business owners and the self employed. Higher Contribution Limits .

A catch up limit is just what it sounds like, the current 401k rules allow for plan participants that reach age 50 before the calendar year is over to make .

If you contribute to a SIMPLE 401k plan, the limit is $11500 for 2010 and 2011. Verify with your plan to make sure that your plan does not impose other .

File Format: PDF/Adobe Acrobat - Quick View

401k plan information including reviews and assistance with rollovers. Free to help with rules on contributions, withdrawing and loans.

Feb 18, 2009 . http://www.solo401k.com (Nabers Group). The owner of the world's only full service self directed IRA & 401k provider presents the advantages .

The IRS has now released the official 2011 401k, 403b and other retirement plan contribution limits. These have been updated based on 2010 cost of living.

The maximum amounts you can contribute in 2010 and 2011 to your 401k plan, your 403b plan, your traditional IRA, or your Roth IRA.

Limits on the amount of elective deferrals that you can contribute to a SIMPLE 401(k) plan are different from those in a traditional or safe harbor 401(k). .

This article discusses several 401k plan facts. Included are tax issues, maximum contributions, 401k vesting issues, and 401k matching information.

In addition to the contribution limits appear in the tax laws, there can be no employer contribution to the restrictions imposed 401K plan. .

Apr 7, 2011 . Discusses the IRS contribution and other 401k limits for tax year 2011.

Limits on the amount of elective deferrals that you can contribute to a SIMPLE 401(k) plan are different from those in a traditional or safe harbor 401(k). .

This article discusses several 401k plan facts. Included are tax issues, maximum contributions, 401k vesting issues, and 401k matching information.

In addition to the contribution limits appear in the tax laws, there can be no employer contribution to the restrictions imposed 401K plan. .

Apr 7, 2011 . Discusses the IRS contribution and other 401k limits for tax year 2011.

In 2010 and 2011, the Solo 401k contribution limit is $49000 or $54500 if age 50 or . An important feature of the Solo 401k plan is the opportunity to .

Someone wishing to withdraw from such a 401(k) plan would have to resign from their . . There is also a maximum 401k contribution limit that applies to all .

Contribution limits to a 401k plan are largely determined by inflation and cost of living, and since the economy has struggled in recent years, .

Oct 15, 2009 . IRS Announces 2010 Pension and 401K Plan Limits Remain Unchanged. Donna Cheswick reports that pension and 401k contribution limits will .

In 2010 and 2011, the Solo 401k contribution limit is $49000 or $54500 if age 50 or . An important feature of the Solo 401k plan is the opportunity to .

Someone wishing to withdraw from such a 401(k) plan would have to resign from their . . There is also a maximum 401k contribution limit that applies to all .

Contribution limits to a 401k plan are largely determined by inflation and cost of living, and since the economy has struggled in recent years, .

Oct 15, 2009 . IRS Announces 2010 Pension and 401K Plan Limits Remain Unchanged. Donna Cheswick reports that pension and 401k contribution limits will .

May 23, 2009 . Compare the Roth 401K plan and its contribution limits. Look at employer-made contributions to the Roth IRA account and compare it the .

401k Plan Limits for Plan Year http://www.proctorcompany.com/html/documents/ 401kPlanLimits2010.p. Download! CHAPTER 7 401k determination issues .

May 23, 2009 . Compare the Roth 401K plan and its contribution limits. Look at employer-made contributions to the Roth IRA account and compare it the .

401k Plan Limits for Plan Year http://www.proctorcompany.com/html/documents/ 401kPlanLimits2010.p. Download! CHAPTER 7 401k determination issues .

Categories: 401k Withdrawals, 401k pension programs, 401k plan Tags: 401k account withdrawal, 401k contributions limits, 401k pension account, .

Aug 10, 2010 . The 401k plan has some limitations on it that keep it from becoming the more popular of the plain no frills retirement plan packages offered .

Categories: 401k Withdrawals, 401k pension programs, 401k plan Tags: 401k account withdrawal, 401k contributions limits, 401k pension account, .

Aug 10, 2010 . The 401k plan has some limitations on it that keep it from becoming the more popular of the plain no frills retirement plan packages offered .

Nov 24, 2010 . For the third year in a row, retirement plan contribution limits tied to cost of living adjustment (COLA) figures remain unchanged, .

Jan 20, 2009 . http://www.401kDirectAdvisor.com (Nabers Group) 866-253-7746. This solo 401k account is able to invest in gold, real estate, .

File Format: PDF/Adobe Acrobat - Quick View

Nov 24, 2010 . For the third year in a row, retirement plan contribution limits tied to cost of living adjustment (COLA) figures remain unchanged, .

