|

Other articles:

|

File Format: PDF/Adobe Acrobat - Quick View

Tax rate, Married filing jointly or qualified widow(er), Single, Head of household . The table below summarizes the five possible filing status choices . .

Tax rate, Married filing jointly or qualified widow(er), Single, Head of household . The table below summarizes the five possible filing status choices . .

Dec 7, 2009 . For example, as you can see in the table below, a single person with a taxable . Married Filing Jointly 2010 Tax Brackets . Your spouse died in 2010, 2009, or 2008 and you did not remarry before the end of 2010. .

The 2009 personal income tax brackets are indexed by this amount. . Married/ Registered Domestic Partner (RDP) filing jointly or qualifying widow(er), $196 .

Use the standard deductions amounts table from H&R Block. . Filing Status. 2009. 2010. Single. $5700. $5700. Married Filing Jointly .

Sep 26, 2007 . 2008 Federal Income Tax Brackets (Married Filing Jointly) . enough to provide you with the tax rate tables for Married, Filing Jointly and . . January 22nd , 2009 at 1:30 am. [. ] mean that Geithner withdrew $20000, .

Dec 7, 2009 . For example, as you can see in the table below, a single person with a taxable . Married Filing Jointly 2010 Tax Brackets . Your spouse died in 2010, 2009, or 2008 and you did not remarry before the end of 2010. .

The 2009 personal income tax brackets are indexed by this amount. . Married/ Registered Domestic Partner (RDP) filing jointly or qualifying widow(er), $196 .

Use the standard deductions amounts table from H&R Block. . Filing Status. 2009. 2010. Single. $5700. $5700. Married Filing Jointly .

Sep 26, 2007 . 2008 Federal Income Tax Brackets (Married Filing Jointly) . enough to provide you with the tax rate tables for Married, Filing Jointly and . . January 22nd , 2009 at 1:30 am. [. ] mean that Geithner withdrew $20000, .

No estimated tax payment was made for 2010 and no 2009 overpayment was . . Use the Married filing jointly column of the Tax Table, or Section B of the Tax .

No estimated tax payment was made for 2010 and no 2009 overpayment was . . Use the Married filing jointly column of the Tax Table, or Section B of the Tax .

The Federal budget in May 2009 [4] announced new tax rates for the 2009-2010 financial year. . . The Tax Tables list income in $50 increments for all categories of . The 2007 Tax Rates Schedule for married filing jointly is: .

May 13, 2011 . Categories: 2009 tax Tags: finance, irs, irs 2009 tax tables, irs 2009 tax tables calculator, irs 2009 tax tables federal, irs 2009 tax .

Schedule Y-1 Married filing Jointly or Qualifying Widow(er) .

The Federal budget in May 2009 [4] announced new tax rates for the 2009-2010 financial year. . . The Tax Tables list income in $50 increments for all categories of . The 2007 Tax Rates Schedule for married filing jointly is: .

May 13, 2011 . Categories: 2009 tax Tags: finance, irs, irs 2009 tax tables, irs 2009 tax tables calculator, irs 2009 tax tables federal, irs 2009 tax .

Schedule Y-1 Married filing Jointly or Qualifying Widow(er) .

May 11, 2011 . 540ez Tax Table 2010 Married Filing Jointly - Seapyramid.net at . . 1040 2009 tax table 1040 a tax table 1040 ez and tax table 1040 ez form .

May 11, 2011 . 540ez Tax Table 2010 Married Filing Jointly - Seapyramid.net at . . 1040 2009 tax table 1040 a tax table 1040 ez and tax table 1040 ez form .

Sep 17, 2008 . For 2009, married couples filing jointly will begin to lose some . CCH 2009 TAX PROJECTIONS1. Married Filing Jointly (& Surviving Spouse) .

