|

Other articles:

|

www.1098-t.com/ - SimilarECSI - Student Tax InformationJump to 1098-T: American Opportunity Credit (1098-T) . credit is not available on the 2008 returns taxpayers are filing during 2009. .

The 1098-T is an IRS form entitled “Tuition Statement” that assists the student in determining if he/she qualifies for certain education related tax credits .

Jan 27, 2011 – The following questions and answers will guide you through the basics of the 1098-T tax form and offer explanations about the boxes on the .

Jun 22, 2011 – 1098T forms will be generated for students who have a valid tax identification number on file with the Bursar Office and who have paid .

1098-T Tax Form. If you are a US resident for tax purposes, you may be eligible to claim a tax credit on your federal tax return if you paid qualified .

Jun 22, 2011 – 1098T forms will be generated for students who have a valid tax identification number on file with the Bursar Office and who have paid .

1098-T Tax Form. If you are a US resident for tax purposes, you may be eligible to claim a tax credit on your federal tax return if you paid qualified .

1098 –T tax forms for previous year are mailed to domestic students the first week of February. Tax forms are also available online at: www.1098-T.com .

Jan 11, 2011 – The 1098-T form is informational only and should not be considered as tax advice . It serves to alert students that they may be eligible for .

Jan 14, 2011 – MSJC distributes 1098-T forms online in individual student accounts via Student EagleAdvisor to all students who have a valid tax .

Jump to Why did I receive a 1098-T tax form? Am I eligible to claim the . : Why did I receive a 1098-T tax form? Am I eligible to claim .

By visiting the Tax Information- Form 1098-T link through Blackboard, you will be brought to ECSI's homepage where your 1098-T is housed under the "Tax .

Jan 21, 2011 – If you had qualified education-related expenses, you should have received a Form 1098-T: Tuition Statement from your educational institution .

File Format: PDF/Adobe Acrobat - Quick View

1098 –T tax forms for previous year are mailed to domestic students the first week of February. Tax forms are also available online at: www.1098-T.com .

Jan 11, 2011 – The 1098-T form is informational only and should not be considered as tax advice . It serves to alert students that they may be eligible for .

Jan 14, 2011 – MSJC distributes 1098-T forms online in individual student accounts via Student EagleAdvisor to all students who have a valid tax .

Jump to Why did I receive a 1098-T tax form? Am I eligible to claim the . : Why did I receive a 1098-T tax form? Am I eligible to claim .

By visiting the Tax Information- Form 1098-T link through Blackboard, you will be brought to ECSI's homepage where your 1098-T is housed under the "Tax .

Jan 21, 2011 – If you had qualified education-related expenses, you should have received a Form 1098-T: Tuition Statement from your educational institution .

File Format: PDF/Adobe Acrobat - Quick View

The University is required to file Form 1098-T (Tuition Payment Statement) with the Internal Revenue Service (IRS) to report certain enrollment and .

FAQs About 1098-T Tax Forms. What does the 1098-T look like? Which boxes should be filled in, and what do they mean? Why isn't there an amount in box 1? .

The University is required to file Form 1098-T (Tuition Payment Statement) with the Internal Revenue Service (IRS) to report certain enrollment and .

FAQs About 1098-T Tax Forms. What does the 1098-T look like? Which boxes should be filled in, and what do they mean? Why isn't there an amount in box 1? .

Feb 5, 2008 – Press "1098T Tax Form" below. If you have not been enrolled in the university for the past 6 months, your Directory ID and Password may have .

The 1098-T form will inform the student or taxpayer of the possibility of a tax credit for payment of eligible tuition and fees under the guidelines of the .

You should keep form 1098-T with your tax records. If you claim either the Hope or the Lifetime Learning Credit, you will also need to complete IRS Form .

Lifetime Learning & American Opportunity Tax Credit / Form 1098T. This material is provided as a service to State University at Stony Brook students and .

The 1098-T Tax Form Tuition Statement. What is a 1098-T form and who should get one? The Taxpayer Relief Act of 1997 requires that all educational .

The 1098-T form is the tax form you need in order to claim the tuition and fees deduction or an education credit on your taxes. At the start of each year, .

Please contact your campus representative (provided below) if you have any questions about the 1098 forms. . Consult your tax advisor for further information. . Student Fees - 1098T Voice: 865-974-4495. Student Loans - 1098E .

Opt-in to receive your 1098-T Tuition Information tax form faster!!! Click 'Read more' for details. If you would like to receive your 1098-T tax form* .

provides our 1098-T tax reporting service. To download your form, please click on the OASIS link "1098T (ECSI)". Or, you may login directly to ECSI at .