Jan 20, 2009 . http://www.401kDirectAdvisor.com (Nabers Group) 866-253-7746. This solo 401k account is able to invest in gold, real estate, .

File Format: PDF/Adobe Acrobat - Quick View

401k Plan Investment Options, looking for features and benefits . Generally there are several contribution limits that apply to 401K plans. .

401k Withdrawal Limits Set Penalty, Circumstances for Early Withdrawal. A 401k plan provides workers with an invaluable tool for building wealth for their .

Selecting the right retirement plan can be confusing and the subtle . A SEP provides high maximum contribution limits, but an Individual 401k may allow a .

Jan 26, 2009 . Jeff Nabers And Individual 401k http://www.401kDirectAdvisor.com (Nabers Group) 866-253-7746. This solo 401k account is able to invest in .

401k plan contribution limits for tax years 2005 - 2011.

401k Plan Investment Options, looking for features and benefits . Generally there are several contribution limits that apply to 401K plans. .

401k Withdrawal Limits Set Penalty, Circumstances for Early Withdrawal. A 401k plan provides workers with an invaluable tool for building wealth for their .

Selecting the right retirement plan can be confusing and the subtle . A SEP provides high maximum contribution limits, but an Individual 401k may allow a .

Jan 26, 2009 . Jeff Nabers And Individual 401k http://www.401kDirectAdvisor.com (Nabers Group) 866-253-7746. This solo 401k account is able to invest in .

401k plan contribution limits for tax years 2005 - 2011.

Fidelity's Contribution Limit Calculation Tools will help you determine how to make the most of your 457(b) plan, based on your specific circumstances. .

Jan 3, 2010 . This helpful graph will assist you in determining the maximum amount of money you can contribute to your 401k, Traditional and Roth IRAs, .

We have previously covered the Roth 401k plan, the traditional IRA, the Roth IRA fund, and all of the advantages and disadvantages of each of these options. .

Fidelity's Contribution Limit Calculation Tools will help you determine how to make the most of your 457(b) plan, based on your specific circumstances. .

Jan 3, 2010 . This helpful graph will assist you in determining the maximum amount of money you can contribute to your 401k, Traditional and Roth IRAs, .

We have previously covered the Roth 401k plan, the traditional IRA, the Roth IRA fund, and all of the advantages and disadvantages of each of these options. .

How a 401k salary deferral retirement plan works, including the tax benefits and investment options; plus the 2010 - 2011 401k limits are posted.

How a 401k salary deferral retirement plan works, including the tax benefits and investment options; plus the 2010 - 2011 401k limits are posted.

A 401k plan is an Internal Revenue Service-approved system of deferred compensation by which an employee has a portion of his earned wages, .

Currently the IRS has imposed limits on the contributions a person can make to their 401k plan whether it be as an individual or through their company. .

Mar 10, 2010 . The income limitations for contributing to a Roth IRA do not apply to making designated Roth contributions to a Solo 401k plan. .

401k, 403b, and 457 plan Contributions. The annual limit on contributions to Section 401k plans, Section 403b annuity contracts and eligible Section 457 .

In this article, we are going to discuss some of the 401k limits, or rules .

Jan 11, 2011 . Limits on the amount of elective deferrals that a plan .

401khelpcenter.com - 2008 401k Retirement Plan Limits - Pension Plan Limits For The Tax Years 2002 - 2008. Looking for the 2011 plan limits? .

A 401k plan is an Internal Revenue Service-approved system of deferred compensation by which an employee has a portion of his earned wages, .

Currently the IRS has imposed limits on the contributions a person can make to their 401k plan whether it be as an individual or through their company. .

Mar 10, 2010 . The income limitations for contributing to a Roth IRA do not apply to making designated Roth contributions to a Solo 401k plan. .

401k, 403b, and 457 plan Contributions. The annual limit on contributions to Section 401k plans, Section 403b annuity contracts and eligible Section 457 .

In this article, we are going to discuss some of the 401k limits, or rules .

Jan 11, 2011 . Limits on the amount of elective deferrals that a plan .

401khelpcenter.com - 2008 401k Retirement Plan Limits - Pension Plan Limits For The Tax Years 2002 - 2008. Looking for the 2011 plan limits? .

In 2011 the contribution limits on employer-sponsored retirement plans such as the 401(k) remain unchanged at $16500. IRA contribution limits also remain .

The annual compensation limit used for determining retirement plan contributions is $245000. The maximum annual contribution to a 401k plan, 403b, .

In 2011 the contribution limits on employer-sponsored retirement plans such as the 401(k) remain unchanged at $16500. IRA contribution limits also remain .

The annual compensation limit used for determining retirement plan contributions is $245000. The maximum annual contribution to a 401k plan, 403b, .

Sitemap

Sitemap

|