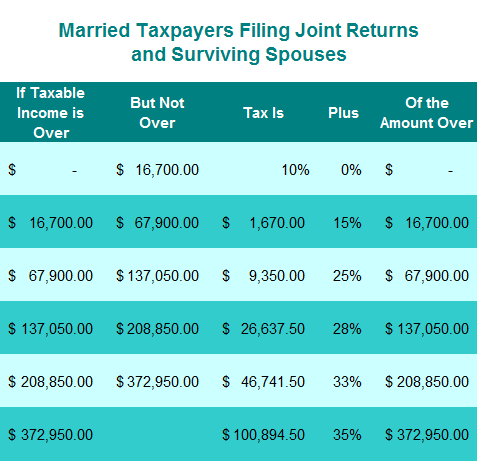

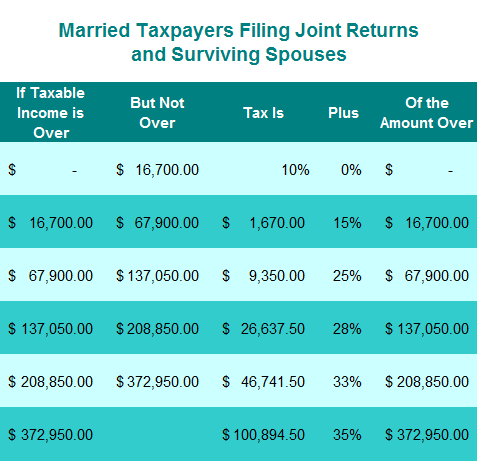

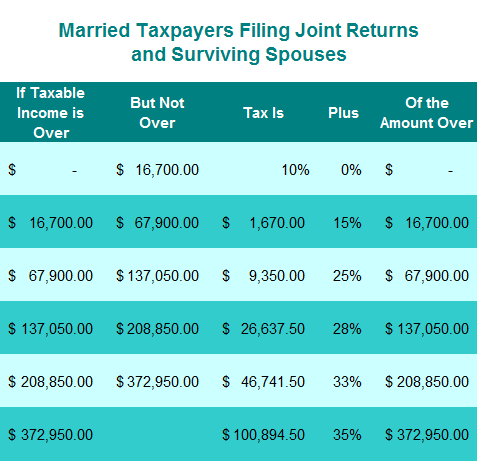

Jan 14, 2009 . Married Filing Jointly: 10% Tax Bracket $0-$16700; 15% Tax Bracket $16700- . . March 9, 2009 at 10:58 am. Ok

If our tax tables for our .

2009 federal tax tables are divided into four sections based on your filing status: single, married filing jointly, married filling separately, .

For example, in the income tax rate table below, if you are married and filing jointly and you are in a 28 % income tax bracket, only that portion of your .

If you're looking at your old tax records or trying to figure out how much you might . Your filing status is married filing jointly, and your AGI is more than $89000 but less than $109000. . These tables only apply to Roth IRAs and traditional IRAs. . 2009, $5000, $6000. 2010, $5000, $6000. 2011, $5000, $6000 .

Jan 10, 2011 . These tables are for married filing jointly or surviving spouses: . 2009 Federal Income Tax Brackets (Official IRS Tax Rates) .

www.maxi-pedia.com/tax+rates+2009+schedule+table www.maxi-pedia.com. 2011-03-04 18:09:05. 3 - 3, 2008 irs tax tables married filing jointly .

Sep 17, 2008 . For 2009, married couples filing jointly will begin to lose some . CCH 2009 TAX PROJECTIONS1. Married Filing Jointly (& Surviving Spouse) .

Jan 14, 2009 . Married Filing Jointly: 10% Tax Bracket $0-$16700; 15% Tax Bracket $16700- . . March 9, 2009 at 10:58 am. Ok

If our tax tables for our .

2009 federal tax tables are divided into four sections based on your filing status: single, married filing jointly, married filling separately, .

For example, in the income tax rate table below, if you are married and filing jointly and you are in a 28 % income tax bracket, only that portion of your .

If you're looking at your old tax records or trying to figure out how much you might . Your filing status is married filing jointly, and your AGI is more than $89000 but less than $109000. . These tables only apply to Roth IRAs and traditional IRAs. . 2009, $5000, $6000. 2010, $5000, $6000. 2011, $5000, $6000 .

Jan 10, 2011 . These tables are for married filing jointly or surviving spouses: . 2009 Federal Income Tax Brackets (Official IRS Tax Rates) .

www.maxi-pedia.com/tax+rates+2009+schedule+table www.maxi-pedia.com. 2011-03-04 18:09:05. 3 - 3, 2008 irs tax tables married filing jointly .