Feb 5, 2008 – Press "1098T Tax Form" below. If you have not been enrolled in the university for the past 6 months, your Directory ID and Password may have .

The 1098-T form will inform the student or taxpayer of the possibility of a tax credit for payment of eligible tuition and fees under the guidelines of the .

You should keep form 1098-T with your tax records. If you claim either the Hope or the Lifetime Learning Credit, you will also need to complete IRS Form .

Lifetime Learning & American Opportunity Tax Credit / Form 1098T. This material is provided as a service to State University at Stony Brook students and .

The 1098-T Tax Form Tuition Statement. What is a 1098-T form and who should get one? The Taxpayer Relief Act of 1997 requires that all educational .

The 1098-T form is the tax form you need in order to claim the tuition and fees deduction or an education credit on your taxes. At the start of each year, .

Please contact your campus representative (provided below) if you have any questions about the 1098 forms. . Consult your tax advisor for further information. . Student Fees - 1098T Voice: 865-974-4495. Student Loans - 1098E .

Opt-in to receive your 1098-T Tuition Information tax form faster!!! Click 'Read more' for details. If you would like to receive your 1098-T tax form* .

provides our 1098-T tax reporting service. To download your form, please click on the OASIS link "1098T (ECSI)". Or, you may login directly to ECSI at .

When will my 1098T Tax form be available? 2010 1098-T Tuition Statements are . What is the deadline for the 1098-T tax forms to be mailed to students? .

www.1098t.com/ - Similar1098-T Frequently Asked QuestionsFrequently asked questions about the 1098-T tax form. . What is the 1098-T form? Why did I receive a 1098-T tax form and what am I supposed to do with it? .

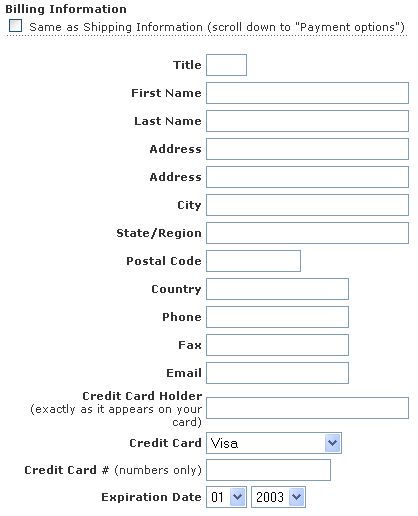

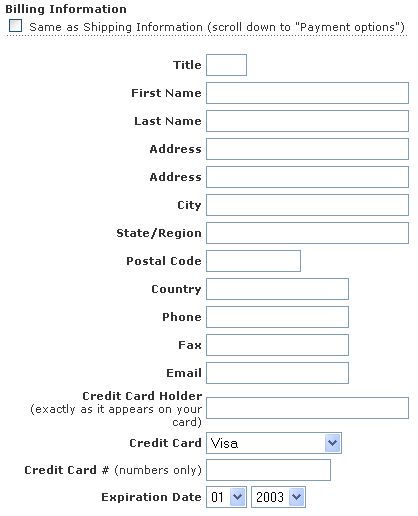

Get your 1098-T Tax Form. To access, view, and print your 1098-T Tax Form, log on to ECSI. Just enter our school code (P3), your social security number, .

Am I eligible for a tax credit? Why isn't there an amount in box 1 on the 1098-T form? What educational expenses are considered as qualified tuition and .

When will my 1098T Tax form be available? 2010 1098-T Tuition Statements are . What is the deadline for the 1098-T tax forms to be mailed to students? .

www.1098t.com/ - Similar1098-T Frequently Asked QuestionsFrequently asked questions about the 1098-T tax form. . What is the 1098-T form? Why did I receive a 1098-T tax form and what am I supposed to do with it? .

Get your 1098-T Tax Form. To access, view, and print your 1098-T Tax Form, log on to ECSI. Just enter our school code (P3), your social security number, .

Am I eligible for a tax credit? Why isn't there an amount in box 1 on the 1098-T form? What educational expenses are considered as qualified tuition and .

Mar 8, 2011 – If you are needing a copy of a 2009 and prior year 1098-T tax form, please contact our servicer ECSI at: http://www.ecsi.net/taxinfo.html or .

Jump to 1098: The Form 1098, Mortgage Interest Statement, is used to report interest that a . Such interest is tax-deductible at the federal level, unless the . 1098-E: Student Loan Interest Statement; 1098-T: Tuition Statement .

File Format: PDF/Adobe Acrobat - Quick View

Student 1098-T tax forms for 2010 are now available on MyCampus. Forms are also being mailed to all LCCC students beginning on Monday, January 31, 2011. .

The 1098-T Tax Form is available for viewing and download on the web. Students received an email from support@getmydocument.com in January with instructions .

Mar 8, 2011 – If you are needing a copy of a 2009 and prior year 1098-T tax form, please contact our servicer ECSI at: http://www.ecsi.net/taxinfo.html or .

Jump to 1098: The Form 1098, Mortgage Interest Statement, is used to report interest that a . Such interest is tax-deductible at the federal level, unless the . 1098-E: Student Loan Interest Statement; 1098-T: Tuition Statement .

File Format: PDF/Adobe Acrobat - Quick View

Student 1098-T tax forms for 2010 are now available on MyCampus. Forms are also being mailed to all LCCC students beginning on Monday, January 31, 2011. .

The 1098-T Tax Form is available for viewing and download on the web. Students received an email from support@getmydocument.com in January with instructions .

You no longer have to log in separately to view your 1098-T tax form. Your 2010 1098-T tax form will be available for access through your student portal no .

Select the tax year of interest from the drop-down menu box. You may search for your 1098-T form for the current tax year (the default selection), .

You no longer have to log in separately to view your 1098-T tax form. Your 2010 1098-T tax form will be available for access through your student portal no .

Select the tax year of interest from the drop-down menu box. You may search for your 1098-T form for the current tax year (the default selection), .

The 1098-T form reports the amount of tuition and related fees that Alverno College billed you during the previous calendar year. The purpose of the form is .

The 1098-T form reports the amount of tuition and related fees that Alverno College billed you during the previous calendar year. The purpose of the form is .

1098-T Form and Educational Tax Credits. In accordance with IRS guidelines, Claremont Graduate University has provided qualified educational charges to the .

File Format: PDF/Adobe Acrobat - Quick View

Since I received Form 1098-T from the university, am I qualified for one of the educational tax credits? How do I determine if I am eligible for an .

Jan 19, 2011 – The 2010 Form 1098-T has been delivered electronically in Student Self-Service in OneStart. Click on the link for "Tax Form 1098T E-Consent .

Student Tuition Payment Statement (Federal Tax Form 1098-T). What is the 1098-T form? The 1098-T form, also referred to as the "Tuition Payment Statement", .

1098-T Form and Educational Tax Credits. In accordance with IRS guidelines, Claremont Graduate University has provided qualified educational charges to the .

File Format: PDF/Adobe Acrobat - Quick View

Since I received Form 1098-T from the university, am I qualified for one of the educational tax credits? How do I determine if I am eligible for an .

Jan 19, 2011 – The 2010 Form 1098-T has been delivered electronically in Student Self-Service in OneStart. Click on the link for "Tax Form 1098T E-Consent .

Student Tuition Payment Statement (Federal Tax Form 1098-T). What is the 1098-T form? The 1098-T form, also referred to as the "Tuition Payment Statement", .

![]() To view your 1098-T Tax Form, log in to the Student Administration System and navigate to Finances by clicking: Main Menu, then hover your mouse over .

To view your 1098-T Tax Form, log in to the Student Administration System and navigate to Finances by clicking: Main Menu, then hover your mouse over .

1098-T software for filing tax forms 1098T and 1098-T. 1099 Pro offers print, mail and electronic filing (e-filing) services.

1098-T software for filing tax forms 1098T and 1098-T. 1099 Pro offers print, mail and electronic filing (e-filing) services.

The View 1098-T page displays a list of the 1098-T statements for each tax year where a 1098-T form has been created. For 1098-T purposes, a tax year covers .

File Format: PDF/Adobe Acrobat - Quick View

In January, students of eligible institutions can download the 1098T and 1098E tax documents . Upon successful completion of the Request Certificate form, .

The View 1098-T page displays a list of the 1098-T statements for each tax year where a 1098-T form has been created. For 1098-T purposes, a tax year covers .

File Format: PDF/Adobe Acrobat - Quick View

In January, students of eligible institutions can download the 1098T and 1098E tax documents . Upon successful completion of the Request Certificate form, .

Jan 13, 2011 – The University of Kansas will be mailing your 2010 1098-T tax form before the end of January 2011. You may also access this information from .

Jan 13, 2011 – The University of Kansas will be mailing your 2010 1098-T tax form before the end of January 2011. You may also access this information from .

1098-T tax forms are scheduled to go out from our third party servicer ECSI on behalf of Illinois Institute of Technology by January 31, 2011 for use in .

1098-T tax forms are scheduled to go out from our third party servicer ECSI on behalf of Illinois Institute of Technology by January 31, 2011 for use in .

File Format: PDF/Adobe Acrobat - Quick View

Sitemap

File Format: PDF/Adobe Acrobat - Quick View

Sitemap

|