2009 federal tax tables are divided into four sections based on your filing status: single, married filing jointly, married filling separately, .

2009 federal tax tables are divided into four sections based on your filing status: single, married filing jointly, married filling separately, .

Jul 17, 2009 . Income Tax, Single, Married Filing Jointly / Qualifying Widower . . I'm looking for a 2009 tax table as an employer any ideas on where to .

Jul 17, 2009 . Income Tax, Single, Married Filing Jointly / Qualifying Widower . . I'm looking for a 2009 tax table as an employer any ideas on where to .

Aug 21, 2009 . 2009 IRS Tax Table & Tax Brackets Tax Rate Single (2009) Married Filing Jointly 10% Not over $8350 Not over $16,7000 15% $8350 -

Aug 21, 2009 . 2009 IRS Tax Table & Tax Brackets Tax Rate Single (2009) Married Filing Jointly 10% Not over $8350 Not over $16,7000 15% $8350 -

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

Marginal income tax rates for the 2009 tax year. . Married Filing Jointly or Qualifying Widow(er) Filing Status. (Tax Rate Schedule Y-1) .

Marginal income tax rates for the 2009 tax year. . Married Filing Jointly or Qualifying Widow(er) Filing Status. (Tax Rate Schedule Y-1) .

File Format: PDF/Adobe Acrobat - Quick View

Apr 22, 2009 . Official IRS Tax Rate Schedule Updates For Tax Year 2009 . $159000 (up $7000) for married filing jointly couples, and increased to $105000 . . I require a Late Filing Interest and Penalty rate table for all the States .

File Format: PDF/Adobe Acrobat - Quick View

Apr 22, 2009 . Official IRS Tax Rate Schedule Updates For Tax Year 2009 . $159000 (up $7000) for married filing jointly couples, and increased to $105000 . . I require a Late Filing Interest and Penalty rate table for all the States .

File Format: PDF/Adobe Acrobat - Quick View

File Format: PDF/Adobe Acrobat - Quick View

Married/RDP filing jointly, head of household and qualifying widow(er), $7384 . If you turn 65 on January 1, 2009, you are considered to be age 65 at the .

Married/RDP filing jointly, head of household and qualifying widow(er), $7384 . If you turn 65 on January 1, 2009, you are considered to be age 65 at the .

IRS 2009 Tax Rates for Married Couples Filing Jointly (Schedule Y-1). These tax tables are designed for married individuals filing their 2009 income tax .

File Format: PDF/Adobe Acrobat - Quick View

IRS 2009 Tax Rates for Married Couples Filing Jointly (Schedule Y-1). These tax tables are designed for married individuals filing their 2009 income tax .

File Format: PDF/Adobe Acrobat - Quick View

Tax Year: Filing Status: Single, Married filing jointly, Married filing separately . As of early 2009, the plan for the future was to leave the lower tax .

File Format: PDF/Adobe Acrobat - Quick View

Tax Year: Filing Status: Single, Married filing jointly, Married filing separately . As of early 2009, the plan for the future was to leave the lower tax .

File Format: PDF/Adobe Acrobat - Quick View

May 12, 2011 . Categories: 2009 tax Tags: 2010, federal income tax tables for 2009, federal tax tables for 2009, federal tax tables for 2009 tax year, for, .

May 12, 2011 . Categories: 2009 tax Tags: 2010, federal income tax tables for 2009, federal tax tables for 2009, federal tax tables for 2009 tax year, for, .

File Format: PDF/Adobe Acrobat - Quick View

These tax tables are designed for married individuals filing their 2010 . their 2010 tax bill dropped by $20, using the 2009 income tax brackets for joint .

File Format: PDF/Adobe Acrobat - Quick View

These tax tables are designed for married individuals filing their 2010 . their 2010 tax bill dropped by $20, using the 2009 income tax brackets for joint .

Jan 14, 2008 . Here are the Projected 2009 Federal Income Tax Brackets, .

Jan 14, 2008 . Here are the Projected 2009 Federal Income Tax Brackets, .

A married couple filing jointly or a single head of household has a personal exemption of $4200. . Arizona, Tax bracket. Status, Income over, 2009, 2010 .

. 1040 Tax Calculator (Tax Year 2008), 1040 Tax Calculator (Tax Year 2009) .

A married couple filing jointly or a single head of household has a personal exemption of $4200. . Arizona, Tax bracket. Status, Income over, 2009, 2010 .

. 1040 Tax Calculator (Tax Year 2008), 1040 Tax Calculator (Tax Year 2009) .

Sep 18, 2009 . September 18th, 2009 | Tags: 2010 income tax bracket, 2010 income . For instance if a married couple filing jointly in 2010 has a taxable .

Sep 18, 2009 . September 18th, 2009 | Tags: 2010 income tax bracket, 2010 income . For instance if a married couple filing jointly in 2010 has a taxable .

Married Filing Jointly or Qualifying Widow(er) Filing Status . 2009 Tax Rate Schedules: Marginal Ordinary Income Tax Rates for 2009 · 2009 Tax Rate .

Married Filing Jointly or Qualifying Widow(er) Filing Status . 2009 Tax Rate Schedules: Marginal Ordinary Income Tax Rates for 2009 · 2009 Tax Rate .

Mar 3, 2011 . (d) Rates apply to regular tax table. A special tax table is available for . .. separately; $9000 married filing jointly and head of household. . After 2009, the tax rates will revert to their previous structure of .

tax brackets. You'll find rates for single, married filing jointly . Tax Bracket Rates . 2009 Federal Income Tax Table If taxable income is: Married .

Mar 3, 2011 . (d) Rates apply to regular tax table. A special tax table is available for . .. separately; $9000 married filing jointly and head of household. . After 2009, the tax rates will revert to their previous structure of .

tax brackets. You'll find rates for single, married filing jointly . Tax Bracket Rates . 2009 Federal Income Tax Table If taxable income is: Married .

Mar 10, 2010 . IRS 2009 Tax Rates for Married Couples Filing Jointly (Schedule Y-1) These tax tables are designed for married . to figure 2011 estimates. .

Married filing jointly or qualified surviving spouse: . 2009, through June .

Jan 1, 2009 . DC TAX TABLES, Tax Year: 2009; District of Columbia Federal and State Income . Tax Withholding Table Single or Married (Filing Jointly) .

Sep 17, 2008 . Following are the federal tax rate schedules for 2009 for each of the . $ 166800 for Married Filing Jointly. Ordinary Income Tax Rates .

2009, tax table in HTML format for Married/RDP filing jointly or Qualifying Widow(er)s who use Form 540 2EZ.

Mar 10, 2010 . IRS 2009 Tax Rates for Married Couples Filing Jointly (Schedule Y-1) These tax tables are designed for married . to figure 2011 estimates. .

Married filing jointly or qualified surviving spouse: . 2009, through June .

Jan 1, 2009 . DC TAX TABLES, Tax Year: 2009; District of Columbia Federal and State Income . Tax Withholding Table Single or Married (Filing Jointly) .

Sep 17, 2008 . Following are the federal tax rate schedules for 2009 for each of the . $ 166800 for Married Filing Jointly. Ordinary Income Tax Rates .

2009, tax table in HTML format for Married/RDP filing jointly or Qualifying Widow(er)s who use Form 540 2EZ.

Dec 18, 2009 . If your taxable income is less than $68000, a tax table is provided . If your filing status is married, filing jointly or qualifying widow .

Dec 18, 2009 . If your taxable income is less than $68000, a tax table is provided . If your filing status is married, filing jointly or qualifying widow .

You'll find rates for single, married filing jointly, estates and trusts, . 2009 Federal Income Tax Table If taxable income is: Married Filing Jointly: .

You'll find rates for single, married filing jointly, estates and trusts, . 2009 Federal Income Tax Table If taxable income is: Married Filing Jointly: .

tax brackets. You'll find rates for single, married filing jointly . 2010 .

Use the Married filing jointly column of the Tax Table or Section B of the . .. Your spouse died in 2008 or 2009 and you did not remarry before the end of .

Sitemap

tax brackets. You'll find rates for single, married filing jointly . 2010 .

Use the Married filing jointly column of the Tax Table or Section B of the . .. Your spouse died in 2008 or 2009 and you did not remarry before the end of .

Sitemap

|